Sustainable Private Equity A Growing Market

Defining Sustainable Private Equity

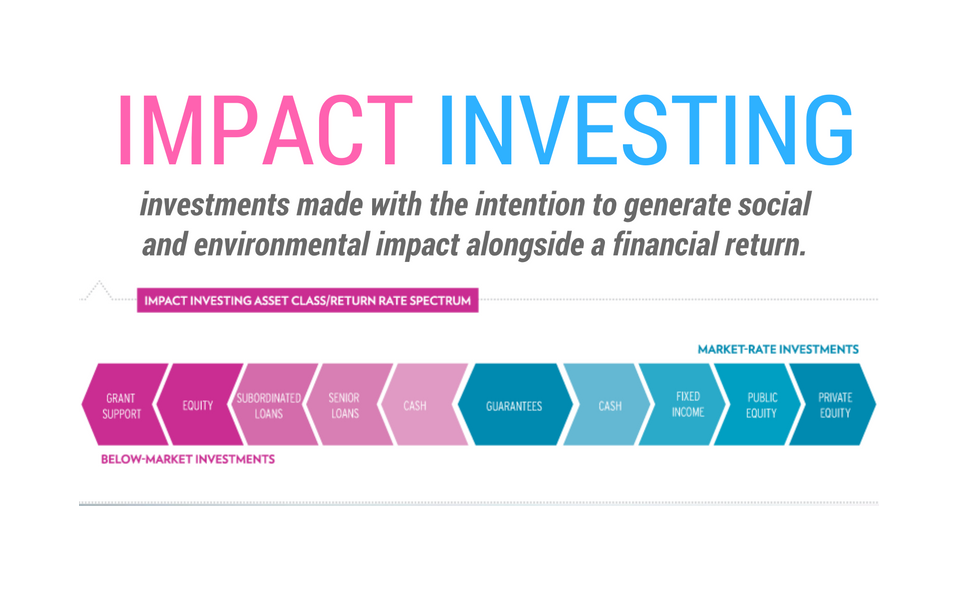

Sustainable private equity (SPE) is a rapidly expanding segment of the private equity market. It focuses on investments in companies that demonstrate strong environmental, social, and governance (ESG) performance. This isn’t just about “doing good”; it’s about identifying companies with robust business models that are built on sustainable practices, ultimately leading to better long-term financial returns. SPE firms actively integrate ESG factors into their investment strategy, due diligence, and portfolio company management, going beyond simply checking boxes to actively shaping sustainable business practices within their portfolio.

The Drivers Behind the Growth of Sustainable Private Equity

Several factors are fueling the surge in SPE. Increasingly, institutional investors, such as pension funds and endowments, are incorporating ESG considerations into their investment mandates, demanding more sustainable investment options. Growing awareness of climate change and its economic implications is another key driver. Investors are recognizing that companies with strong ESG profiles are often better positioned to navigate environmental and social risks, leading to enhanced resilience and long-term value creation. Finally, a growing number of consumers are actively choosing to support businesses committed to sustainability, creating a strong market demand for environmentally and socially responsible products and services.

Investment Strategies in Sustainable Private Equity

SPE firms employ diverse strategies, focusing on various sectors and impact areas. Some specialize in clean energy, renewable resources, and green technology, contributing directly to the transition to a low-carbon economy. Others focus on companies improving resource efficiency, reducing waste, or developing sustainable products and services across various industries. Some SPE firms employ a thematic approach, concentrating on specific ESG issues, such as water conservation or circular economy solutions. Others adopt a broader approach, integrating ESG factors across their portfolio companies, regardless of specific sector.

Measuring and Reporting Impact in Sustainable Private Equity

Transparency and accountability are paramount in SPE. To accurately measure and report the impact of their investments, SPE firms utilize various methodologies and frameworks. These include established standards like the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) standards, as well as industry-specific metrics. Reporting is increasingly sophisticated, moving beyond simple metrics to incorporate a more holistic view of ESG performance, taking into account both quantitative and qualitative data. This data helps investors understand the positive social and environmental contributions of their investments and enables continuous improvement within portfolio companies.

Challenges and Opportunities in Sustainable Private Equity

Despite its rapid growth, SPE faces challenges. One key challenge is the standardization of ESG data and metrics. Inconsistencies in reporting can make it difficult to compare investments and assess true impact. Another challenge lies in balancing financial returns with social and environmental impact. Finding companies that meet both financial and sustainability criteria can sometimes be difficult. However, these challenges also present opportunities. The development of robust ESG data and reporting standards is a key area of ongoing innovation. Moreover, the increasing demand for sustainable investments creates a significant opportunity for SPE firms to generate attractive returns while driving positive change.

The Future of Sustainable Private Equity

The future of SPE looks promising. Growing investor demand, coupled with increasing regulatory pressure and consumer awareness, is expected to drive further expansion of this market segment. We can anticipate more innovation in investment strategies, impact measurement, and reporting. Greater collaboration between SPE firms, investors, and policymakers will be essential to overcoming remaining challenges and accelerating the transition to a more sustainable economy. The integration of ESG factors will likely become even more deeply embedded into mainstream investment practices, making SPE not just a niche market, but a significant driver of future economic growth.

The Role of Technology in Sustainable Private Equity

Technology plays a crucial role in enabling the growth of SPE. Data analytics and artificial intelligence (AI) are increasingly used to screen companies, assess ESG risks, and monitor portfolio company performance. Blockchain technology can enhance transparency and traceability in supply chains, helping SPE firms track and verify the sustainability claims of their portfolio companies. Sophisticated data platforms are also allowing for more granular and impactful reporting on ESG performance, enhancing accountability and improving investment decision-making. Read more about private equity sustainable investing.

Thriving in Developed Economies: Latest Updates and Trends

Thriving in Developed Economies: Latest Updates and Trends

Developed economies stand at the forefront of global economic landscapes, characterized by stability, innovation, and robust infrastructures. This article delves into the current updates and trends shaping these advanced economies, offering insights for businesses and investors seeking to thrive.

Economic Resilience and Recovery

Developed economies have showcased resilience in the face of global challenges, including the recent pandemic. Rigorous vaccination campaigns, comprehensive stimulus packages, and adaptive policies have fueled economic recovery. The emphasis on innovation and technology adoption has played a pivotal role in shaping a resilient economic landscape.

Innovation and Technology Integration

The continuous integration of innovation and technology distinguishes developed economies. Investments in research and development, digital infrastructure, and emerging technologies drive economic growth. Businesses operating in these economies must stay agile and embrace technological advancements to remain competitive in rapidly evolving markets.

Labor Market Dynamics and Remote Work Trends

The labor market in developed economies is undergoing transformative changes. Remote work has become a prevalent trend, facilitated by advanced digital infrastructure. Companies are reevaluating traditional work models, emphasizing flexibility, and adopting hybrid approaches. This shift in labor dynamics necessitates adaptability in workforce management strategies.

Sustainable Practices and ESG Integration

Developed economies are increasingly prioritizing sustainability and Environmental, Social, and Governance (ESG) considerations. Businesses aligning with ESG principles are gaining favor among investors and consumers. Governments in these economies are implementing policies that promote sustainable practices, encouraging a collective commitment to addressing environmental and social challenges.

Financial Markets and Investment Opportunities

The financial markets of developed economies offer a diverse range of investment opportunities. Investors are navigating through various asset classes, including equities, bonds, and alternative investments. Analyzing market trends, staying informed about monetary policies, and assessing risk factors are crucial for optimizing investment portfolios in these dynamic financial environments.

Global Trade Relations and Economic Partnerships

Developed economies actively engage in global trade relations and form strategic economic partnerships. Trade agreements and collaborations with other advanced and emerging economies shape the international economic landscape. Businesses should monitor geopolitical developments and evolving trade dynamics to capitalize on global market opportunities.

Government Policies and Economic Stimulus

Government policies play a significant role in shaping economic outcomes in developed economies. Ongoing economic stimulus packages, fiscal policies, and regulatory frameworks impact businesses and industries. Staying informed about policy changes and understanding their implications are essential for strategic decision-making.

Digital Transformation in Industries

Industries across developed economies are undergoing digital transformations. From manufacturing and healthcare to finance and education, technological advancements are reshaping traditional sectors. Companies that embrace digital transformation are better positioned to enhance efficiency, meet changing consumer demands, and gain a competitive edge.

Infrastructure Development and Smart Cities Initiatives

Continuous infrastructure development is a hallmark of developed economies. Smart cities initiatives, characterized by the integration of technology for urban management, are gaining prominence. Investments in sustainable infrastructure, efficient transportation systems, and advanced utilities contribute to the overall quality of life and economic vibrancy.

The Future Landscape: Adaptation and Innovation

In conclusion, thriving in developed economies requires adaptation and a commitment to innovation. Businesses and investors should monitor the latest updates and trends, leverage technological advancements, and align with sustainable practices. For those interested in a deeper exploration of developed economies updates, visit Developed economies updates.

As the landscape continues to evolve, staying agile and responsive to economic shifts positions stakeholders for success in developed economies. The ability to navigate through dynamic environments, harness innovation, and contribute to sustainability goals defines a prosperous future in these advanced economic hubs.

Global Economic Outlook: Trends and Projections

Global Economic Outlook: Trends and Projections

Understanding the current global economic landscape and anticipating future trends is essential for informed decision-making. In this exploration, we delve into the factors shaping the global economic outlook, offering insights into trends and projections.

Current State of the Global Economy

The global economic outlook is influenced by various factors, including GDP growth, employment rates, and trade dynamics. As of the latest data, the world is experiencing a recovery from the impacts of the COVID-19 pandemic. Governments and central banks have implemented measures to stimulate economic growth, and businesses are adapting to new challenges and opportunities.

GDP Growth and Economic Resilience

GDP growth remains a key indicator of economic health. While some regions are showing robust recovery, others face challenges. Factors such as vaccination rates, fiscal policies, and global supply chain disruptions contribute to variations in economic resilience. Projections indicate a gradual return to pre-pandemic growth levels, with emerging economies playing a significant role.

Employment Trends and Labor Market Dynamics

Examining employment trends provides insights into the labor market’s resilience and adaptability. Despite recovery, disparities exist, with certain sectors facing persistent challenges. Remote work and technological advancements are shaping the future of work, impacting job types and required skill sets. Global collaboration on workforce development is crucial for addressing these shifts.

Trade Dynamics in a Post-Pandemic World

Global trade dynamics are evolving as nations recover from the pandemic. Supply chain disruptions and changes in consumer behavior have prompted a reevaluation of trade strategies. The global economic outlook anticipates a recalibration of trade relationships, with an emphasis on resilience, sustainability, and adaptability to future disruptions.

Inflation and Central Bank Policies

Inflation trends and central bank policies are central to the global economic outlook. While some regions grapple with rising inflation, others maintain accommodative monetary policies. Central banks are carefully balancing the need for economic stimulus with the risk of overheating. Coordinated efforts are essential to manage inflationary pressures effectively.

Technology and Digital Transformation

The acceleration of digital transformation is a significant driver of the global economic outlook. Technology adoption has become synonymous with resilience and competitiveness. Nations and businesses embracing digital innovation are better positioned to navigate uncertainties and capitalize on emerging opportunities, contributing to sustained economic growth.

Environmental, Social, and Governance (ESG) Considerations

The global economic outlook incorporates a growing emphasis on ESG considerations. Sustainable practices, social responsibility, and governance principles are integral to long-term economic resilience. Businesses and investors integrating ESG criteria into decision-making contribute to a more sustainable and inclusive global economy.

Challenges and Opportunities on the Horizon

While the global economic outlook is optimistic, challenges persist. Geopolitical tensions, cybersecurity threats, and the uneven distribution of vaccines pose risks to global recovery. However, these challenges also underscore the need for international collaboration, innovation, and adaptive strategies to build a more robust and equitable economic future.

Investment Strategies in a Changing Landscape

In a dynamic economic landscape, strategic investment is paramount. Investors are evaluating opportunities across sectors, with a focus on industries driving digital innovation, sustainable practices, and resilience. Diversification and risk management are key considerations for navigating uncertainties and optimizing investment portfolios.

Shaping a Sustainable and Inclusive Future

The global economic outlook is not just a projection of numbers; it’s a narrative of resilience, adaptation, and collective efforts to shape a sustainable and inclusive future. As the world moves forward, international cooperation, innovative solutions, and a commitment to shared prosperity will play pivotal roles in determining the trajectory of the global economy.

In conclusion, the global economic outlook is a tapestry woven with diverse factors and influenced by a myriad of forces. For those interested in exploring this complex landscape further, visit Global economic outlook. By staying informed and adaptable, stakeholders can actively contribute to and thrive in the evolving global economic landscape.