Systemic Risk Management Global Market Growth Rise

The global market is a complex web of interconnected financial institutions and activities. When one part of this system experiences distress, it can quickly spread, potentially triggering a widespread financial crisis. This is where Systemic Risk Management comes into play. It’s the proactive process of identifying, assessing, and mitigating risks that could destabilize the entire financial system. Understanding its role is crucial for investors, policymakers, and anyone interested in the health of the global economy.

Key Takeaways:

- Systemic Risk Management is essential for maintaining the stability of the global financial system.

- Growth in this area is driven by increased regulatory scrutiny, technological advancements, and a desire for greater financial resilience.

- Effective Systemic Risk Management requires collaboration between institutions, regulators, and international bodies.

Understanding the Growing Importance of Systemic Risk Management

The rise of globalization and the increasing complexity of financial instruments have amplified the potential for systemic risk. Events like the 2008 financial crisis highlighted the devastating consequences when these risks are not adequately managed. As a result, regulators worldwide have implemented stricter rules and guidelines to promote Systemic Risk Management. These regulations often require financial institutions to hold more capital, improve their risk assessment processes, and develop resolution plans to minimize the impact of potential failures.

Furthermore, advancements in technology have both created new avenues for risk and provided new tools for managing it. For example, algorithmic trading and high-frequency trading can amplify market volatility, increasing systemic risk. However, sophisticated data analytics and artificial intelligence can also be used to identify and monitor potential systemic risks more effectively.

The demand for skilled professionals in Systemic Risk Management is also on the rise. Financial institutions, regulatory bodies, and consulting firms are actively seeking individuals with expertise in risk modeling, data analysis, and regulatory compliance. This growing demand reflects the increasing recognition of the importance of proactively managing systemic risk to protect the stability of the financial system and the broader economy. The ongoing pursuit of financial stability and resilience is the core driving force of global market growth in Systemic Risk Management.

Factors Driving Global Market Growth in Systemic Risk Management

Several factors are fueling the growth of the Systemic Risk Management market on a global scale. Let’s examine some of the key drivers:

- Increased Regulatory Scrutiny: As mentioned earlier, regulators around the world are placing greater emphasis on Systemic Risk Management. New regulations, such as Basel III and Dodd-Frank, require financial institutions to enhance their risk management practices and demonstrate their ability to withstand potential shocks to the system.

- Technological Advancements: The use of technology, particularly data analytics and AI, is transforming Systemic Risk Management. These tools enable institutions to analyze vast amounts of data, identify emerging risks, and develop more effective mitigation strategies. The ability to process complex information more quickly and accurately is essential for managing systemic risk in today’s fast-paced markets.

- Growing Complexity of Financial Instruments: The proliferation of complex financial instruments, such as derivatives and structured products, has made it more difficult to assess and manage systemic risk. These instruments can create hidden interconnections and amplify the impact of market shocks. Effective Systemic Risk Management requires a deep understanding of these instruments and their potential impact on the financial system.

- Globalization of Financial Markets: The increasing integration of financial markets has made them more susceptible to contagion. A crisis in one country can quickly spread to others, potentially triggering a global financial meltdown. Systemic Risk Management must therefore be coordinated across borders, with international cooperation among regulators and institutions.

- The need to protect us from future financial shocks: No one wants another 2008. The memory of the last crisis and the hardship it brought motivates all of us to ensure a stable financial future.

The Role of Technology in Systemic Risk Management

Technology plays a pivotal role in modern Systemic Risk Management. The sheer volume and complexity of data generated by financial markets necessitate the use of advanced tools for analysis and monitoring. Here are some specific ways in which technology is being used:

- Risk Modeling: Sophisticated risk models are used to simulate the impact of various scenarios on the financial system. These models can help institutions identify potential vulnerabilities and develop contingency plans.

- Data Analytics: Data analytics tools are used to analyze vast amounts of data to identify patterns and trends that may indicate emerging risks. This includes analyzing transaction data, market data, and news data to identify potential sources of systemic risk.

- Artificial Intelligence: AI is being used to automate risk management processes, improve the accuracy of risk assessments, and detect anomalies that may indicate fraudulent activity or other forms of misconduct.

- Real-Time Monitoring: Technology enables real-time monitoring of financial markets, allowing regulators and institutions to quickly identify and respond to potential threats. This includes monitoring trading activity,

Capital Requirements Regulation Global Market Growth

The global financial landscape is constantly evolving, and a key driver of this evolution is the implementation and impact of financial regulations. One such regulation with far-reaching consequences is the Capital Requirements Regulation. This regulation plays a vital role in shaping financial stability, influencing investment decisions, and, most importantly, protecting consumers and the overall economy from excessive risk. Understanding the Capital Requirements Regulation and its influence on global market growth is crucial for anyone involved in the financial sector, from investors and bankers to policymakers and even everyday citizens. This article will help us break down the complexities of CRR and illustrate its effects on the global market.

Key Takeaways:

- Capital Requirements Regulation (CRR) aims to strengthen the financial system by setting minimum capital requirements for banks.

- CRR impacts global market growth by influencing lending practices, investment strategies, and overall financial stability.

- Differences in CRR implementation across regions can create both opportunities and challenges for international businesses.

- Ongoing developments and potential future changes to CRR necessitate continuous monitoring and adaptation by financial institutions.

Understanding the Impact of Capital Requirements Regulation

The Capital Requirements Regulation is a set of rules designed to ensure that banks and other financial institutions hold enough capital to absorb potential losses. These regulations are based on the Basel Accords, an international agreement aimed at promoting stability in the global financial system. The core principle is simple: the more risk a bank takes, the more capital it should hold as a buffer. This approach is designed to prevent banks from becoming excessively leveraged and therefore less vulnerable to financial shocks.

The impact of the Capital Requirements Regulation on global market growth is multifaceted. Firstly, by increasing the amount of capital that banks must hold, the CRR can influence their lending practices. Banks with higher capital requirements may be more selective in their lending, potentially leading to reduced credit availability for businesses and consumers. This can impact economic growth, especially for smaller businesses that rely on bank loans for funding.

Secondly, the Capital Requirements Regulation can affect investment strategies. Banks may adjust their investment portfolios to optimize their capital ratios, potentially shifting away from riskier assets toward safer, more liquid investments. This can impact the allocation of capital in the global market and influence asset prices.

Finally, and perhaps most importantly, the Capital Requirements Regulation contributes to overall financial stability. By reducing the likelihood of bank failures, the CRR helps to maintain confidence in the financial system and prevent systemic crises. This is crucial for sustained economic growth.

How Does the Capital Requirements Regulation Affect Different Regions?

While the Capital Requirements Regulation is based on international agreements, its implementation can vary across different regions. For example, the European Union has its own version of the CRR, which incorporates the Basel III standards. Other countries and regions may have their own interpretations and implementations of these standards.

These regional differences can create both opportunities and challenges for international businesses. On the one hand, they can allow companies to take advantage of regulatory arbitrage, by choosing to operate in jurisdictions with more favorable capital requirements. On the other hand, they can increase the complexity of doing business across borders, as companies need to comply with different sets of regulations in different countries.

Furthermore, the specific economic conditions and financial systems of different regions can influence the impact of the Capital Requirements Regulation. For example, a region with a highly developed financial market may be better equipped to absorb the costs of higher capital requirements than a region with a less developed market. Therefore, understanding the regional nuances of the Capital Requirements Regulation is essential for assessing its impact on global market growth.

The Role of the Capital Requirements Regulation in Financial Stability

The primary objective of the Capital Requirements Regulation is to promote financial stability. By requiring banks to hold adequate capital, the CRR reduces the risk of bank failures and helps to prevent systemic crises. This is particularly important in today’s interconnected global financial system, where a failure in one institution can quickly spread to others.

The Capital Requirements Regulation also plays a crucial role in protecting consumers. By ensuring that banks are financially sound, the CRR reduces the risk of depositors losing their money. This helps to maintain confidence in the banking system and encourages people to save and invest.

However, it is important to note that the Capital Requirements Regulation is not a silver bullet. It is just one tool in a broader toolkit for managing financial risk. Other important tools include effective supervision, strong corporate governance, and sound macroeconomic policies. A holistic approach is needed to ensure financial stability and promote sustainable economic growth.

Future Trends and Challenges for Capital Requirements Regulation

The Capital Requirements Regulation is not a static set of rules. It

Tokenized Assets Your Simple Investment Guide

What are Tokenized Assets?

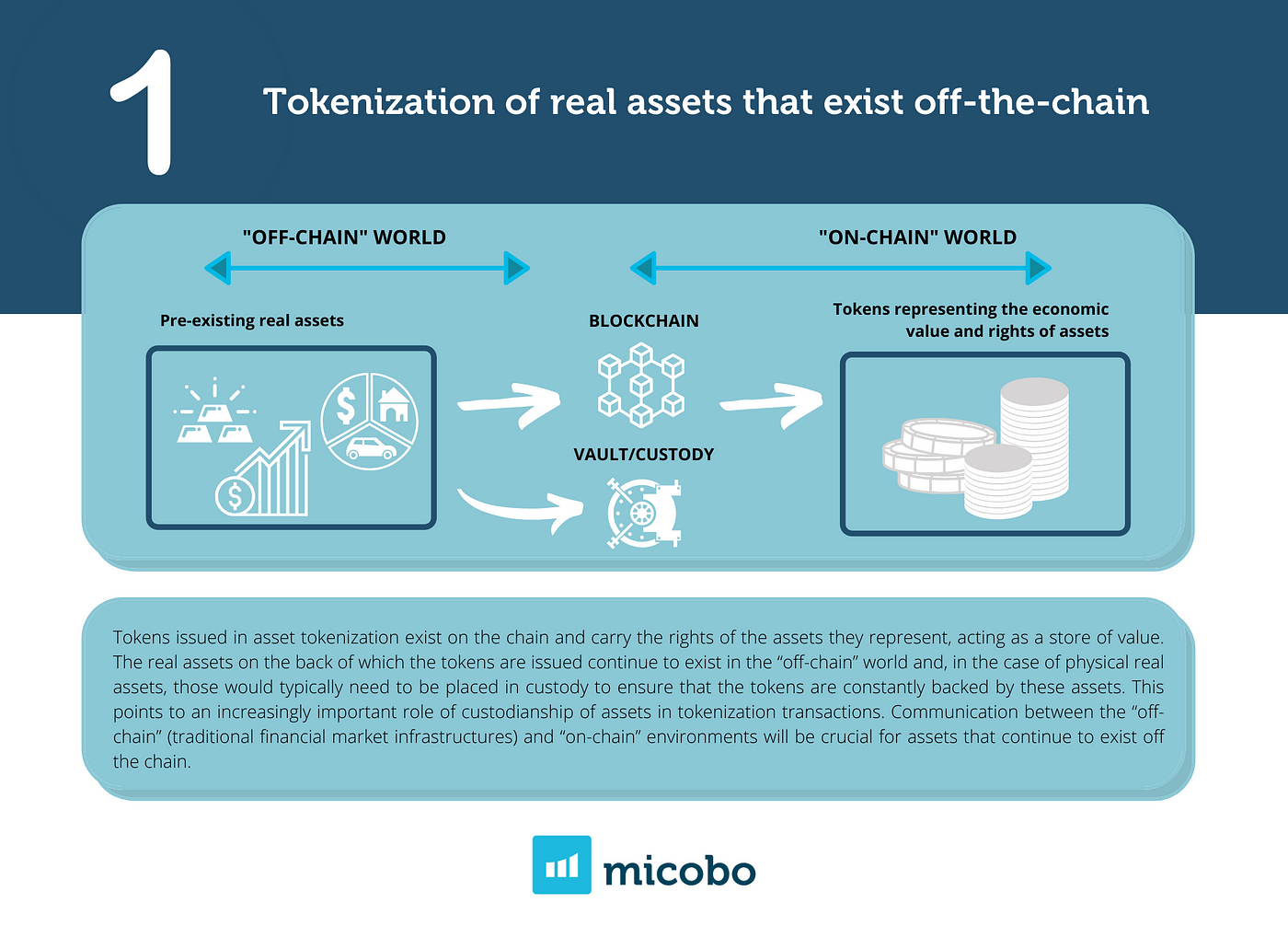

Imagine owning a tiny fraction of a valuable asset, like a piece of a famous painting, a share of real estate, or even a limited-edition sneaker, all without the hassle of traditional ownership. That’s the power of tokenized assets. Essentially, it’s the process of representing ownership of an asset – whether physical or digital – as a digital token on a blockchain. This token acts as proof of ownership, making it easily transferable and divisible. Think of it like a digital certificate of ownership, but with significantly improved security and transparency.

How Tokenization Works

The process begins by creating a digital representation of the asset. This involves verifying its authenticity and value. Then, this asset is divided into smaller, tradable units, each represented by a unique token on a blockchain network. Smart contracts, self-executing contracts with the terms of the agreement between buyer and seller written directly into the code, automate the transfer of these tokens. This eliminates the need for intermediaries, speeding up transactions and reducing costs.

Benefits of Investing in Tokenized Assets

Tokenization unlocks several compelling advantages for investors. Fractional ownership becomes possible, allowing individuals to invest in assets previously inaccessible due to high minimum investment requirements. Liquidity improves significantly; you can buy and sell tokens representing fractions of assets much more easily than the assets themselves. Transparency increases due to the public nature of blockchain records. Finally, costs associated with traditional asset management, such as brokerage fees, are often reduced. Ensure long-term success with a Home Loans Illawarra

Types of Tokenized Assets

The range of assets that can be tokenized is vast and constantly expanding. Real estate is a popular choice, allowing for fractional ownership of properties. Art and collectibles, such as paintings, sculptures, and rare trading cards, are also frequently tokenized. Securities like stocks and bonds can be tokenized for easier trading and increased liquidity. Even intellectual property rights, such as patents and copyrights, are finding their way onto the blockchain.

Risks Associated with Tokenized Assets

While tokenized assets offer numerous benefits, it’s crucial to acknowledge potential risks. The regulatory landscape for tokenized assets is still evolving, and the lack of clear regulations in some jurisdictions could lead to uncertainty. The value of tokenized assets is inherently linked to the underlying asset, so any decrease in the asset’s value will impact the token’s price. The security of the blockchain platform is critical; any vulnerabilities could compromise the integrity of the tokens and potentially lead to losses.

Choosing a Tokenized Asset Platform

When exploring investments in tokenized assets, selecting a reliable platform is paramount. Look for platforms with a strong track record, robust security measures, and transparent fee structures. Research the platform’s compliance with relevant regulations and its reputation within the industry. Consider the platform’s user interface and the ease of buying, selling, and managing your tokenized assets. Don’t hesitate to compare different platforms before committing your investment.

Due Diligence and Diversification

Before investing in any tokenized asset, thorough due diligence is essential. Understand the underlying asset, its potential value appreciation, and the associated risks. Research the project team behind the tokenization, examining their experience and expertise. Remember that diversification is crucial to mitigate risk. Don’t put all your eggs in one basket; spread your investments across various tokenized assets to reduce the impact of any single asset’s underperformance.

The Future of Tokenized Assets

The potential for tokenized assets is immense. As blockchain technology matures and regulatory clarity improves, we can anticipate a significant increase in the adoption of tokenized assets across various asset classes. This could revolutionize how we invest, trade, and manage assets, making them more accessible and efficient for a broader range of participants. The future looks bright for this innovative investment avenue, but careful research and a well-informed investment strategy are crucial for success. Read also about how to invest in tokenized assets.

Banking Without the Bank How Embedded Finance Works

What is Embedded Finance?

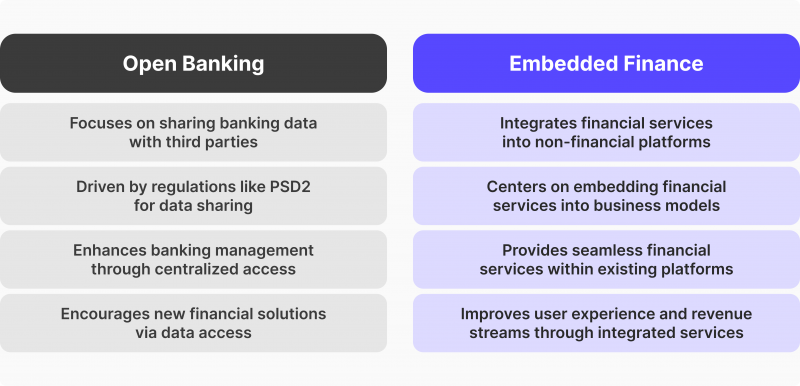

Embedded finance is the seamless integration of financial services into non-financial products and platforms. Think about it like this: instead of going to a bank for a loan, you apply for it directly through the platform where you’re already buying a product or service. This could be anything from a retailer’s website offering financing for a purchase, to a ride-sharing app providing insurance options to its drivers. The key is that the financial service is integrated directly into the customer’s journey, making it convenient and readily available.

How Embedded Finance Differs from Traditional Banking

Traditional banking involves separate interactions with financial institutions. You go to the bank for a loan, a credit card, or an investment account. Embedded finance eliminates this friction. It leverages existing user relationships and data from platforms already engaging with customers, streamlining access to financial products. This often results in a faster and more personalized experience, tailoring offerings to the customer’s specific needs within the context of their current activity.

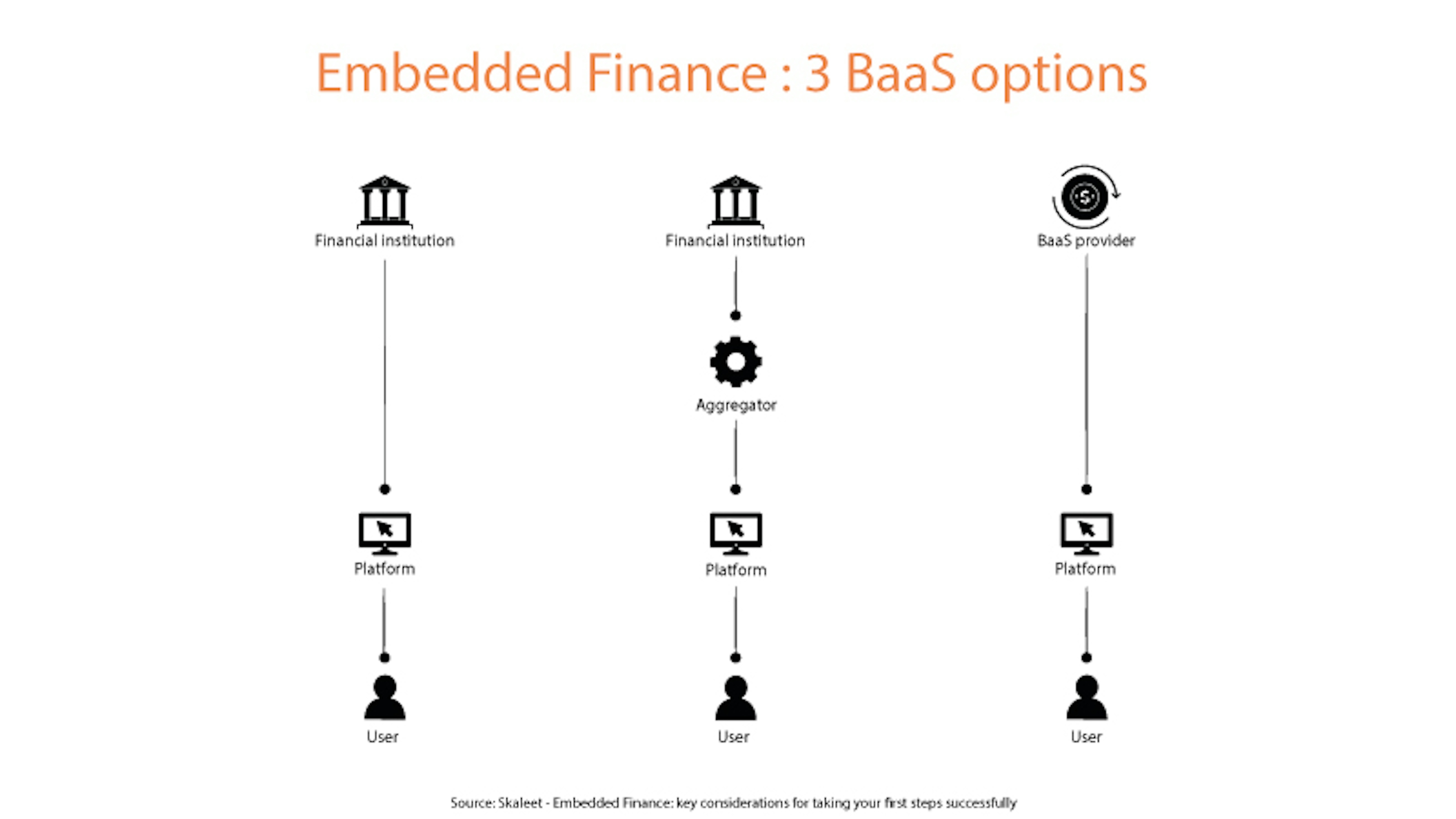

The Key Players in Embedded Finance

Several key players drive this shift in the financial landscape. First, there are the **technology providers** that build the infrastructure to embed these financial services. These are often fintech companies specializing in APIs and payment gateways. Then there are the **financial institutions** (banks, credit unions, insurers) that provide the actual financial products. Finally, we have the **platforms** that integrate these services into their offerings, ranging from e-commerce sites to SaaS providers. The collaboration between these players is crucial for the success of embedded finance.

Benefits for Businesses Integrating Embedded Finance

For businesses, integrating embedded finance unlocks numerous benefits. It increases customer lifetime value by offering additional services that increase engagement and retention. It opens up new revenue streams through commissions or fees generated from the financial services offered. Furthermore, it improves the customer experience by providing a streamlined and convenient way to access financial products at the point of need. This improved experience can foster brand loyalty and enhance the overall customer relationship.

Benefits for Consumers Using Embedded Finance

Consumers benefit from increased convenience and a more personalized experience. They can access financial services at the precise moment they need them, without the hassle of navigating separate applications or visiting a physical branch. This ease of access can lead to better financial decision-making, as consumers can seamlessly manage their finances within the context of their everyday activities. Moreover, tailored financial offerings can cater to specific needs, making financial products more relevant and accessible.

Examples of Embedded Finance in Action

Numerous real-world examples showcase the versatility of embedded finance. A furniture retailer might offer financing options directly at checkout, allowing customers to spread the cost of a purchase. A travel booking platform could provide travel insurance as part of the booking process. A software-as-a-service (SaaS) company might allow users to pay for their subscription with a buy-now-pay-later option. These examples highlight how diverse businesses are leveraging embedded finance to enhance their offerings and improve customer experience.

The Future of Embedded Finance

Embedded finance is rapidly evolving, driven by advancements in technology and changing customer expectations. We can expect to see even more sophisticated integrations, personalized offerings, and a wider range of financial products seamlessly embedded into various platforms. As the technology matures and regulatory frameworks evolve, embedded finance is poised to become a significant driver of innovation within the financial sector and beyond, fundamentally changing how we access and utilize financial services.

Fractional Ownership Invest in Art, Now Easier Than Ever

Unlocking the World of Art Investment: Fractional Ownership

For years, the art market has been seen as an exclusive club, accessible only to the ultra-wealthy. The sheer cost of acquiring significant pieces has kept many potential investors on the sidelines. But the rise of fractional ownership is changing all that, democratizing access to blue-chip artworks and offering a new avenue for diversification within investment portfolios.

How Fractional Ownership Works: A Simple Explanation

Fractional ownership, in the context of art investment, is precisely what it sounds like: owning a share of a valuable artwork. Imagine a masterpiece valued at $1 million. Instead of one individual needing to invest the full amount, the artwork is divided into, say, 100 shares, each costing $10,000. Investors can purchase one or more shares, giving them proportional ownership and all the associated benefits – appreciation in value, potential for exhibitions, and even a share of any profits from future sales.

The Benefits of Investing in Art Through Fractional Ownership

The advantages are multifaceted. Firstly, it significantly lowers the barrier to entry. Access to high-value art is no longer limited by massive capital requirements. Secondly, art often acts as a hedge against inflation, providing a portfolio buffer against market volatility. Thirdly, diversification is key to any successful investment strategy, and art, traditionally an illiquid asset, is now accessible to a broader range of investors, adding a unique layer of diversification. Finally, successful art investments can offer impressive returns, potentially outperforming traditional asset classes over the long term.

Navigating the Fractional Ownership Market: Choosing the Right Platform

With the growing popularity of fractional ownership, several platforms have emerged to facilitate these transactions. Careful due diligence is crucial. Look for platforms with transparent fee structures, robust security measures, and a proven track record. Consider the platform’s selection of artworks; does it offer a diverse range of styles, artists, and price points? Read reviews and compare different platforms before making a decision. Reputable platforms provide detailed information on the artworks, including provenance (history of ownership) and professional appraisals, building confidence and transparency.

Understanding the Risks Involved: A Balanced Perspective

While fractional ownership offers exciting opportunities, it’s important to acknowledge the inherent risks. The art market is inherently volatile, influenced by factors such as artist popularity, market trends, and economic conditions. Unlike more liquid assets, selling your fractional share may take time. There’s also the risk associated with choosing a less reputable platform, hence the importance of thorough research. Diversification across multiple artworks and platforms can help mitigate some of these risks.

The Future of Art Investment: Fractional Ownership’s Role

Fractional ownership is undoubtedly transforming the art investment landscape. It’s not just about making art accessible to a wider audience; it’s about broadening investment opportunities and fostering a deeper engagement with the art world. As technology continues to advance and platforms refine their offerings, fractional ownership is poised for significant growth, making the art market more inclusive and dynamic than ever before. This opens up exciting possibilities for both seasoned investors and newcomers alike, offering a fresh perspective on diversification and long-term investment strategies.

Due Diligence and Professional Advice: Protecting Your Investment

Before investing in fractional art ownership, it’s strongly recommended to seek professional financial advice. A qualified financial advisor can help assess your risk tolerance, investment goals, and determine if fractional art ownership aligns with your overall portfolio strategy. Thoroughly research the chosen platform and the specific artwork before committing funds. Understand the platform’s fees, the valuation process, and the potential liquidity challenges associated with selling your fractional share. Remember, informed decisions are crucial for successful investing.

Beyond Financial Returns: The Intangible Benefits of Art Ownership

Investing in art through fractional ownership isn’t solely about financial gains; it also provides access to a world of cultural enrichment. Owning a piece of history, a moment of creative genius, can offer intangible rewards that extend far beyond monetary value. The ability to appreciate the artwork, visit exhibitions, and connect with the art world adds another dimension to this unique investment opportunity. Please click here for news about tokenized assets.

Investing in the Future WhiteRock’s Blockchain

Understanding WhiteRock’s Blockchain Technology

WhiteRock’s blockchain isn’t just another cryptocurrency; it’s a sophisticated platform designed for real-world applications. Unlike many blockchains focused solely on financial transactions, WhiteRock aims to revolutionize several sectors through its unique architecture and functionalities. It leverages a hybrid consensus mechanism, combining the security of proof-of-stake with the efficiency of delegated proof-of-stake, aiming for a balance between decentralization and scalability. This approach is intended to overcome the limitations of purely decentralized systems, such as slow transaction speeds and high energy consumption, making it attractive for various industries beyond simple cryptocurrency trading.

WhiteRock’s Focus on Real-World Applications

WhiteRock’s development team has a clear vision: to build a blockchain that solves practical problems. They’re actively exploring partnerships and developing solutions for supply chain management, digital identity verification, and secure data storage. Imagine a system where the provenance of goods can be effortlessly tracked, reducing fraud and ensuring consumer trust. Or a system that allows individuals to securely manage and share their digital identities without compromising privacy. These are just a few examples of the potential WhiteRock offers, moving beyond the speculative realm of many cryptocurrencies and into tangible, impactful applications.

Investment Potential and Risk Assessment

Investing in any blockchain project, including WhiteRock, carries inherent risks. The cryptocurrency market is notoriously volatile, and the value of WhiteRock’s native token can fluctuate significantly. However, the potential rewards can also be substantial. If WhiteRock successfully delivers on its promises and gains wider adoption in its target sectors, the value of its token could increase significantly. Thorough due diligence, including researching the team’s experience, the technology’s viability, and the competitive landscape, is crucial before committing any funds. Diversifying your investment portfolio is also a wise strategy to mitigate risk.

The WhiteRock Development Team and Community

The success of any blockchain project heavily relies on its development team and community. WhiteRock boasts a team of experienced developers, blockchain experts, and industry professionals with a proven track record. Furthermore, an active and engaged community is essential for the long-term growth and sustainability of the project. A thriving community provides feedback, contributes to development, and helps spread awareness. Investigating the team’s background and the activity within the WhiteRock community can provide valuable insights into the project’s potential for success.

Analyzing the WhiteRock Ecosystem

Beyond the core blockchain technology, the entire ecosystem surrounding WhiteRock is crucial to consider. This includes the partnerships the project has secured, the regulatory landscape it operates within, and the overall market demand for the solutions it offers. Strong partnerships with established businesses can significantly accelerate adoption and increase the project’s credibility. Understanding the regulatory environment is also vital, as regulations can significantly impact a blockchain project’s growth and potential. Assessing market demand will help determine whether there’s a genuine need for the solutions WhiteRock provides.

Long-Term Growth Prospects and Sustainability

The long-term viability of WhiteRock depends on various factors, including technological advancements, market adoption, and the project’s ability to adapt to changing circumstances. Continuous innovation and improvement of the blockchain technology are essential to maintain its competitiveness. Gaining wider acceptance within its target industries is also crucial for long-term growth. A strong focus on sustainability, both environmentally and financially, will also enhance the project’s appeal to investors and stakeholders. Considering these factors offers a glimpse into the potential longevity and success of WhiteRock.

Comparing WhiteRock to Other Blockchain Projects

It’s vital to compare WhiteRock to other similar blockchain projects to understand its competitive advantages and disadvantages. What makes WhiteRock stand out from its competitors? Does it offer a unique technological advantage, a stronger team, or a more promising application focus? Understanding the competitive landscape helps investors make informed decisions and assess the project’s potential for market share and growth. A thorough comparison can reveal whether WhiteRock genuinely offers a compelling investment opportunity.

Strategies for Investing in WhiteRock

Investing in WhiteRock, or any cryptocurrency, should be a well-planned and considered decision. Start with a small investment that you’re comfortable losing, and gradually increase your holdings as you gain more confidence in the project. Use reputable exchanges for trading and secure your assets with robust security measures. Regularly review your portfolio and adjust your investment strategy based on market conditions and the project’s progress. Remember, patience and a long-term perspective are key to successful cryptocurrency investments. Please click here to learn more about whiterock tokenized assets blockchain.

Blockchain’s New Frontier Tokenized Assets

What are Tokenized Assets?

Tokenization is the process of representing real-world assets, such as real estate, art, or even intellectual property, as digital tokens on a blockchain. These tokens, often represented as NFTs (Non-Fungible Tokens) or other types of digital assets, mirror the ownership and characteristics of the underlying asset. This allows for fractional ownership, easier trading, and increased liquidity in markets traditionally plagued by high transaction costs and slow processing times.

The Blockchain Advantage in Asset Tokenization

Blockchain’s decentralized, transparent, and secure nature makes it the ideal platform for tokenizing assets. Its immutable ledger ensures transparency and prevents tampering with ownership records, offering a high degree of trust and security. Smart contracts, self-executing contracts with the terms of the agreement between buyer and seller directly written into code, automate the transfer of ownership and other processes, streamlining the entire transaction process. This reduces reliance on intermediaries, lowering costs and speeding up transactions.

Fractional Ownership and Increased Liquidity

One of the most significant advantages of tokenized assets is the ability to divide assets into smaller, easily tradable units. This allows more people to participate in markets previously inaccessible due to high minimum investment thresholds. For instance, owning a piece of a valuable artwork or a share of a high-value real estate property becomes achievable for a wider range of investors. This increased accessibility fuels higher liquidity, making it easier to buy and sell these assets quickly and efficiently.

Real-World Applications of Tokenized Assets

The applications of tokenized assets are vast and continue to expand. In the real estate sector, fractional ownership through tokens allows investors to diversify their portfolios and access properties they wouldn’t be able to afford otherwise. In the art market, tokenization provides verifiable provenance and simplifies the buying, selling, and trading of digital and physical artwork. Beyond these, we see applications emerging in areas like supply chain management, where tokens can track goods throughout their journey, and in the financial sector, where tokenized securities offer a more efficient and transparent way of managing investments.

The Role of NFTs in Asset Tokenization

Non-Fungible Tokens (NFTs) play a crucial role in tokenizing unique and non-divisible assets. Unlike cryptocurrencies like Bitcoin which are fungible (interchangeable), NFTs represent unique digital assets with verifiable ownership. This is particularly relevant for unique items like artwork, collectibles, and intellectual property rights, where maintaining proof of ownership and authenticity is paramount. NFTs provide a secure and tamper-proof record of ownership, adding value and trust to the asset.

Challenges and Regulatory Considerations

While the potential of tokenized assets is enormous, there are challenges to overcome. Regulatory clarity is crucial. Governments worldwide are grappling with how to regulate these new forms of digital assets, and a consistent regulatory framework is needed to foster growth and prevent misuse. Concerns around security, scalability, and interoperability between different blockchain platforms also need addressing. These challenges, however, do not overshadow the transformative potential of tokenized assets to revolutionize various sectors.

The Future of Tokenized Assets

The future of tokenized assets looks bright. As blockchain technology matures and regulatory frameworks evolve, we can expect to see even wider adoption across diverse sectors. The ability to fractionalize ownership, enhance liquidity, and increase transparency will continue to attract investors and businesses. The development of new blockchain infrastructure and improved interoperability will further fuel this growth, leading to a more efficient and accessible global economy.

Security and Trust in Tokenized Asset Platforms

The security of the blockchain platform and the smart contracts used to govern tokenized assets is paramount. Robust security measures are necessary to protect against hacking and fraud. Furthermore, building trust in the underlying platform is essential for widespread adoption. This necessitates transparent processes, rigorous audits, and community involvement to ensure the integrity and reliability of tokenized asset platforms.

The Impact on Traditional Markets

Tokenized assets are poised to disrupt traditional markets significantly. Their increased efficiency, reduced costs, and enhanced transparency can challenge established intermediaries and create new opportunities for participants. This disruption, however, will also lead to opportunities for collaboration and innovation as traditional players adapt to this new landscape and integrate tokenization into their operations. The result will likely be a more efficient and competitive market environment. Read more about tokenized assets on the blockchain.

What is Embedded Finance & How Does it Work?

What Exactly is Embedded Finance?

Embedded finance is the seamless integration of financial services into non-financial platforms and applications. Instead of users needing to navigate to a separate bank or financial institution’s website or app, they can access financial products and services directly within the platforms they already use regularly. Think of it like this: you’re using your favorite shopping app, and suddenly you have the option to pay with a buy-now-pay-later service, or take out a loan to finance your purchase, all without leaving the app. That’s embedded finance in action.

Examples of Embedded Finance in Action

The applications of embedded finance are incredibly diverse and expanding rapidly. Consider a ride-sharing app offering users instant insurance for each ride, a travel booking site allowing customers to secure travel insurance or finance their trip, or a social media platform enabling peer-to-peer payments. These are all practical examples of how companies are leveraging embedded finance to enhance user experience and expand revenue streams. Even software-as-a-service (SaaS) businesses are getting in on the action, offering integrated invoice financing or payment solutions for their clients directly within their platform.

How Embedded Finance Works: The Technical Side

Behind the scenes, embedded finance relies on a complex network of partnerships and APIs (Application Programming Interfaces). The non-financial platform partners with financial service providers (like banks, lenders, and insurers) to offer their services. APIs act as the bridges, connecting the platform’s user interface with the financial institution’s backend systems. This allows for secure and efficient data transfer, enabling users to seamlessly complete financial transactions without ever leaving the main application. Robust security protocols and regulatory compliance are absolutely crucial to ensure the safety and privacy of user data.

Benefits for Businesses Implementing Embedded Finance

For businesses, embedded finance offers a multitude of advantages. Primarily, it enhances customer loyalty by providing a more convenient and personalized user experience. It can also significantly boost revenue through increased sales and added fees from financial products. By offering relevant financial services, businesses can better meet customer needs and increase customer lifetime value. Furthermore, it can lead to the development of new revenue streams and open up opportunities for strategic partnerships with financial institutions.

Benefits for Consumers Using Embedded Finance Services

Consumers benefit greatly from the ease and convenience embedded finance offers. The process is streamlined, making financial transactions quicker and simpler. Users can access needed financial products at the precise moment they need them – no more navigating to separate websites or apps to complete transactions. This integrated approach removes friction and enhances the overall user experience, potentially offering more competitive pricing or tailored financial products based on individual needs and context.

The Role of APIs and Partnerships in Embedded Finance

APIs are the lifeblood of embedded finance, facilitating the communication between the platform and the financial service provider. These APIs allow for secure and efficient transfer of data, including user information, transaction details, and risk assessment factors. Strong partnerships between the technology platform and financial institutions are critical to ensuring compliance with regulations, maintaining data security, and providing a seamless customer experience. Selecting the right partners is essential to success, as they bring the financial expertise and regulatory know-how.

Security and Regulatory Considerations in Embedded Finance

Given the sensitive nature of financial data, security and regulatory compliance are paramount. Robust security measures, including encryption and multi-factor authentication, must be in place to protect user data from unauthorized access. Furthermore, businesses must comply with relevant regulations, such as data privacy laws (like GDPR or CCPA) and financial regulations specific to the offered products. Meeting these stringent requirements is critical to maintaining trust and avoiding legal repercussions.

The Future of Embedded Finance

The future of embedded finance is bright, with ongoing innovations and expansion into new areas. We can expect to see further integration into everyday applications, with even more diverse financial products becoming readily available. The potential to personalize financial services based on individual user behavior and needs is enormous. Expect more sophisticated risk assessment techniques, AI-driven solutions, and a continued focus on improving security and regulatory compliance to fuel the growth of embedded finance across industries. Read also about what is embedded finance.

Visa Enters the World of Tokenized Assets

Visa’s Leap into Tokenized Assets: A New Frontier

Visa, a global leader in digital payments, is making significant strides into the burgeoning world of tokenized assets. This move signifies a major shift in the company’s strategy, reflecting its commitment to embracing and facilitating innovation within the financial technology landscape. By integrating tokenized assets into its existing infrastructure, Visa aims to expand its reach and offer its vast network of clients access to a wider array of financial instruments.

Understanding the Significance of Tokenization

Tokenization, in essence, involves representing assets—from real estate and art to carbon credits and intellectual property—as digital tokens on a blockchain. This process enhances liquidity, facilitates fractional ownership, and simplifies the transfer and management of assets. For Visa, engaging with this technology means leveraging blockchain’s inherent security and transparency to streamline transactions and potentially open up new revenue streams. It’s a strategic move to remain competitive in a rapidly evolving payments ecosystem.

Visa’s Approach to Tokenized Asset Integration

Visa’s approach is multi-faceted. It’s not merely exploring tokenization theoretically; the company is actively investing in and collaborating with companies operating in the blockchain and digital asset spaces. This involves partnering with established players to integrate tokenized assets seamlessly into its existing payment rails. The goal is to provide a familiar, user-friendly experience for customers, regardless of whether they’re dealing with traditional fiat currencies or digital tokens representing various assets.

Benefits for Businesses and Consumers

The integration of tokenized assets through Visa’s network offers several key benefits for both businesses and consumers. Businesses gain access to new fundraising opportunities and improved efficiency in managing assets. The streamlined transfer of assets can significantly reduce operational costs and administrative burdens. For consumers, access to fractional ownership of high-value assets opens up previously unavailable investment possibilities, democratizing access to asset classes traditionally confined to high-net-worth individuals. The increased transparency and security provided by the blockchain also benefit all parties involved.

Addressing Potential Challenges and Risks

While the potential benefits of tokenized assets are substantial, several challenges need addressing. Regulatory uncertainty remains a major hurdle, with varying legal frameworks across different jurisdictions. Ensuring the security of these assets on the blockchain is also crucial, as any vulnerabilities could have significant financial implications. Visa acknowledges these challenges and is actively working with regulators and technology providers to mitigate these risks and develop robust solutions that ensure compliance and protect consumers.

The Future of Payments: Visa’s Vision

Visa’s foray into the tokenized asset arena underscores its long-term vision for the future of payments. The company anticipates a future where digital assets are seamlessly integrated into everyday financial transactions, alongside traditional fiat currencies. This vision requires ongoing collaboration with various stakeholders, including regulators, technology developers, and other financial institutions. By actively shaping this future, Visa aims to maintain its position as a leader in the global payments landscape and provide innovative solutions that meet the evolving needs of its customers.

Strategic Partnerships and Technological Advancements

Central to Visa’s success in this domain will be its strategic partnerships and its ability to adapt to technological advancements in the blockchain space. Visa will need to maintain close relationships with leading blockchain companies, ensuring interoperability between different blockchain networks and maintaining seamless integration with its existing infrastructure. The rapid evolution of blockchain technology means that ongoing innovation and adaptation are crucial to Visa’s continued success in this new frontier.

The Broader Implications for the Financial Ecosystem

Visa’s involvement in the tokenized asset space carries broader implications for the entire financial ecosystem. Its entry into this market signals a growing acceptance of blockchain technology and its potential to revolutionize financial services. Other major players in the financial industry are likely to follow suit, leading to a more interconnected and dynamic financial landscape. This increased competition could ultimately drive further innovation and benefit consumers through greater access to financial products and services. Please click here to learn more about visa tokenized assets.