Investing in the Future WhiteRock’s Blockchain

Understanding WhiteRock’s Blockchain Technology

WhiteRock’s blockchain isn’t just another cryptocurrency; it’s a sophisticated platform designed for real-world applications. Unlike many blockchains focused solely on financial transactions, WhiteRock aims to revolutionize several sectors through its unique architecture and functionalities. It leverages a hybrid consensus mechanism, combining the security of proof-of-stake with the efficiency of delegated proof-of-stake, aiming for a balance between decentralization and scalability. This approach is intended to overcome the limitations of purely decentralized systems, such as slow transaction speeds and high energy consumption, making it attractive for various industries beyond simple cryptocurrency trading.

WhiteRock’s Focus on Real-World Applications

WhiteRock’s development team has a clear vision: to build a blockchain that solves practical problems. They’re actively exploring partnerships and developing solutions for supply chain management, digital identity verification, and secure data storage. Imagine a system where the provenance of goods can be effortlessly tracked, reducing fraud and ensuring consumer trust. Or a system that allows individuals to securely manage and share their digital identities without compromising privacy. These are just a few examples of the potential WhiteRock offers, moving beyond the speculative realm of many cryptocurrencies and into tangible, impactful applications.

Investment Potential and Risk Assessment

Investing in any blockchain project, including WhiteRock, carries inherent risks. The cryptocurrency market is notoriously volatile, and the value of WhiteRock’s native token can fluctuate significantly. However, the potential rewards can also be substantial. If WhiteRock successfully delivers on its promises and gains wider adoption in its target sectors, the value of its token could increase significantly. Thorough due diligence, including researching the team’s experience, the technology’s viability, and the competitive landscape, is crucial before committing any funds. Diversifying your investment portfolio is also a wise strategy to mitigate risk.

The WhiteRock Development Team and Community

The success of any blockchain project heavily relies on its development team and community. WhiteRock boasts a team of experienced developers, blockchain experts, and industry professionals with a proven track record. Furthermore, an active and engaged community is essential for the long-term growth and sustainability of the project. A thriving community provides feedback, contributes to development, and helps spread awareness. Investigating the team’s background and the activity within the WhiteRock community can provide valuable insights into the project’s potential for success.

Analyzing the WhiteRock Ecosystem

Beyond the core blockchain technology, the entire ecosystem surrounding WhiteRock is crucial to consider. This includes the partnerships the project has secured, the regulatory landscape it operates within, and the overall market demand for the solutions it offers. Strong partnerships with established businesses can significantly accelerate adoption and increase the project’s credibility. Understanding the regulatory environment is also vital, as regulations can significantly impact a blockchain project’s growth and potential. Assessing market demand will help determine whether there’s a genuine need for the solutions WhiteRock provides.

Long-Term Growth Prospects and Sustainability

The long-term viability of WhiteRock depends on various factors, including technological advancements, market adoption, and the project’s ability to adapt to changing circumstances. Continuous innovation and improvement of the blockchain technology are essential to maintain its competitiveness. Gaining wider acceptance within its target industries is also crucial for long-term growth. A strong focus on sustainability, both environmentally and financially, will also enhance the project’s appeal to investors and stakeholders. Considering these factors offers a glimpse into the potential longevity and success of WhiteRock.

Comparing WhiteRock to Other Blockchain Projects

It’s vital to compare WhiteRock to other similar blockchain projects to understand its competitive advantages and disadvantages. What makes WhiteRock stand out from its competitors? Does it offer a unique technological advantage, a stronger team, or a more promising application focus? Understanding the competitive landscape helps investors make informed decisions and assess the project’s potential for market share and growth. A thorough comparison can reveal whether WhiteRock genuinely offers a compelling investment opportunity.

Strategies for Investing in WhiteRock

Investing in WhiteRock, or any cryptocurrency, should be a well-planned and considered decision. Start with a small investment that you’re comfortable losing, and gradually increase your holdings as you gain more confidence in the project. Use reputable exchanges for trading and secure your assets with robust security measures. Regularly review your portfolio and adjust your investment strategy based on market conditions and the project’s progress. Remember, patience and a long-term perspective are key to successful cryptocurrency investments. Please click here to learn more about whiterock tokenized assets blockchain.

Blockchain’s New Frontier Tokenized Assets

What are Tokenized Assets?

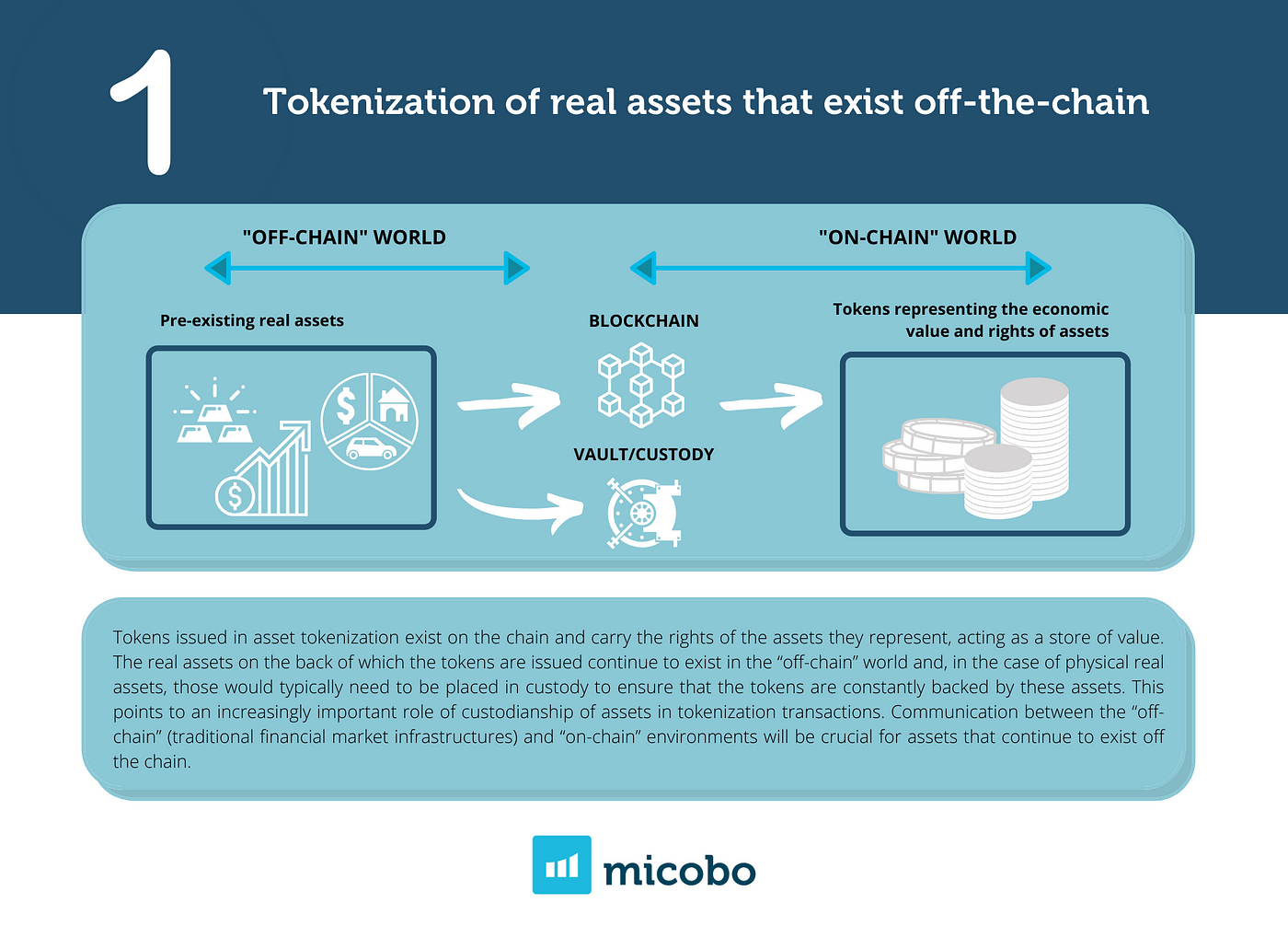

Tokenization is the process of representing real-world assets, such as real estate, art, or even intellectual property, as digital tokens on a blockchain. These tokens, often represented as NFTs (Non-Fungible Tokens) or other types of digital assets, mirror the ownership and characteristics of the underlying asset. This allows for fractional ownership, easier trading, and increased liquidity in markets traditionally plagued by high transaction costs and slow processing times.

The Blockchain Advantage in Asset Tokenization

Blockchain’s decentralized, transparent, and secure nature makes it the ideal platform for tokenizing assets. Its immutable ledger ensures transparency and prevents tampering with ownership records, offering a high degree of trust and security. Smart contracts, self-executing contracts with the terms of the agreement between buyer and seller directly written into code, automate the transfer of ownership and other processes, streamlining the entire transaction process. This reduces reliance on intermediaries, lowering costs and speeding up transactions.

Fractional Ownership and Increased Liquidity

One of the most significant advantages of tokenized assets is the ability to divide assets into smaller, easily tradable units. This allows more people to participate in markets previously inaccessible due to high minimum investment thresholds. For instance, owning a piece of a valuable artwork or a share of a high-value real estate property becomes achievable for a wider range of investors. This increased accessibility fuels higher liquidity, making it easier to buy and sell these assets quickly and efficiently.

Real-World Applications of Tokenized Assets

The applications of tokenized assets are vast and continue to expand. In the real estate sector, fractional ownership through tokens allows investors to diversify their portfolios and access properties they wouldn’t be able to afford otherwise. In the art market, tokenization provides verifiable provenance and simplifies the buying, selling, and trading of digital and physical artwork. Beyond these, we see applications emerging in areas like supply chain management, where tokens can track goods throughout their journey, and in the financial sector, where tokenized securities offer a more efficient and transparent way of managing investments.

The Role of NFTs in Asset Tokenization

Non-Fungible Tokens (NFTs) play a crucial role in tokenizing unique and non-divisible assets. Unlike cryptocurrencies like Bitcoin which are fungible (interchangeable), NFTs represent unique digital assets with verifiable ownership. This is particularly relevant for unique items like artwork, collectibles, and intellectual property rights, where maintaining proof of ownership and authenticity is paramount. NFTs provide a secure and tamper-proof record of ownership, adding value and trust to the asset.

Challenges and Regulatory Considerations

While the potential of tokenized assets is enormous, there are challenges to overcome. Regulatory clarity is crucial. Governments worldwide are grappling with how to regulate these new forms of digital assets, and a consistent regulatory framework is needed to foster growth and prevent misuse. Concerns around security, scalability, and interoperability between different blockchain platforms also need addressing. These challenges, however, do not overshadow the transformative potential of tokenized assets to revolutionize various sectors.

The Future of Tokenized Assets

The future of tokenized assets looks bright. As blockchain technology matures and regulatory frameworks evolve, we can expect to see even wider adoption across diverse sectors. The ability to fractionalize ownership, enhance liquidity, and increase transparency will continue to attract investors and businesses. The development of new blockchain infrastructure and improved interoperability will further fuel this growth, leading to a more efficient and accessible global economy.

Security and Trust in Tokenized Asset Platforms

The security of the blockchain platform and the smart contracts used to govern tokenized assets is paramount. Robust security measures are necessary to protect against hacking and fraud. Furthermore, building trust in the underlying platform is essential for widespread adoption. This necessitates transparent processes, rigorous audits, and community involvement to ensure the integrity and reliability of tokenized asset platforms.

The Impact on Traditional Markets

Tokenized assets are poised to disrupt traditional markets significantly. Their increased efficiency, reduced costs, and enhanced transparency can challenge established intermediaries and create new opportunities for participants. This disruption, however, will also lead to opportunities for collaboration and innovation as traditional players adapt to this new landscape and integrate tokenization into their operations. The result will likely be a more efficient and competitive market environment. Read more about tokenized assets on the blockchain.

Visa Enters the World of Tokenized Assets

Visa’s Leap into Tokenized Assets: A New Frontier

Visa, a global leader in digital payments, is making significant strides into the burgeoning world of tokenized assets. This move signifies a major shift in the company’s strategy, reflecting its commitment to embracing and facilitating innovation within the financial technology landscape. By integrating tokenized assets into its existing infrastructure, Visa aims to expand its reach and offer its vast network of clients access to a wider array of financial instruments.

Understanding the Significance of Tokenization

Tokenization, in essence, involves representing assets—from real estate and art to carbon credits and intellectual property—as digital tokens on a blockchain. This process enhances liquidity, facilitates fractional ownership, and simplifies the transfer and management of assets. For Visa, engaging with this technology means leveraging blockchain’s inherent security and transparency to streamline transactions and potentially open up new revenue streams. It’s a strategic move to remain competitive in a rapidly evolving payments ecosystem.

Visa’s Approach to Tokenized Asset Integration

Visa’s approach is multi-faceted. It’s not merely exploring tokenization theoretically; the company is actively investing in and collaborating with companies operating in the blockchain and digital asset spaces. This involves partnering with established players to integrate tokenized assets seamlessly into its existing payment rails. The goal is to provide a familiar, user-friendly experience for customers, regardless of whether they’re dealing with traditional fiat currencies or digital tokens representing various assets.

Benefits for Businesses and Consumers

The integration of tokenized assets through Visa’s network offers several key benefits for both businesses and consumers. Businesses gain access to new fundraising opportunities and improved efficiency in managing assets. The streamlined transfer of assets can significantly reduce operational costs and administrative burdens. For consumers, access to fractional ownership of high-value assets opens up previously unavailable investment possibilities, democratizing access to asset classes traditionally confined to high-net-worth individuals. The increased transparency and security provided by the blockchain also benefit all parties involved.

Addressing Potential Challenges and Risks

While the potential benefits of tokenized assets are substantial, several challenges need addressing. Regulatory uncertainty remains a major hurdle, with varying legal frameworks across different jurisdictions. Ensuring the security of these assets on the blockchain is also crucial, as any vulnerabilities could have significant financial implications. Visa acknowledges these challenges and is actively working with regulators and technology providers to mitigate these risks and develop robust solutions that ensure compliance and protect consumers.

The Future of Payments: Visa’s Vision

Visa’s foray into the tokenized asset arena underscores its long-term vision for the future of payments. The company anticipates a future where digital assets are seamlessly integrated into everyday financial transactions, alongside traditional fiat currencies. This vision requires ongoing collaboration with various stakeholders, including regulators, technology developers, and other financial institutions. By actively shaping this future, Visa aims to maintain its position as a leader in the global payments landscape and provide innovative solutions that meet the evolving needs of its customers.

Strategic Partnerships and Technological Advancements

Central to Visa’s success in this domain will be its strategic partnerships and its ability to adapt to technological advancements in the blockchain space. Visa will need to maintain close relationships with leading blockchain companies, ensuring interoperability between different blockchain networks and maintaining seamless integration with its existing infrastructure. The rapid evolution of blockchain technology means that ongoing innovation and adaptation are crucial to Visa’s continued success in this new frontier.

The Broader Implications for the Financial Ecosystem

Visa’s involvement in the tokenized asset space carries broader implications for the entire financial ecosystem. Its entry into this market signals a growing acceptance of blockchain technology and its potential to revolutionize financial services. Other major players in the financial industry are likely to follow suit, leading to a more interconnected and dynamic financial landscape. This increased competition could ultimately drive further innovation and benefit consumers through greater access to financial products and services. Please click here to learn more about visa tokenized assets.