Japan’s Current Monetary Policy Stance

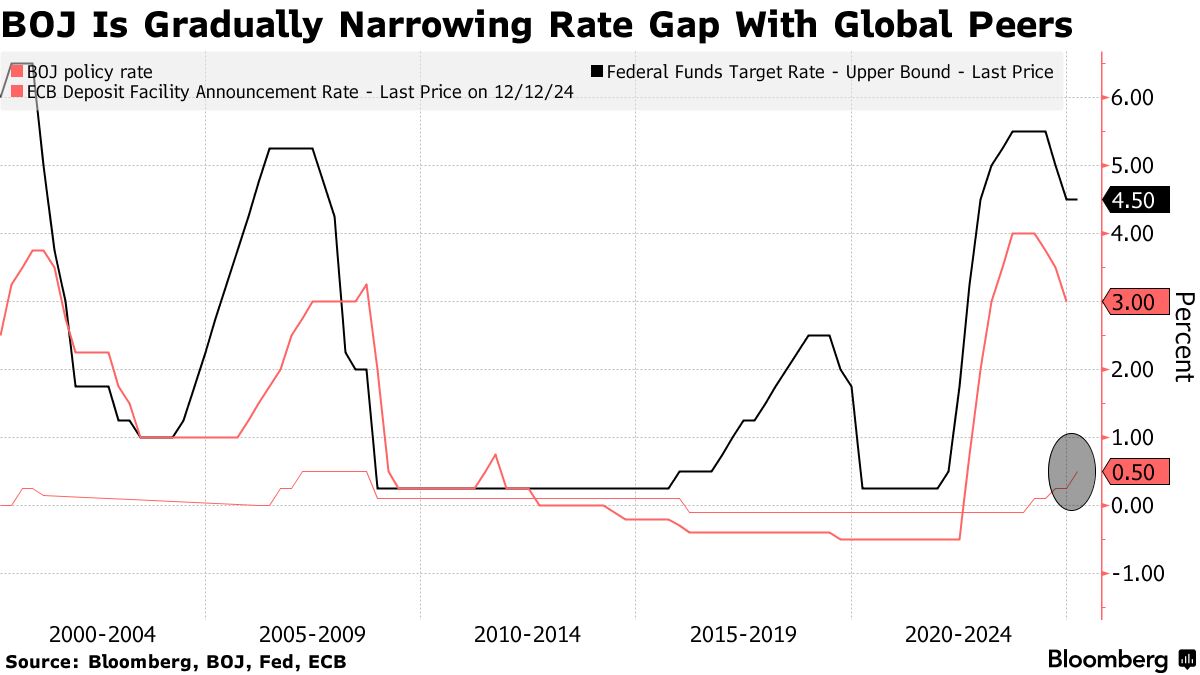

As of late 2023, the Bank of Japan (BOJ) continues to maintain its ultra-loose monetary policy, characterized by negative interest rates on some commercial bank reserves and a commitment to yield curve control (YCC). This means the BOJ actively intervenes in the bond market to keep the 10-year government bond yield around zero. This policy, implemented to stimulate economic growth and combat deflation, has been a cornerstone of Japan’s economic strategy for years. However, the effectiveness and long-term sustainability of this approach remain a subject of ongoing debate, both domestically and internationally.

Global Inflationary Pressures and Their Impact on Japan

The global inflationary environment presents a significant challenge to the BOJ’s current policy. While Japan has experienced relatively subdued inflation compared to other developed nations, rising import costs due to global energy prices and supply chain disruptions are putting upward pressure on prices. This inflationary pressure, while currently moderate, could force a recalibration of the BOJ’s approach in the coming years. The balance between supporting economic growth and controlling inflation will be a key consideration for policymakers.

Potential Shifts in BOJ Policy in 2025

Predicting the BOJ’s actions in 2025 is inherently uncertain, but several scenarios are possible. One possibility is a gradual exit from YCC, potentially involving a slow and controlled increase in long-term interest rates. This approach would aim to minimize market disruption while allowing the BOJ to respond to evolving economic conditions. Another scenario might involve a more abrupt shift, driven by unexpectedly high inflation or a significant change in global economic dynamics. A complete abandonment of negative interest rates is also a possibility, though the timing and execution remain highly debated.

The Yen’s Volatility and its Influence on Interest Rates

The value of the Japanese yen plays a crucial role in shaping the BOJ’s policy decisions. A weakening yen can exacerbate inflationary pressures by increasing import costs, making it more difficult for the BOJ to maintain its ultra-loose stance. Conversely, a strengthening yen could provide some breathing room, allowing for a more gradual adjustment of monetary policy. The yen’s volatility will be a key factor influencing the BOJ’s strategy in the lead-up to and throughout 2025.

Economic Growth Projections for Japan in 2025

Japan’s economic growth outlook for 2025 is subject to considerable uncertainty. Factors such as global economic conditions, domestic consumption patterns, and the success of government structural reform initiatives will all play a role. While sustained, albeit moderate, growth is anticipated by many economists, the pace of expansion remains a key unknown. This uncertainty further complicates the BOJ’s task in balancing growth and inflation management.

Impact of Interest Rate Changes on Businesses and Consumers

Any changes to interest rates in Japan will have significant consequences for businesses and consumers. Higher interest rates could increase borrowing costs for businesses, potentially slowing investment and economic growth. Consumers might also face higher mortgage rates and reduced borrowing capacity. Conversely, lower interest rates, while stimulating borrowing and investment, could potentially fuel inflation if not carefully managed. The impact will depend heavily on the magnitude and speed of any interest rate adjustments.

The Role of Government Fiscal Policy

The BOJ’s monetary policy decisions are intertwined with the government’s fiscal policies. Fiscal stimulus measures can support economic growth, potentially reducing the need for aggressive monetary tightening. However, excessive government spending could lead to higher inflation and complicate the BOJ’s efforts to control price increases. The coordination between monetary and fiscal policies will be crucial in navigating the economic challenges of 2025.

Risks and Uncertainties for the Japanese Economy

The outlook for Japan’s economy in 2025 is fraught with uncertainties. Geopolitical risks, including the ongoing war in Ukraine and tensions in the Taiwan Strait, could disrupt global supply chains and trigger further inflationary pressures. Domestic factors such as an aging population and shrinking workforce also present challenges to long-term economic growth. The BOJ will need to carefully consider these risks when formulating its monetary policy strategy.

Potential for Unexpected Events and Their Impact

The economic landscape is inherently unpredictable, and unexpected events could significantly impact Japan’s interest rates and economic performance in 2025. Sudden shifts in global commodity prices, unforeseen geopolitical developments, or unexpected changes in domestic political dynamics could all necessitate rapid adjustments in BOJ policy. The ability of the BOJ to adapt to these unforeseen circumstances will be a critical determinant of Japan’s economic success in the coming years. Learn more about the Bank of Japan’s interest rate policy in 2025 here: [link to tankionlineaz.com]