Defining Sustainable Private Equity

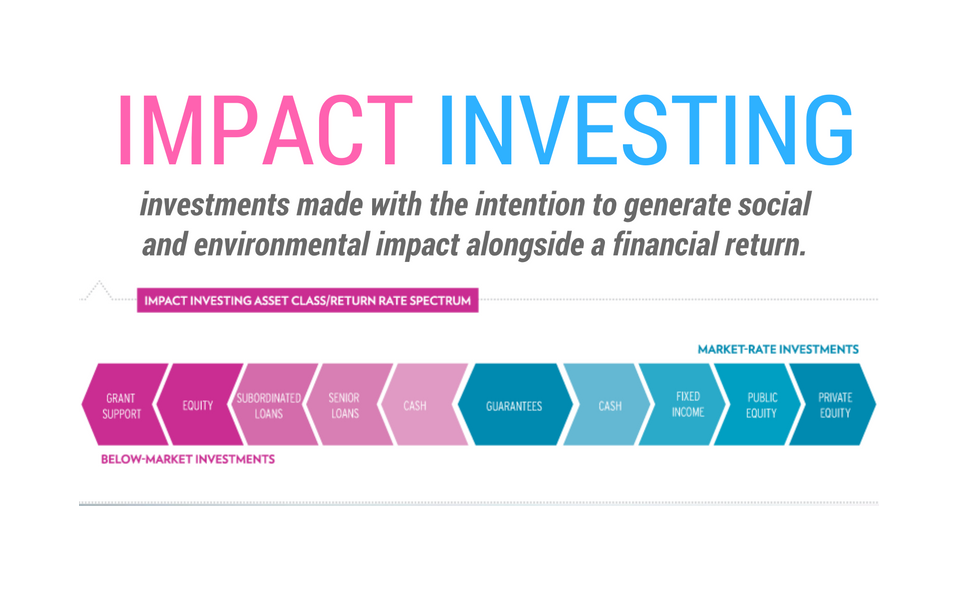

Sustainable private equity (SPE) is a rapidly expanding segment of the private equity market. It focuses on investments in companies that demonstrate strong environmental, social, and governance (ESG) performance. This isn’t just about “doing good”; it’s about identifying companies with robust business models that are built on sustainable practices, ultimately leading to better long-term financial returns. SPE firms actively integrate ESG factors into their investment strategy, due diligence, and portfolio company management, going beyond simply checking boxes to actively shaping sustainable business practices within their portfolio.

The Drivers Behind the Growth of Sustainable Private Equity

Several factors are fueling the surge in SPE. Increasingly, institutional investors, such as pension funds and endowments, are incorporating ESG considerations into their investment mandates, demanding more sustainable investment options. Growing awareness of climate change and its economic implications is another key driver. Investors are recognizing that companies with strong ESG profiles are often better positioned to navigate environmental and social risks, leading to enhanced resilience and long-term value creation. Finally, a growing number of consumers are actively choosing to support businesses committed to sustainability, creating a strong market demand for environmentally and socially responsible products and services.

Investment Strategies in Sustainable Private Equity

SPE firms employ diverse strategies, focusing on various sectors and impact areas. Some specialize in clean energy, renewable resources, and green technology, contributing directly to the transition to a low-carbon economy. Others focus on companies improving resource efficiency, reducing waste, or developing sustainable products and services across various industries. Some SPE firms employ a thematic approach, concentrating on specific ESG issues, such as water conservation or circular economy solutions. Others adopt a broader approach, integrating ESG factors across their portfolio companies, regardless of specific sector.

Measuring and Reporting Impact in Sustainable Private Equity

Transparency and accountability are paramount in SPE. To accurately measure and report the impact of their investments, SPE firms utilize various methodologies and frameworks. These include established standards like the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) standards, as well as industry-specific metrics. Reporting is increasingly sophisticated, moving beyond simple metrics to incorporate a more holistic view of ESG performance, taking into account both quantitative and qualitative data. This data helps investors understand the positive social and environmental contributions of their investments and enables continuous improvement within portfolio companies.

Challenges and Opportunities in Sustainable Private Equity

Despite its rapid growth, SPE faces challenges. One key challenge is the standardization of ESG data and metrics. Inconsistencies in reporting can make it difficult to compare investments and assess true impact. Another challenge lies in balancing financial returns with social and environmental impact. Finding companies that meet both financial and sustainability criteria can sometimes be difficult. However, these challenges also present opportunities. The development of robust ESG data and reporting standards is a key area of ongoing innovation. Moreover, the increasing demand for sustainable investments creates a significant opportunity for SPE firms to generate attractive returns while driving positive change.

The Future of Sustainable Private Equity

The future of SPE looks promising. Growing investor demand, coupled with increasing regulatory pressure and consumer awareness, is expected to drive further expansion of this market segment. We can anticipate more innovation in investment strategies, impact measurement, and reporting. Greater collaboration between SPE firms, investors, and policymakers will be essential to overcoming remaining challenges and accelerating the transition to a more sustainable economy. The integration of ESG factors will likely become even more deeply embedded into mainstream investment practices, making SPE not just a niche market, but a significant driver of future economic growth.

The Role of Technology in Sustainable Private Equity

Technology plays a crucial role in enabling the growth of SPE. Data analytics and artificial intelligence (AI) are increasingly used to screen companies, assess ESG risks, and monitor portfolio company performance. Blockchain technology can enhance transparency and traceability in supply chains, helping SPE firms track and verify the sustainability claims of their portfolio companies. Sophisticated data platforms are also allowing for more granular and impactful reporting on ESG performance, enhancing accountability and improving investment decision-making. Read more about private equity sustainable investing.