Economic Consequences of International Monetary Regulation Changes

Navigating the Economic Landscape: International Changes in Monetary Regulations

The intricate dance of global economics is continually influenced by a multitude of factors. One such pivotal element is the constant evolution of monetary regulations on the international stage. In this article, we delve into the economic consequences of these changes and their far-reaching impacts.

The Ripple Effect on Global Trade and Commerce

Changes in international monetary regulations have a profound impact on global trade and commerce. Alterations in exchange rates, trade agreements, and currency valuations can lead to shifts in the competitive landscape. Exporters and importers must adapt to these changes, affecting supply chains and ultimately influencing the cost of goods and services worldwide.

Investor Sentiment and Financial Markets

Investors are particularly sensitive to changes in monetary regulations as they directly affect financial markets. Currency fluctuations and adjustments in interest rates can significantly impact investment strategies and portfolio performances. The uncertainty stemming from regulatory changes often leads to shifts in investor sentiment, influencing market trends and volatility.

Currency Valuations and Exchange Rate Risks

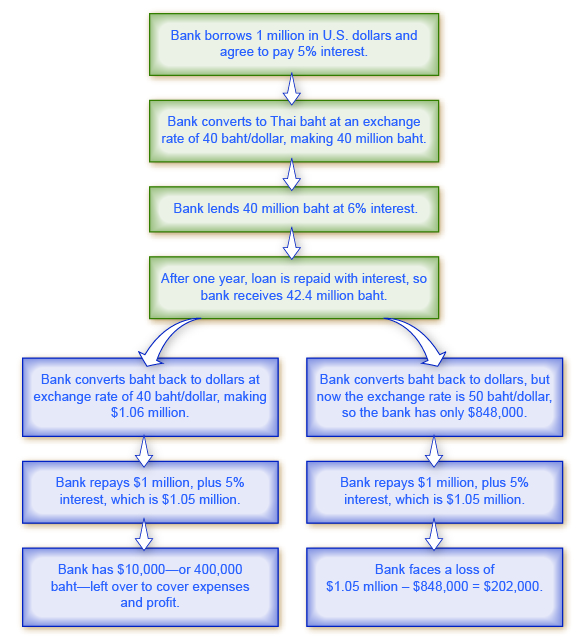

One of the direct consequences of international monetary changes is the fluctuation in currency valuations. Exchange rates become more volatile, introducing new dimensions of risk for businesses engaged in international transactions. Companies must carefully manage and hedge against these risks to maintain stability in their financial operations.

Inflationary Pressures and Central Bank Policies

Changes in monetary regulations can have direct implications on inflationary pressures within countries. Central banks often adjust interest rates and money supply to achieve economic stability. However, the effectiveness of these policies can vary, leading to challenges in managing inflation and its cascading effects on consumer purchasing power and overall economic health.

Global Financial Stability and Systemic Risks

The interconnectedness of the global financial system means that changes in monetary regulations can introduce systemic risks. Events in one part of the world can quickly transmit shockwaves across borders, affecting financial institutions and markets. Policymakers must carefully balance the need for regulatory adjustments with the potential destabilizing effects on the broader financial ecosystem.

Impacts on Developing Economies and Emerging Markets

Developing economies and emerging markets are often more susceptible to the consequences of international changes in monetary regulations. These regions may face challenges in maintaining economic stability, attracting investments, and managing debt levels. The resulting disparities in economic conditions can exacerbate global inequalities.

Trade Balances and Current Account Deficits

International monetary changes can influence a country’s trade balance and current account deficits. Fluctuations in exchange rates impact the competitiveness of exports and imports, affecting the overall balance of trade. Persistent current account deficits can lead to economic imbalances and vulnerability to external shocks.

Technological Innovations in Financial Services

The landscape of financial services is evolving rapidly, and international monetary changes play a role in shaping this transformation. Innovations such as digital currencies and blockchain technology are gaining prominence, challenging traditional banking systems and providing new avenues for cross-border transactions. These advancements bring both opportunities and challenges for the global economic system.

Looking Ahead: Adaptation and Collaboration

As the world grapples with the economic consequences of international changes in monetary regulations, adaptation and collaboration are key. Policymakers, businesses, and investors must remain vigilant, fostering an environment that supports economic resilience and sustainability. The ability to navigate the complexities of the global economic landscape will be crucial for ensuring a stable and prosperous future.

For a more comprehensive understanding of the economic consequences of international changes in monetary regulations, explore this detailed study here. The study provides insights into case analyses and potential strategies to navigate the evolving global economic landscape in the wake of regulatory shifts.