AI Revolutionizing Legal Research in 2025

AI-Powered Legal Research Platforms: A Game Changer

The legal profession, traditionally known for its meticulous research methods, is experiencing a seismic shift. 2025 marks a point where AI-powered legal research platforms are no longer a futuristic dream but a practical reality for many firms and solo practitioners. These platforms go far beyond simple keyword searches; they leverage sophisticated algorithms to analyze vast datasets of legal documents, case law, statutes, and regulations, delivering highly targeted and relevant results with unprecedented speed and accuracy.

Beyond Keyword Searches: Understanding Context and Nuance

The limitations of traditional keyword searches in legal research are well-documented. A simple keyword might yield thousands of irrelevant results, while crucial information buried within complex documents could easily be missed. AI-powered platforms overcome these limitations by employing natural language processing (NLP) and machine learning (ML). They can understand the context and nuances of legal language, identifying relevant cases even when the precise keywords aren’t present. This allows lawyers to spend less time sifting through irrelevant information and more time analyzing the material that truly matters.

Predictive Analytics: Anticipating Case Outcomes

One of the most exciting developments in AI-driven legal research is the emergence of predictive analytics. These tools analyze vast quantities of past case data to predict the likely outcome of current cases. By identifying patterns and trends in judicial decisions, these platforms can help lawyers assess the strengths and weaknesses of their cases, and potentially inform settlement negotiations. While not a guarantee of success, this predictive capability provides invaluable insights that can significantly impact litigation strategies.

Enhanced Due Diligence and Contract Analysis

Beyond litigation, AI is transforming other aspects of legal practice. Due diligence, a process typically involving painstaking manual review of vast amounts of documentation, is becoming significantly faster and more efficient. AI can automatically scan and analyze contracts, identifying potential risks and clauses that may require further attention. This not only saves time but also minimizes the risk of overlooking crucial details that could have significant legal ramifications.

Accessibility and Democratization of Legal Services

The increasing accessibility of AI-powered legal research tools is democratizing access to legal services. Smaller firms and solo practitioners, who may not have the resources for extensive manual research, can now compete with larger firms by leveraging the power of AI. This level playing field is fostering greater competition and potentially leading to more affordable legal services for clients.

Addressing Ethical Concerns and Data Privacy

The rapid advancement of AI in legal research also raises ethical concerns. Issues of bias in algorithms, data privacy, and the potential displacement of legal professionals need careful consideration. The legal community is actively engaging in discussions to develop responsible guidelines and regulations to ensure that AI is used ethically and transparently. This includes ensuring that AI tools are properly vetted for bias and that data privacy is protected throughout the research process.

The Future of Legal Research: Collaboration Between Humans and AI

The future of legal research is not about humans versus AI, but rather humans and AI working together. AI tools are proving to be invaluable assistants, augmenting the capabilities of legal professionals, not replacing them. While AI can automate tedious tasks and identify patterns, human judgment and legal expertise remain crucial for interpreting complex legal issues and providing nuanced strategic advice. The most successful legal professionals in 2025 and beyond will be those who can effectively leverage the power of AI to enhance their own skills and knowledge.

Improved Efficiency and Cost Savings

The bottom line is that AI is significantly improving the efficiency and reducing the costs associated with legal research. Lawyers can spend less time on repetitive tasks and more time on higher-value work, such as client communication, strategy development, and case preparation. This translates to cost savings for both law firms and clients, making legal services more accessible and affordable. Click here to learn about AI in legal research in 2025.

Japan’s Interest Rates 2025 Outlook & Economic Impact

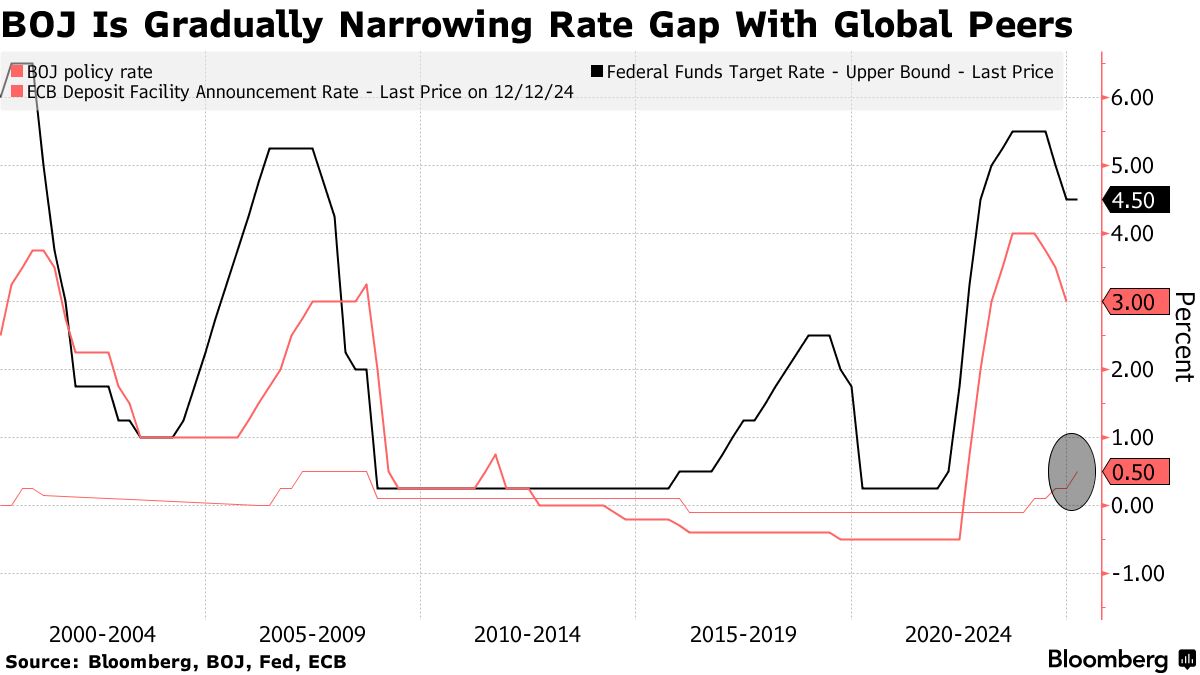

Japan’s Current Monetary Policy Stance

As of late 2023, the Bank of Japan (BOJ) continues to maintain its ultra-loose monetary policy, characterized by negative interest rates on some commercial bank reserves and a commitment to yield curve control (YCC). This means the BOJ actively intervenes in the bond market to keep the 10-year government bond yield around zero. This policy, implemented to stimulate economic growth and combat deflation, has been a cornerstone of Japan’s economic strategy for years. However, the effectiveness and long-term sustainability of this approach remain a subject of ongoing debate, both domestically and internationally.

Global Inflationary Pressures and Their Impact on Japan

The global inflationary environment presents a significant challenge to the BOJ’s current policy. While Japan has experienced relatively subdued inflation compared to other developed nations, rising import costs due to global energy prices and supply chain disruptions are putting upward pressure on prices. This inflationary pressure, while currently moderate, could force a recalibration of the BOJ’s approach in the coming years. The balance between supporting economic growth and controlling inflation will be a key consideration for policymakers.

Potential Shifts in BOJ Policy in 2025

Predicting the BOJ’s actions in 2025 is inherently uncertain, but several scenarios are possible. One possibility is a gradual exit from YCC, potentially involving a slow and controlled increase in long-term interest rates. This approach would aim to minimize market disruption while allowing the BOJ to respond to evolving economic conditions. Another scenario might involve a more abrupt shift, driven by unexpectedly high inflation or a significant change in global economic dynamics. A complete abandonment of negative interest rates is also a possibility, though the timing and execution remain highly debated.

The Yen’s Volatility and its Influence on Interest Rates

The value of the Japanese yen plays a crucial role in shaping the BOJ’s policy decisions. A weakening yen can exacerbate inflationary pressures by increasing import costs, making it more difficult for the BOJ to maintain its ultra-loose stance. Conversely, a strengthening yen could provide some breathing room, allowing for a more gradual adjustment of monetary policy. The yen’s volatility will be a key factor influencing the BOJ’s strategy in the lead-up to and throughout 2025.

Economic Growth Projections for Japan in 2025

Japan’s economic growth outlook for 2025 is subject to considerable uncertainty. Factors such as global economic conditions, domestic consumption patterns, and the success of government structural reform initiatives will all play a role. While sustained, albeit moderate, growth is anticipated by many economists, the pace of expansion remains a key unknown. This uncertainty further complicates the BOJ’s task in balancing growth and inflation management.

Impact of Interest Rate Changes on Businesses and Consumers

Any changes to interest rates in Japan will have significant consequences for businesses and consumers. Higher interest rates could increase borrowing costs for businesses, potentially slowing investment and economic growth. Consumers might also face higher mortgage rates and reduced borrowing capacity. Conversely, lower interest rates, while stimulating borrowing and investment, could potentially fuel inflation if not carefully managed. The impact will depend heavily on the magnitude and speed of any interest rate adjustments.

The Role of Government Fiscal Policy

The BOJ’s monetary policy decisions are intertwined with the government’s fiscal policies. Fiscal stimulus measures can support economic growth, potentially reducing the need for aggressive monetary tightening. However, excessive government spending could lead to higher inflation and complicate the BOJ’s efforts to control price increases. The coordination between monetary and fiscal policies will be crucial in navigating the economic challenges of 2025.

Risks and Uncertainties for the Japanese Economy

The outlook for Japan’s economy in 2025 is fraught with uncertainties. Geopolitical risks, including the ongoing war in Ukraine and tensions in the Taiwan Strait, could disrupt global supply chains and trigger further inflationary pressures. Domestic factors such as an aging population and shrinking workforce also present challenges to long-term economic growth. The BOJ will need to carefully consider these risks when formulating its monetary policy strategy.

Potential for Unexpected Events and Their Impact

The economic landscape is inherently unpredictable, and unexpected events could significantly impact Japan’s interest rates and economic performance in 2025. Sudden shifts in global commodity prices, unforeseen geopolitical developments, or unexpected changes in domestic political dynamics could all necessitate rapid adjustments in BOJ policy. The ability of the BOJ to adapt to these unforeseen circumstances will be a critical determinant of Japan’s economic success in the coming years. Learn more about the Bank of Japan’s interest rate policy in 2025 here: [link to tankionlineaz.com]

Trump’s 2025 Interest Rate Plan What You Need to Know

Understanding the Uncertainty Surrounding a Potential Trump 2025 Interest Rate Plan

Predicting Donald Trump’s economic policies, particularly regarding interest rates, is a challenging task. His past actions and statements offer clues, but his approach tends to be unpredictable and often driven by immediate political considerations. Any proposed plan for 2025 would depend heavily on the economic climate at the time and the composition of the Federal Reserve Board, which operates independently from the executive branch. We can, however, analyze potential scenarios based on his previous actions and rhetoric.

Trump’s Past Approach to Interest Rates

During his first term, Trump often publicly criticized the Federal Reserve’s decisions to raise interest rates. He viewed these increases as hindering economic growth, favoring lower rates to stimulate the economy and bolster the stock market. This pressure, though ultimately unsuccessful in dictating specific policy, highlights his preference for lower borrowing costs. However, the actual impact of his pressure is debatable, with economists pointing to other factors influencing the economy’s performance during his presidency.

Potential Scenarios for a 2025 Interest Rate Plan

If re-elected in 2024, several scenarios could unfold regarding interest rates in 2025. One possibility is a continuation of the low-rate environment, potentially aiming for even lower rates to further stimulate economic growth. This might be appealing in a post-pandemic economy still struggling to fully recover, but it also carries risks, such as increased inflation. Conversely, a more cautious approach might prioritize inflation control, potentially leading to rate hikes, even if it dampens short-term economic expansion. The exact course would depend on numerous interacting factors.

The Role of the Federal Reserve

It’s crucial to remember that the Federal Reserve (the Fed) maintains its independence in setting interest rates. While a President can influence the Fed’s choices through appointments to the Board of Governors and through public statements, the Fed is designed to act autonomously to manage monetary policy. Therefore, any “Trump plan” would face the reality of the Fed’s own economic forecasts and assessments, which may or may not align with the administration’s political goals.

The Impact of Inflation on Interest Rate Decisions

Inflation will likely be a dominant factor influencing interest rate decisions in 2025, regardless of who is President. High inflation generally necessitates higher interest rates to cool down the economy. If inflation remains elevated, the Fed would likely prioritize bringing it under control, even if it means slowing economic growth. Conversely, if inflation moderates, a lower-rate environment could become more politically and economically feasible.

The Influence of Global Economic Conditions

The global economic landscape will also significantly shape interest rate policy. Global economic shocks, geopolitical instability, and international trade relations all play a role. A global recession, for instance, could push the Fed (and potentially a Trump administration) toward lower rates to stimulate the US economy. Conversely, strong global growth might allow for higher rates without significant economic disruption. The interconnectedness of the global economy makes predicting this aspect particularly complex.

The Political Implications of Interest Rate Decisions

Interest rates have profound political implications. Lower rates are generally popular in the short term, as they boost consumer spending and investment. However, sustained low rates can lead to inflation and longer-term economic instability. Higher rates, while potentially necessary to curb inflation, often face political criticism as they can slow economic growth and impact borrowing costs for businesses and consumers. A Trump administration would need to navigate this political tightrope carefully.

Potential for Unconventional Monetary Policy

It’s not entirely outside the realm of possibility that a Trump administration might advocate for or even influence the adoption of unconventional monetary policies. These policies, used in the past in response to severe economic crises, involve measures beyond the traditional manipulation of interest rates. This could involve quantitative easing (QE) programs or other unconventional measures, but these carry their own risks and have to be carefully considered by the Fed.

The Importance of Considering Multiple Factors

Predicting interest rate policy in 2025 requires considering multiple interacting factors: the economic climate, inflation levels, global economic conditions, the Fed’s independence, and the President’s policy preferences. While Trump’s past pronouncements give us some hints, any prediction remains highly speculative, and a multitude of unforeseen events could alter the course of events dramatically.

Analyzing the Long-Term Economic Outlook

Ultimately, a successful economic strategy necessitates a long-term perspective that balances short-term goals with sustainable growth. While a specific interest rate policy for 2025 remains elusive, analyzing the interplay of these economic factors provides a more nuanced understanding of the possible scenarios and their potential consequences. A thorough economic assessment, incorporating various data points and projections, is crucial for sound policy-making. Click here to learn about Trump’s interest rate policy in 2025.