AI-Driven Insights for Legal Professionals

Streamlining Legal Research with AI

The sheer volume of legal documents, case laws, and statutes can be overwhelming for even the most seasoned legal professional. AI-powered research tools are changing this landscape by offering significantly faster and more comprehensive searches. These tools can sift through massive datasets, identifying relevant precedents, statutes, and regulatory information in a fraction of the time it would take a human. They can also analyze the language used in these documents, identifying key themes and patterns that might be missed by human eyes, leading to more thorough and effective legal research.

Predictive Analytics for Case Outcomes

Predicting the outcome of a case is a crucial aspect of legal strategy. AI algorithms, trained on vast amounts of historical case data, can analyze various factors such as jurisdiction, judge, type of claim, and evidence presented to predict the likelihood of success or failure. While not a guarantee, this predictive analytics capability enables lawyers to make more informed decisions about settlement negotiations, resource allocation, and overall case strategy. This improved foresight allows for better client counseling and more realistic expectations.

Enhanced Due Diligence and Contract Review

Due diligence and contract review are notoriously time-consuming processes. AI can significantly accelerate these tasks by automatically identifying key clauses, risks, and potential liabilities within contracts. Sophisticated AI tools can analyze language for ambiguities, inconsistencies, and hidden obligations, alerting legal teams to potentially problematic areas that might otherwise be overlooked. This meticulous analysis reduces the risk of costly errors and allows legal teams to focus their efforts on more complex, nuanced issues.

Automating Routine Tasks and Increasing Efficiency

Many legal tasks are repetitive and mundane, such as document review, summarization, and data entry. AI-powered automation tools can handle these tasks efficiently, freeing up lawyers to focus on more complex and strategically important work. This not only increases efficiency but also reduces the risk of human error associated with repetitive tasks. By automating these processes, law firms can improve their overall productivity and profitability.

Improving Accessibility to Legal Services

AI has the potential to democratize access to legal services, particularly for individuals and small businesses who may not have the resources to hire expensive legal counsel. AI-powered chatbots and virtual assistants can provide basic legal information and guidance, answering frequently asked questions and providing initial assessments of legal issues. While not a replacement for human lawyers, these tools can act as a crucial first point of contact, ensuring that individuals receive the necessary information and support to navigate legal challenges.

Ethical Considerations and Data Privacy

The use of AI in the legal profession raises significant ethical concerns. Issues such as bias in algorithms, data privacy, and the potential displacement of human lawyers require careful consideration. It’s vital that legal professionals understand the limitations of AI and use it responsibly, ensuring that it enhances, rather than replaces, human judgment and expertise. Strict adherence to data protection regulations and transparency in the use of AI are paramount to maintaining public trust and upholding ethical standards within the legal field.

Integration of AI into Existing Legal Workflows

Successfully integrating AI into existing legal workflows requires careful planning and execution. It’s not simply a matter of adopting new technology; it necessitates a thorough assessment of current processes, identifying areas where AI can add value, and training legal teams on the effective use of new tools. This gradual integration, coupled with ongoing monitoring and evaluation, ensures a smooth transition and maximizes the benefits of AI without disrupting established practices.

The Future of AI in Law

The application of AI in the legal field is still evolving, with new tools and applications constantly emerging. As AI technology continues to advance, we can expect to see even more sophisticated and powerful tools that transform the way legal professionals work. This continuous innovation holds the promise of increased efficiency, improved accuracy, and enhanced access to justice for everyone. Please click here to learn about AI innovations in legal research.

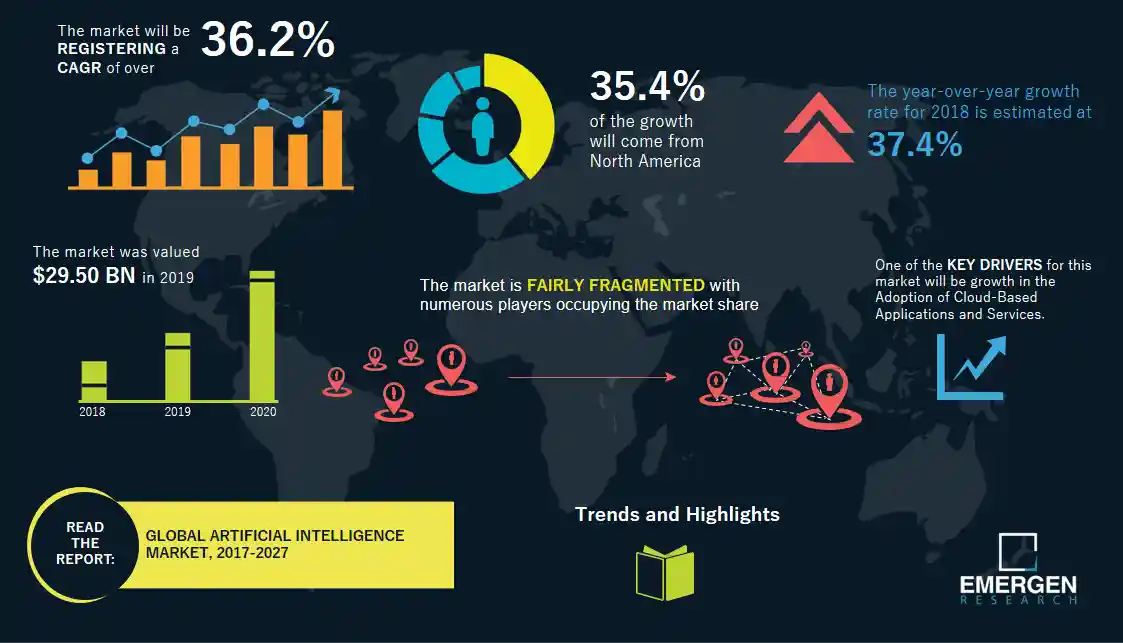

AI Revolutionizes Legal Research Market Trends

The Rise of AI-Powered Legal Research Tools

The legal profession, traditionally reliant on painstaking manual research, is undergoing a dramatic transformation. AI is rapidly becoming an indispensable tool, automating time-consuming tasks and significantly enhancing the efficiency and effectiveness of legal research. Sophisticated algorithms are now capable of sifting through vast databases of legal documents, case law, statutes, and regulations, identifying relevant information far quicker than any human researcher could achieve. This increased efficiency allows lawyers to focus more on strategic legal counsel and client interaction, rather than being bogged down in the minutiae of research.

Enhanced Accuracy and Reduced Errors

Human error is an inherent risk in any research-intensive field, and legal research is no exception. The meticulous nature of legal work demands absolute accuracy, and even small oversights can have significant consequences. AI-powered research tools minimize this risk. These tools are programmed to adhere to strict parameters and algorithms, eliminating the possibility of human errors such as misinterpretations or missed key terms. This boosts the overall reliability and integrity of the legal research process, ensuring lawyers are making decisions based on the most accurate and complete information available.

Predictive Analytics and Litigation Strategy

Beyond simply retrieving relevant information, AI is increasingly used for predictive analytics in litigation. By analyzing vast datasets of past case outcomes and legal precedents, AI algorithms can help lawyers predict the likely success of a particular legal strategy. This allows for more informed decision-making, enabling lawyers to develop more effective strategies and manage client expectations more realistically. This predictive capability extends beyond individual cases to help assess risk profiles and predict future legal trends.

Increased Accessibility and Democratization of Legal Services

The cost and complexity of traditional legal research have historically limited access to justice, particularly for individuals and smaller firms. AI-powered tools are changing this by providing more affordable and accessible research options. These tools offer user-friendly interfaces and streamlined workflows, making them accessible to a wider range of users, regardless of their technical expertise. This democratizing effect expands the reach of legal services, fostering greater equality within the justice system.

Challenges and Ethical Considerations

Despite its transformative potential, the integration of AI into legal research is not without its challenges. Concerns about data privacy, algorithmic bias, and the potential displacement of human researchers require careful consideration. Ensuring the ethical development and deployment of AI in the legal field is paramount. Ongoing discussions and regulations are needed to address these challenges and ensure that AI tools are used responsibly and ethically, promoting fairness and justice.

The Future of AI in Legal Research: Collaboration, Not Replacement

The future of legal research is not about replacing human lawyers with AI, but rather about empowering them with powerful new tools. AI’s strength lies in its ability to handle the repetitive and computationally intensive tasks, freeing up lawyers to focus on the uniquely human aspects of legal practice: critical thinking, strategic planning, client communication, and ethical judgment. The most effective approach will be a collaborative one, leveraging the strengths of both human expertise and AI technology to create a more efficient, accurate, and accessible legal system.

Market Trends: Growth and Innovation

The market for AI-powered legal research tools is experiencing explosive growth, driven by increasing demand for efficiency and accuracy. Investment in this sector is booming, fueling innovation and the development of even more sophisticated tools. We’re seeing the emergence of specialized AI solutions tailored to specific legal niches, further enhancing the capabilities and effectiveness of these technologies. This trend indicates a strong future for AI within the legal profession, with ongoing innovation promising even greater advancements in the years to come.

Impact on Legal Education and Training

The rise of AI in legal research is also having a significant impact on legal education and training. Law schools are adapting their curricula to incorporate AI literacy, equipping future lawyers with the skills and knowledge necessary to effectively utilize these technologies. This evolving educational landscape ensures that the legal profession remains adaptable and competitive in the face of rapid technological advancement. Continuous learning and adaptation are becoming crucial for lawyers to navigate the changing legal landscape. Click here to learn about AI in the legal research market analysis.

Access Justice Faster AI in Legal Research

The Rise of AI in Legal Research

The legal profession, long known for its reliance on meticulous research and detailed analysis, is undergoing a significant transformation thanks to the advent of artificial intelligence (AI). AI-powered tools are rapidly changing how legal professionals conduct research, offering faster, more efficient, and often more comprehensive results than traditional methods. This shift isn’t just about saving time; it’s about fundamentally altering the accessibility and affordability of legal services, potentially leveling the playing field for individuals and smaller firms.

Access Justice Faster: A Focus on Efficiency

One of the most immediate benefits of AI in legal research is increased efficiency. Imagine spending hours sifting through countless case laws, statutes, and regulations to find relevant precedents. AI-powered platforms can perform this task in a fraction of the time, using sophisticated algorithms to identify and prioritize the most pertinent information. This allows lawyers to focus on strategic thinking, client communication, and other higher-level tasks, ultimately improving productivity and case management.

Beyond Keyword Searches: Understanding Context and Nuance

Traditional legal research often relies heavily on keyword searches, which can be limiting and often miss relevant documents due to variations in terminology or phrasing. AI, however, goes beyond simple keyword matching. Advanced algorithms can understand the context and nuances of legal language, identifying relevant documents even if they don’t contain the exact keywords used in the search query. This more sophisticated approach significantly improves the recall rate, ensuring that lawyers don’t overlook crucial information.

Predictive Analysis: Anticipating Legal Outcomes

Some AI-powered legal research tools are taking the process a step further by incorporating predictive analytics. By analyzing vast datasets of legal precedents and outcomes, these tools can predict the likely success rate of a case based on various factors, such as jurisdiction, legal precedents, and the strength of the evidence. This predictive capability allows legal professionals to make more informed decisions about case strategy, settlement negotiations, and overall litigation planning.

Democratizing Access to Justice

The increased efficiency and improved accuracy offered by AI in legal research have significant implications for access to justice. These tools can help level the playing field by making legal research more accessible to individuals and smaller firms who may not have the resources to hire extensive research teams. This democratizing effect can empower individuals to better understand their legal rights and navigate the complexities of the legal system with greater confidence.

Addressing Concerns and Challenges

While AI offers tremendous potential for legal research, it’s important to acknowledge some concerns. Data bias in training datasets can lead to skewed results, and the potential for AI to perpetuate existing inequalities within the legal system needs careful consideration. Moreover, the reliance on AI-generated information requires a critical evaluation of the outputs, ensuring that human oversight and legal expertise remain central to the research process. Developing robust ethical guidelines and ensuring transparency in the use of AI are crucial to mitigate these risks.

The Future of Legal Research: A Human-AI Partnership

The future of legal research is likely to involve a collaborative partnership between humans and AI. AI will handle the heavy lifting of information retrieval and analysis, freeing up legal professionals to focus on the strategic and human aspects of the law. This collaboration will lead to more efficient, effective, and equitable legal services, ultimately benefiting all stakeholders involved in the legal process. The key lies in harnessing the power of AI responsibly, ensuring its use complements and enhances, rather than replaces, human judgment and expertise.

Beyond Research: Expanding AI’s Role in Law

The applications of AI in the legal field extend far beyond research. AI is being used in areas like contract review, due diligence, and even legal writing. As AI technology continues to evolve, we can expect even more innovative applications that will further streamline legal processes and improve access to justice. The integration of AI is transforming the legal landscape, offering a promising future for both legal professionals and the clients they serve. Read more about AI in legal research platforms.

Unlocking Success with Transactional Lawyers’ Strategies

Subheading: Introduction

Transactional lawyers play a pivotal role in facilitating business deals and transactions. Their expertise goes beyond just legal knowledge; it encompasses strategic thinking, negotiation skills, and a deep understanding of business dynamics. In this article, we delve into the strategies employed by transactional lawyers to unlock success for their clients.

Subheading: Understanding the Role of Transactional Lawyers

At the heart of every successful business transaction lies the expertise of transactional lawyers. These legal professionals specialize in structuring, negotiating, and executing deals on behalf of their clients. Whether it’s a merger, acquisition, or commercial contract, transactional lawyers navigate complex legal issues to ensure their clients’ interests are protected and their objectives are met.

Subheading: Strategic Planning

One of the key strategies employed by transactional lawyers is strategic planning. Before diving into negotiations or drafting contracts, these lawyers meticulously analyze their clients’ goals, risks, and opportunities. They develop a strategic roadmap that outlines the steps needed to achieve the desired outcome while mitigating potential pitfalls along the way.

Subheading: Due Diligence

Due diligence is another critical aspect of transactional lawyering. Before entering into any business transaction, transactional lawyers conduct thorough due diligence to assess the legal, financial, and operational aspects of the deal. This includes reviewing contracts, financial statements, regulatory compliance, and any potential legal liabilities. By uncovering hidden risks and liabilities early on, transactional lawyers can advise their clients on the best course of action to protect their interests.

Subheading: Negotiation Skills

Negotiation is at the core of transactional lawyering. Whether it’s hammering out the terms of a contract or resolving disputes between parties, transactional lawyers leverage their negotiation skills to achieve favorable outcomes for their clients. They strive to find common ground while advocating for their clients’ interests, all while maintaining professionalism and integrity throughout the process.

Subheading: Drafting Clear and Comprehensive Contracts

Drafting contracts is a key responsibility of transactional lawyers. These legal documents serve as the foundation of business transactions, outlining the rights, obligations, and responsibilities of each party involved. Transactional lawyers ensure that contracts are clear, comprehensive, and legally enforceable, protecting their clients from potential disputes and litigation down the line.

Subheading: Risk Management

Transactional lawyers are adept at identifying and managing risks associated with business transactions. They assess the potential legal, financial, and reputational risks inherent in any deal and develop strategies to mitigate them. Whether it’s drafting indemnity clauses, negotiating warranties and representations, or structuring transactions to minimize tax liabilities, transactional lawyers play a crucial role in protecting their clients from unforeseen risks.

Subheading: Compliance and Regulatory Matters

Navigating complex regulatory landscapes is another area where transactional lawyers excel. Whether it’s compliance with industry-specific regulations, antitrust laws, or international trade regulations, transactional lawyers ensure that their clients’ business transactions are conducted in accordance with applicable laws and regulations. They stay abreast of changes in regulatory requirements and advise their clients on how to remain compliant while achieving their business objectives.

Subheading: Client Communication and Relationship Management

Effective communication is essential in transactional lawyering. Transactional lawyers keep their clients informed and engaged throughout the entire process, providing regular updates, explaining complex legal concepts, and seeking input on key decisions. They also cultivate strong relationships with their clients, earning their trust and confidence through their dedication, expertise, and commitment to achieving results.

Subheading: Conclusion

Transactional lawyers play a vital role in unlocking success for their clients’ business transactions. Through strategic planning, due diligence, negotiation skills, and risk management, these legal professionals ensure that their clients’ interests are protected and their objectives are met. By leveraging their expertise and experience, transactional lawyers help their clients navigate the complexities of business transactions with confidence and achieve their desired outcomes. Read more about transactional lawyers

Property Matters Navigating with a Skilled Lawyer

Unraveling Property Complexities: The Significance of a Property Lawyer

In the realm of real estate, the guidance of a seasoned property lawyer becomes indispensable. These legal professionals specialize in navigating the complexities of property transactions, ensuring legal compliance, and safeguarding the interests of buyers, sellers, and property owners.

Contracts and Agreements: Crafting Legal Foundations

Property transactions begin with contracts and agreements that lay the legal foundations for the deal. A property lawyer plays a crucial role in drafting, reviewing, and negotiating these documents. Whether it’s a sale, purchase, lease, or rental agreement, their expertise ensures that the terms align with the law and their client’s objectives.

Title Searches and Due Diligence: Securing Clear Ownership

A key aspect of property transactions is establishing clear ownership. Property lawyers conduct title searches and due diligence to verify the property’s legal status, checking for any encumbrances, liens, or legal issues. This meticulous process ensures that their clients acquire or sell a property with a clear and marketable title.

Navigating Zoning and Land Use Regulations: Legal Compliance

Zoning and land use regulations can significantly impact property development and use. Property lawyers assist clients in navigating these regulations, ensuring that proposed land use complies with local zoning laws. Their expertise is vital in obtaining necessary permits and approvals, mitigating legal risks associated with non-compliance.

Real Estate Litigation: Addressing Disputes

In the event of property-related disputes, property lawyers step into the realm of real estate litigation. Whether it’s boundary disputes, contract breaches, or landlord-tenant conflicts, these legal professionals provide representation and legal advocacy to resolve disputes through negotiation, mediation, or, if necessary, litigation.

Commercial Property Matters: Complexities Unveiled

Commercial property transactions introduce a layer of complexity due to the larger scale and varied legal considerations. Property lawyers specializing in commercial real estate handle matters such as leasing, financing, and development projects. Their expertise ensures that clients navigate these complexities and make informed decisions.

Financing and Mortgages: Legal Aspects of Property Financing

Property financing involves legal intricacies, especially when dealing with mortgages, loans, and financing agreements. Property lawyers work alongside their clients to review financing documents, negotiate terms, and ensure compliance with lending laws. This diligence protects the interests of both property buyers and lenders.

Environmental Considerations: Mitigating Risks

Increasingly, environmental considerations are integral to property transactions. Property lawyers assess environmental risks associated with a property, addressing issues such as contamination or regulatory violations. Their role is crucial in mitigating risks, negotiating solutions, and ensuring compliance with environmental laws.

Eminent Domain and Condemnation: Protecting Property Rights

In cases of eminent domain or condemnation, where the government acquires private property for public use, property lawyers safeguard property rights. They advocate for fair compensation, negotiate with government entities, and ensure that property owners are justly treated in the face of compulsory acquisition.

Explore Property Legal Support: Visit property lawyer at [tankionlineaz.com]

For individuals and businesses immersed in property matters, seeking legal support is a prudent choice. Property lawyer services at [tankionlineaz.com] offer a comprehensive resource. Whether it’s residential transactions, commercial ventures, or legal advice, these legal professionals guide clients through the intricacies of property law, ensuring a secure and legally compliant journey.

Cross-Border Investments: Strategies for Global Growth

Cross-Border Investments: Strategies for Global Growth

The landscape of investment opportunities has expanded beyond domestic markets, with cross-border investments gaining prominence. This article explores the strategies for global growth through cross-border investments and the factors influencing this dynamic approach.

Understanding Cross-Border Investments

Cross-border investments involve allocating capital across different countries, either through direct investments, portfolio investments, or strategic partnerships. This approach allows investors and businesses to diversify their portfolios, access new markets, and capitalize on growth opportunities beyond their home country.

Diversification Benefits and Risk Management

One of the primary motivations for cross-border investments is portfolio diversification. By spreading investments across various geographic regions, industries, and asset classes, investors can reduce risks associated with regional economic downturns or market-specific challenges. Diversification is a key strategy for managing risk and enhancing overall portfolio resilience.

Market Research and Due Diligence

Successful cross-border investments hinge on thorough market research and due diligence. Understanding the regulatory environment, cultural nuances, and economic conditions of the target country is essential. Conducting comprehensive due diligence helps identify potential challenges and opportunities, enabling informed decision-making.

Navigating Regulatory and Legal Frameworks

Each country has its unique regulatory and legal frameworks governing foreign investments. Navigating these structures requires careful consideration of local laws, tax regulations, and compliance requirements. Engaging legal experts and advisors familiar with the target jurisdiction is crucial to ensure adherence to all relevant regulations.

Cultural Sensitivity and Local Partnerships

Cultural sensitivity is paramount in cross-border investments. Building relationships with local partners and understanding cultural nuances contribute to successful business operations in foreign markets. Establishing partnerships with local entities can provide valuable insights, access to networks, and enhance the overall effectiveness of cross-border ventures.

Currency Risks and Hedging Strategies

Currency fluctuations pose a significant risk in cross-border investments. Changes in exchange rates can impact investment returns and financial performance. Implementing effective hedging strategies, such as currency futures or options, helps mitigate these risks and provides a level of certainty in the face of volatile currency markets.

Adapting to Economic and Political Conditions

Economic and political conditions in foreign markets can be dynamic. Adapting to changes in government policies, economic shifts, and geopolitical events is crucial for long-term success. Continuous monitoring of the economic and political landscape helps investors make proactive adjustments to their strategies.

Technology and Global Connectivity

Advancements in technology have facilitated global connectivity, making cross-border investments more accessible. Digital platforms, communication tools, and data analytics enable investors to gather real-time information, conduct virtual meetings, and monitor investments across borders. Leveraging technology enhances the efficiency and speed of cross-border investment processes.

Sector-Specific Opportunities

Different sectors present varying opportunities for cross-border investments. Technology, renewable energy, healthcare, and e-commerce are among the sectors experiencing global growth trends. Identifying sector-specific opportunities aligns investment strategies with broader market dynamics and potential for higher returns.

Long-Term Perspective and Patience

Cross-border investments often require a long-term perspective. Economic cycles, regulatory changes, and market developments may take time to unfold. Patience is a virtue in navigating the complexities of global investments, allowing investors to ride out short-term fluctuations and capitalize on the long-term growth potential.

Conclusion: Navigating the Global Investment Landscape

In conclusion, cross-border investments open doors to a vast and diverse global investment landscape. By embracing strategies such as diversification, thorough research, and cultural understanding, investors and businesses can position themselves for global growth. For those interested in delving deeper into cross-border investments, visit Cross-border investments.

As the world becomes more interconnected, cross-border investments represent a pathway to resilience, innovation, and sustainable growth. Strategic considerations, adaptability, and a commitment to understanding the nuances of each market are key elements in successfully navigating the global investment terrain.