Search Console Mastery: Essential Tips for Google Domination

Unveiling the Power of Google Search Console Tips

Mastering Google Search Console is indispensable for any website owner aiming to enhance their online presence. This article unveils essential tips to harness the full potential of Google Search Console, providing actionable insights for improved performance and visibility.

Understanding the Basics of Google Search Console

Before delving into tips, it’s crucial to understand the fundamentals of Google Search Console. This powerful tool from Google provides valuable insights into how the search engine views and interacts with your website. It offers a plethora of data, including keyword performance, indexing issues, and website health.

Regularly Monitoring Search Performance

A key tip for utilizing Google Search Console effectively is to regularly monitor your website’s search performance. Dive into the Performance section to analyze clicks, impressions, click-through rates, and average position. Identify trends, track changes over time, and use this data to refine your content and SEO strategies.

Utilizing Search Analytics for Keyword Insights

The Search Analytics report is a goldmine for understanding how your website performs in search results. Leverage this section to gain insights into the keywords driving traffic to your site. Identify high-performing keywords and capitalize on opportunities to optimize content for better visibility.

Spotting and Fixing Indexing Issues

Google Search Console is invaluable for identifying and resolving indexing issues. Regularly check the Index Coverage report to uncover pages with indexing problems. Address issues such as crawl errors, duplicate content, and missing meta tags promptly to ensure optimal visibility in search results.

Submitting XML Sitemaps for Better Crawling

Maximize Google’s understanding of your website’s structure by submitting XML sitemaps. This ensures that search engines crawl and index your pages efficiently. Regularly update and submit your sitemap to keep Google informed about new content and changes to existing pages.

Enhancing Mobile Usability with Mobile-Friendly Reports

Mobile usability is a critical factor in search rankings. Leverage Google Search Console’s Mobile Usability reports to identify and resolve issues affecting the mobile experience of your site. A mobile-friendly website not only improves user experience but also aligns with Google’s mobile-first indexing approach.

Optimizing Content with Page Insights

The Page Insights report in Google Search Console offers a detailed view of how individual pages on your site perform. Use this data to optimize underperforming pages, improve meta tags, and enhance overall user experience. A well-optimized page contributes to higher search rankings.

Leveraging URL Inspection Tool for Debugging

When troubleshooting specific URLs, the URL Inspection tool is your go-to resource. Use this tool to check the live version of a URL, view indexing status, and identify any issues. Addressing problems flagged by the URL Inspection tool is crucial for ensuring that your content is accurately indexed.

Receiving Alerts and Messages Promptly

Google Search Console communicates important information through alerts and messages. Stay vigilant and address any alerts promptly to prevent potential issues from affecting your site’s performance. Regularly check the Messages section to stay informed about critical updates from Google.

Exploring New Features and Reports

Google Search Console continually evolves, introducing new features and reports. Stay informed about updates and explore new functionalities within the platform. Google’s commitment to providing webmasters with valuable tools means that regularly exploring new features can lead to enhanced insights and improved website performance.

Elevating Your Website with Google Search Console Mastery

To delve deeper into Google Search Console tips and implement effective strategies, visit Google Search Console tips. Elevate your website’s visibility, address issues proactively, and position your site for success in the dynamic landscape of online search.

Global Financial Reforms: Navigating Economic Consequences

Navigating the Economic Landscape: Consequences of Global Financial Reforms

In the aftermath of financial crises and economic downturns, the global community often rallies to implement financial reforms aimed at fostering stability, resilience, and transparency in financial systems. While these reforms are crucial for preventing future crises, they also bring about significant economic consequences that ripple through various sectors.

Foundation of Reforms: Responding to Financial Crises

Global financial reforms typically emerge as responses to systemic failures and crises. The aftermath of events like the 2008 financial crisis witnessed an international commitment to reevaluate and enhance financial regulations. The primary objective was to build a more robust financial system that could withstand shocks and ensure the protection of investors and the broader economy.

Tightening Regulatory Measures: Impact on Financial Institutions

One of the immediate consequences of global financial reforms is the tightening of regulatory measures on financial institutions. Stricter capital requirements, stress testing, and enhanced risk management practices are imposed to mitigate the likelihood of financial institutions engaging in risky behaviors that could lead to systemic failures. While these measures contribute to stability, they can also limit the profitability and flexibility of financial institutions.

Effects on Lending Practices: Balancing Risk and Access to Credit

The reforms often influence lending practices, impacting the balance between risk management and the accessibility of credit. Stringent regulations may lead banks to adopt more conservative lending approaches, affecting businesses and individuals seeking loans. Striking the right balance becomes a delicate task for policymakers, ensuring that financial institutions remain stable without stifling economic growth through restricted credit availability.

Market Liquidity and Trading Dynamics

Global financial reforms can reshape market liquidity and trading dynamics. Regulations like the Volcker Rule, aimed at curbing excessive risk-taking by banks, can affect market-making activities. While the intention is to prevent speculative trading that could lead to financial instability, there’s a need to carefully assess the consequences on market liquidity, particularly during times of stress or crises.

Impact on Cross-Border Financial Activities

In an interconnected global economy, financial reforms have significant implications for cross-border financial activities. The extraterritorial reach of certain regulations can create challenges for multinational corporations and financial institutions operating across jurisdictions. Coordination and harmonization efforts become essential to ensure a consistent and effective regulatory framework globally.

Technological Innovation and Compliance Costs

As financial institutions adapt to new regulatory requirements, there’s a notable impact on technological innovation and compliance costs. The need to implement sophisticated risk management systems and reporting mechanisms can drive investments in technology. Simultaneously, compliance costs can escalate, particularly for smaller financial entities, influencing their competitiveness and ability to navigate the evolving regulatory landscape.

Global Financial Reforms and Emerging Markets

The consequences of global financial reforms are often amplified in emerging markets. While reforms aim to enhance stability, they may inadvertently create challenges for economies with less-developed financial systems. Stricter regulations can limit the flow of capital to these markets, impacting investment and growth. Policymakers in emerging economies must strike a balance between compliance and fostering economic development.

Unintended Consequences and Regulatory Adjustments

Despite meticulous planning, global financial reforms may lead to unintended consequences. Market participants and institutions may find ways to circumvent regulations, leading to new risks or vulnerabilities. Periodic reassessment and adjustments to regulatory frameworks are crucial to address emerging challenges and maintain the effectiveness of the reforms over time.

The Role of International Cooperation

The consequences of global financial reforms highlight the importance of international cooperation. Coordination among regulatory bodies, central banks, and policymakers is vital to address cross-border challenges and ensure a harmonized global financial system. Regular communication and collaboration contribute to a more effective implementation of reforms while minimizing potential conflicts.

Strategies for Navigating the New Financial Landscape

As the global financial landscape evolves under the influence of reforms, businesses, investors, and policymakers need to develop strategies for navigating the changes. This includes staying informed about regulatory developments, adapting risk management practices, and embracing technological innovations that enhance compliance and efficiency.

Explore more about the Economic Consequences of Global Financial Reforms to understand the evolving dynamics and strategies for navigating the reshaped financial landscape.

Navigating Economic Effects of Global Health Crises

Unveiling the Economic Ripple Effects of Global Health Crises

The world has witnessed the profound economic repercussions triggered by global health crises. From widespread disruptions to economic systems to shifts in consumer behavior, the economic effects of these crises are far-reaching and demand a nuanced understanding to pave the way forward.

Immediate Economic Shockwaves

Global health crises unleash immediate economic shockwaves that reverberate across industries. Lockdowns, travel restrictions, and quarantine measures disrupt business operations, leading to supply chain disruptions, production halts, and a decline in consumer spending. These sudden shocks test the resilience of economies worldwide, exposing vulnerabilities and triggering recessive trends.

Impacts on Employment and Livelihoods

One of the most significant and immediate consequences is the impact on employment and livelihoods. Industries directly affected, such as travel, hospitality, and entertainment, witness mass layoffs and closures. Moreover, indirect impacts on supporting industries create a domino effect, leaving millions unemployed and struggling to meet basic needs. The economic fallout extends beyond the health crisis itself.

Healthcare Expenditure and Fiscal Pressures

Global health crises strain healthcare systems, necessitating increased spending on medical resources, infrastructure, and research. Governments face heightened fiscal pressures as they allocate resources to combat the crisis. Balancing the need for public health interventions with maintaining economic stability becomes a delicate task, often requiring unprecedented fiscal measures and stimulus packages.

Consumer Confidence and Behavioral Shifts

Consumer confidence takes a hit during global health crises, leading to significant shifts in spending patterns. Fear and uncertainty prompt individuals to cut discretionary spending, impacting retail, tourism, and non-essential services. The behavioral shifts often persist beyond the immediate crisis, reshaping consumption habits and influencing market dynamics.

Digital Transformation and Remote Work Trends

Amidst the economic challenges emerge transformative trends. The acceleration of digital transformation becomes evident as businesses adapt to remote work models. Industries embracing technology and innovation find avenues for continuity and growth, showcasing the adaptability and resilience inherent in economic systems during times of crisis.

Global Trade Disruptions and Supply Chain Challenges

International trade faces disruptions due to restrictions on movement and logistical challenges. Supply chains, particularly those heavily reliant on global interconnectedness, experience bottlenecks. Dependence on specific regions for essential goods exposes vulnerabilities, prompting a reevaluation of supply chain strategies to enhance resilience and minimize risks.

Investment Climate and Financial Market Volatility

The economic effects of global health crises extend to financial markets and the investment climate. Increased uncertainty leads to heightened volatility in stock markets, currency values, and commodity prices. Investors grapple with risk aversion, impacting investment decisions and capital flows. Governments and financial institutions implement measures to stabilize markets and instill confidence.

Long-term Structural Changes and Adaptations

Beyond immediate challenges, global health crises catalyze long-term structural changes. Industries may witness shifts in business models, increased automation, and a renewed focus on resilience. Governments may reassess healthcare infrastructure, crisis preparedness, and social safety nets to better withstand future health shocks, fostering economic adaptation.

Collaborative International Responses

Addressing the economic effects of global health crises necessitates collaborative international responses. Countries, organizations, and research institutions join forces to share knowledge, coordinate efforts, and develop strategies for recovery. International cooperation becomes a linchpin in mitigating economic fallout and building a foundation for global resilience.

Building a Resilient Economic Future

In conclusion, understanding the economic effects of global health crises is essential for building a resilient economic future. From immediate shocks to long-term adaptations, navigating these challenges requires coordinated efforts, innovation, and a commitment to fostering economic systems that can withstand and recover from unforeseen health crises.

To explore more about the Economic effects of global health crises, visit tankionlineaz.com.

Crypto SEO Mastery: Elevate Blockchain Business Visibility

Introduction:

In the dynamic landscape of cryptocurrency and blockchain businesses, establishing a robust online presence is paramount. This article explores the intricacies of Search Engine Optimization (SEO) strategies tailored for this innovative industry, shedding light on how to enhance visibility and navigate the evolving digital marketplace.

Understanding the Crypto and Blockchain Ecosystem:

Before delving into SEO tactics, it’s crucial to comprehend the unique dynamics of the cryptocurrency and blockchain space. This industry is characterized by innovation, decentralized technologies, and a global community. Tailoring SEO strategies to the specific needs of this ecosystem is essential for businesses to stand out.

Keyword Research for Technological Precision:

The foundation of successful SEO lies in comprehensive keyword research. Identify terms and phrases relevant to cryptocurrency, blockchain, and related technologies. Incorporate these keywords strategically into your content, ensuring alignment with the language used within the tech-savvy community interested in these cutting-edge solutions.

Optimizing Content for Blockchain Brilliance:

Content serves as a powerful tool in the cryptocurrency and blockchain sphere. Craft content that not only showcases your business’s expertise but also provides valuable insights into the intricacies of blockchain technology. Optimize this content with relevant keywords, making it a go-to resource for those seeking in-depth knowledge.

Structuring Your Website for Crypto Clarity:

A well-structured website is crucial for user experience and SEO. Categorize your services logically, use clear navigation, and employ descriptive headings. Ensure that the structure of your website aligns with the complex and innovative nature of the cryptocurrency and blockchain industry, offering clarity to users exploring your offerings.

Leveraging Social Media for Blockchain Buzz:

Social media plays a significant role in the cryptocurrency and blockchain community. Share updates, industry news, and engaging content on platforms like Twitter, LinkedIn, and Reddit. Engaging with your audience through these channels not only builds brand awareness but also contributes to increased visibility and community engagement.

Building Backlinks for Blockchain Authority:

Quality backlinks from reputable sources are essential for SEO success. Collaborate with other businesses in the blockchain space, participate in industry events, and engage in guest blogging opportunities. These backlinks enhance your business’s authority within the blockchain community, positively impacting search engine rankings.

Mobile Optimization for Crypto on the Go:

The crypto community is often on the move, relying on mobile devices for information. Ensure your website is optimized for mobile viewing to provide a seamless experience. Google prioritizes mobile-friendly websites, making this optimization crucial for favorable search rankings and accessibility to a tech-savvy audience.

Monitoring Performance with Analytics:

Regularly monitoring your website’s performance using analytics tools is crucial. Track metrics such as website traffic, user engagement, and conversion rates. Analyzing this data provides insights into the effectiveness of your SEO efforts, allowing you to make informed decisions for continuous improvement in the dynamic crypto environment.

Encouraging Blockchain Dialogue and Interaction:

Foster a sense of community on your website by encouraging dialogue within the blockchain community. Create forums, discussion boards, and events that celebrate technological advancements and innovations. User interaction not only strengthens your brand’s community feel but also signals positive indicators to search engines about your platform’s vibrancy.

SEO for Cryptocurrency and Blockchain Businesses: A Link to Technological Triumph:

For an in-depth understanding of SEO strategies tailored for cryptocurrency and blockchain businesses, visit SEO for cryptocurrency and blockchain businesses. Implementing these techniques will not only elevate your business’s visibility but also position it as a thought leader in the ever-evolving world of cryptocurrency and blockchain technology.

Conclusion:

In the realm of cryptocurrency and blockchain, mastering SEO is a strategic necessity. By understanding the ecosystem, optimizing content, and leveraging social media and backlinks, businesses can navigate the digital landscape successfully, ensuring visibility and recognition in this cutting-edge industry.

Global Business Cycles: Dynamics and Impacts

Understanding the Dynamics of Global Economies

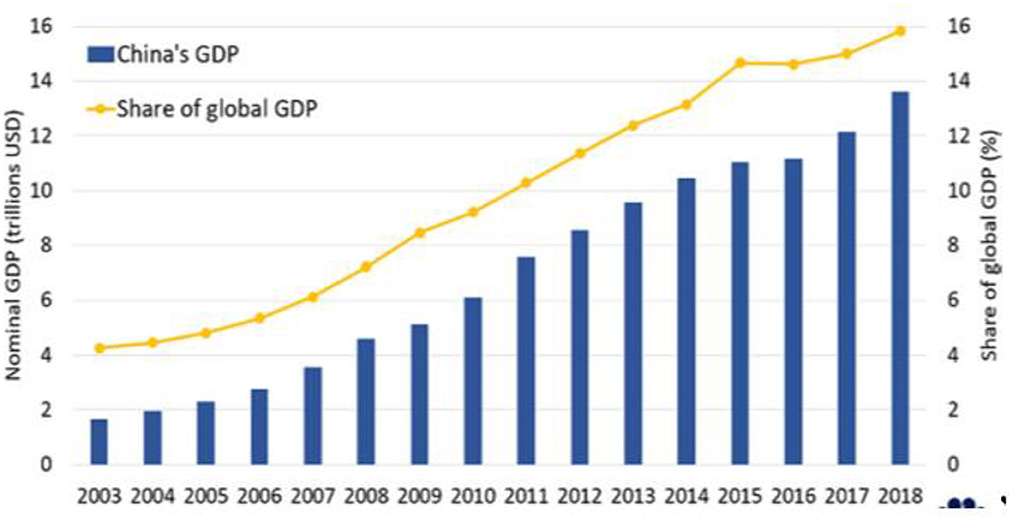

In an era marked by globalization, the interconnectedness of economies across the world has become increasingly apparent. International trade, financial flows, and technological advancements have significantly contributed to the integration of economies on a global scale. This intricate web of interactions gives rise to what is commonly referred to as international business cycles.

The Foundation of International Business Cycles

At the core of international business cycles lies the concept of economic cycles. Economic cycles, also known as business cycles, are recurrent fluctuations in economic activity that typically consist of periods of expansion, contraction, and recovery. These cycles are influenced by various factors such as investment, consumer spending, and government policies.

Interplay of Global Trade

One of the primary drivers of international business cycles is the interconnected nature of global trade. Nations around the world engage in the exchange of goods and services, and the economic performance of one country can have ripple effects on others. When a major economic player experiences a downturn, it can lead to reduced demand for exports from other nations, setting off a chain reaction across the global economy.

Impact of Financial Markets on Global Dynamics

Financial markets play a crucial role in shaping international business cycles. Fluctuations in stock markets, currency values, and interest rates can have profound effects on economic activities worldwide. For example, a financial crisis in one region can trigger a domino effect, causing instability in other markets and contributing to the synchronization of international business cycles.

Exchange Rates and Their Role

The dynamics of exchange rates further contribute to the intricacies of international business cycles. Currency values impact the competitiveness of nations in the global market. A sudden shift in exchange rates can affect trade balances, influence inflation rates, and shape the overall economic landscape. Governments and central banks often intervene to stabilize their currencies and mitigate the impact of exchange rate fluctuations.

Global Supply Chains and Economic Synchronization

The evolution of global supply chains has heightened the synchronization of international business cycles. As businesses become more interconnected across borders, disruptions in the supply chain can have cascading effects. Events such as natural disasters, political instability, or global health crises can disrupt production processes and impact economies worldwide, emphasizing the need for resilience in the face of unforeseen challenges.

Policy Coordination in a Globalized World

Given the interdependence of economies, there is a growing recognition of the importance of policy coordination among nations. Coordinated efforts in fiscal and monetary policies can help mitigate the impact of economic shocks and contribute to global economic stability. International organizations and agreements play a vital role in fostering collaboration among nations to address common challenges and promote sustainable economic growth.

Challenges and Opportunities in a Globalized Economy

While international business cycles present challenges, they also offer opportunities for collaboration and innovation. Businesses that understand the dynamics of global economies can strategically position themselves to navigate the complexities and leverage emerging trends. Cross-border partnerships and investments become avenues for growth and resilience in an interconnected world.

In conclusion, the understanding of international business cycles is crucial for policymakers, businesses, and individuals navigating the complexities of a globalized economy. The interconnected nature of trade, financial markets, and supply chains underscores the need for a holistic approach to economic analysis and policymaking. By recognizing the interplay of factors shaping international business cycles, stakeholders can better adapt to the ever-changing landscape of the global economy.

To delve deeper into the intricacies of international business cycles, you can explore the concept further here.