What is Embedded Finance?

Embedded finance is the seamless integration of financial services into non-financial products and platforms. Think about it like this: instead of going to a bank for a loan, you apply for it directly through the platform where you’re already buying a product or service. This could be anything from a retailer’s website offering financing for a purchase, to a ride-sharing app providing insurance options to its drivers. The key is that the financial service is integrated directly into the customer’s journey, making it convenient and readily available.

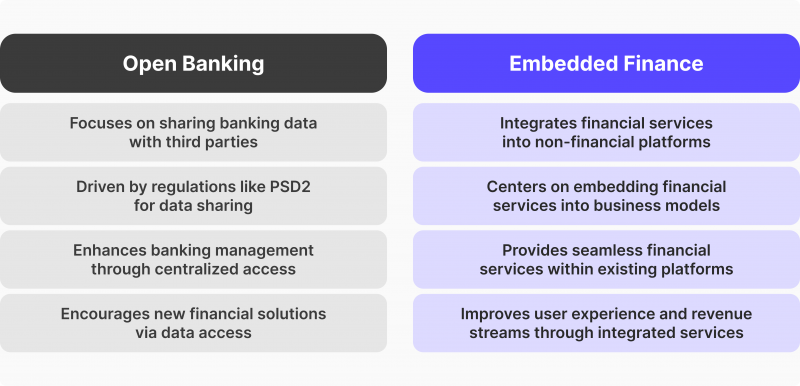

How Embedded Finance Differs from Traditional Banking

Traditional banking involves separate interactions with financial institutions. You go to the bank for a loan, a credit card, or an investment account. Embedded finance eliminates this friction. It leverages existing user relationships and data from platforms already engaging with customers, streamlining access to financial products. This often results in a faster and more personalized experience, tailoring offerings to the customer’s specific needs within the context of their current activity.

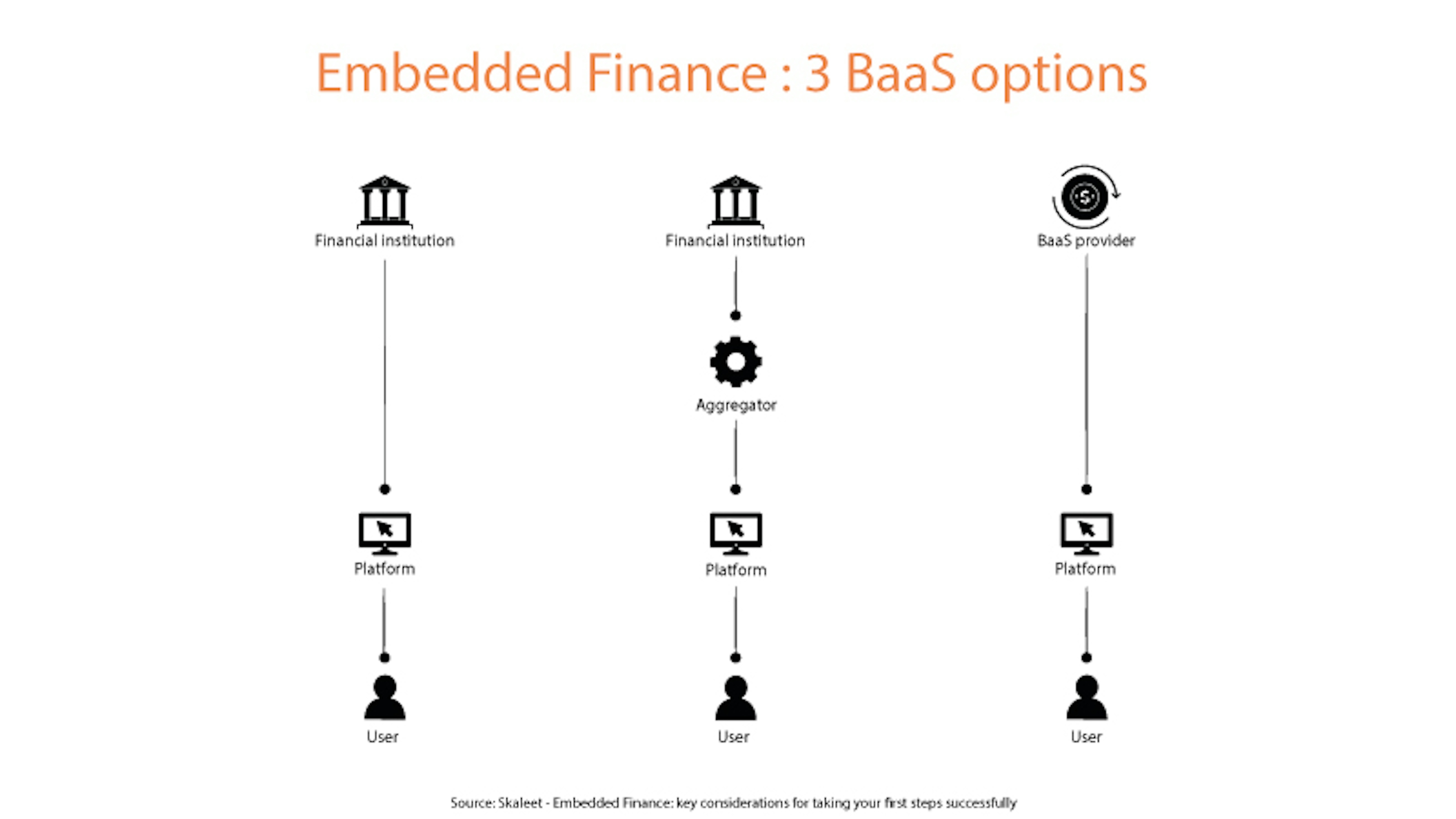

The Key Players in Embedded Finance

Several key players drive this shift in the financial landscape. First, there are the **technology providers** that build the infrastructure to embed these financial services. These are often fintech companies specializing in APIs and payment gateways. Then there are the **financial institutions** (banks, credit unions, insurers) that provide the actual financial products. Finally, we have the **platforms** that integrate these services into their offerings, ranging from e-commerce sites to SaaS providers. The collaboration between these players is crucial for the success of embedded finance.

Benefits for Businesses Integrating Embedded Finance

For businesses, integrating embedded finance unlocks numerous benefits. It increases customer lifetime value by offering additional services that increase engagement and retention. It opens up new revenue streams through commissions or fees generated from the financial services offered. Furthermore, it improves the customer experience by providing a streamlined and convenient way to access financial products at the point of need. This improved experience can foster brand loyalty and enhance the overall customer relationship.

Benefits for Consumers Using Embedded Finance

Consumers benefit from increased convenience and a more personalized experience. They can access financial services at the precise moment they need them, without the hassle of navigating separate applications or visiting a physical branch. This ease of access can lead to better financial decision-making, as consumers can seamlessly manage their finances within the context of their everyday activities. Moreover, tailored financial offerings can cater to specific needs, making financial products more relevant and accessible.

Examples of Embedded Finance in Action

Numerous real-world examples showcase the versatility of embedded finance. A furniture retailer might offer financing options directly at checkout, allowing customers to spread the cost of a purchase. A travel booking platform could provide travel insurance as part of the booking process. A software-as-a-service (SaaS) company might allow users to pay for their subscription with a buy-now-pay-later option. These examples highlight how diverse businesses are leveraging embedded finance to enhance their offerings and improve customer experience.

The Future of Embedded Finance

Embedded finance is rapidly evolving, driven by advancements in technology and changing customer expectations. We can expect to see even more sophisticated integrations, personalized offerings, and a wider range of financial products seamlessly embedded into various platforms. As the technology matures and regulatory frameworks evolve, embedded finance is poised to become a significant driver of innovation within the financial sector and beyond, fundamentally changing how we access and utilize financial services.