Tokenized Assets Your Simple Investment Guide

What are Tokenized Assets?

Imagine owning a tiny fraction of a valuable asset, like a piece of a famous painting, a share of real estate, or even a limited-edition sneaker, all without the hassle of traditional ownership. That’s the power of tokenized assets. Essentially, it’s the process of representing ownership of an asset – whether physical or digital – as a digital token on a blockchain. This token acts as proof of ownership, making it easily transferable and divisible. Think of it like a digital certificate of ownership, but with significantly improved security and transparency.

How Tokenization Works

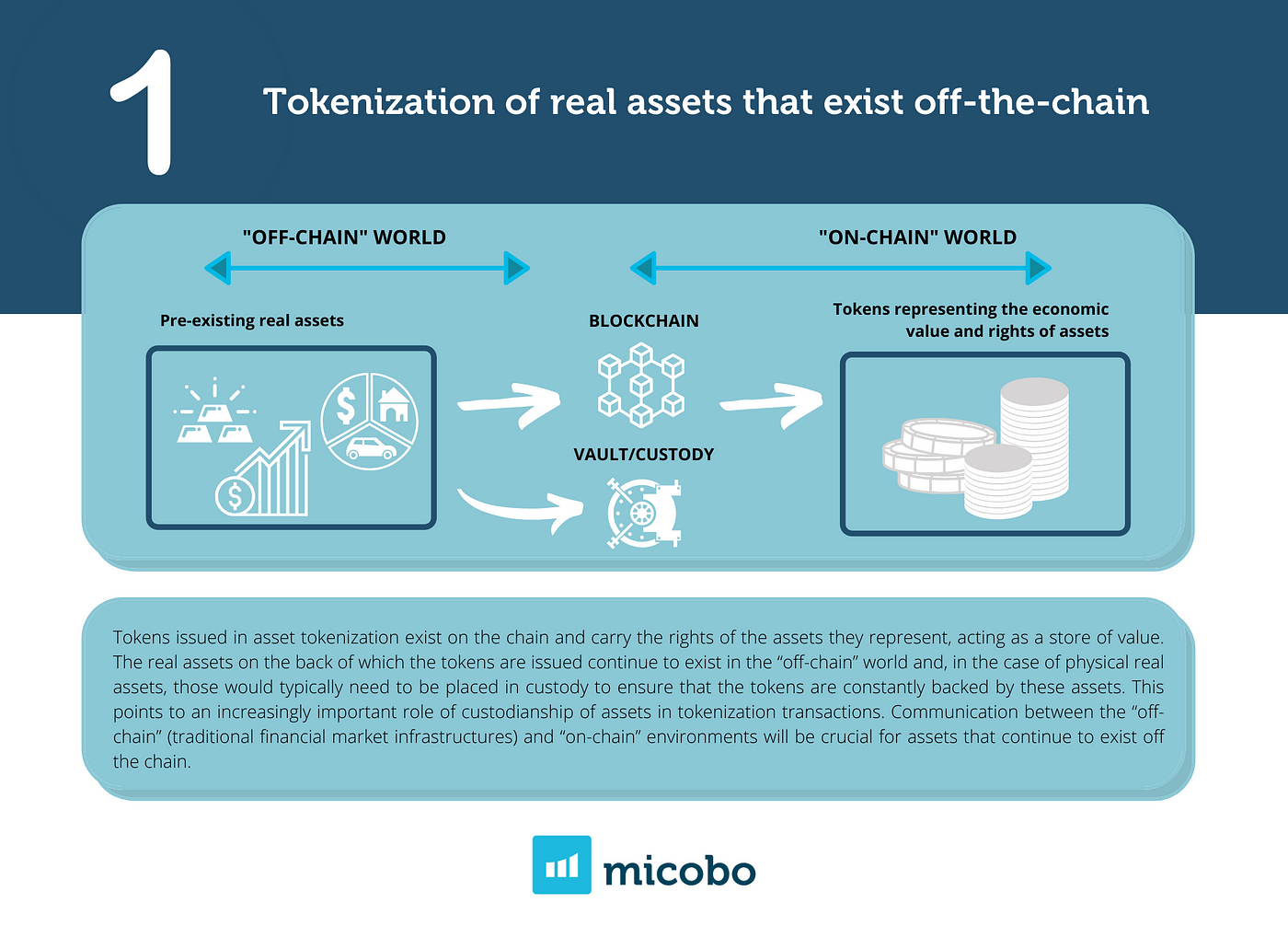

The process begins by creating a digital representation of the asset. This involves verifying its authenticity and value. Then, this asset is divided into smaller, tradable units, each represented by a unique token on a blockchain network. Smart contracts, self-executing contracts with the terms of the agreement between buyer and seller written directly into the code, automate the transfer of these tokens. This eliminates the need for intermediaries, speeding up transactions and reducing costs.

Benefits of Investing in Tokenized Assets

Tokenization unlocks several compelling advantages for investors. Fractional ownership becomes possible, allowing individuals to invest in assets previously inaccessible due to high minimum investment requirements. Liquidity improves significantly; you can buy and sell tokens representing fractions of assets much more easily than the assets themselves. Transparency increases due to the public nature of blockchain records. Finally, costs associated with traditional asset management, such as brokerage fees, are often reduced. Ensure long-term success with a Home Loans Illawarra

Types of Tokenized Assets

The range of assets that can be tokenized is vast and constantly expanding. Real estate is a popular choice, allowing for fractional ownership of properties. Art and collectibles, such as paintings, sculptures, and rare trading cards, are also frequently tokenized. Securities like stocks and bonds can be tokenized for easier trading and increased liquidity. Even intellectual property rights, such as patents and copyrights, are finding their way onto the blockchain.

Risks Associated with Tokenized Assets

While tokenized assets offer numerous benefits, it’s crucial to acknowledge potential risks. The regulatory landscape for tokenized assets is still evolving, and the lack of clear regulations in some jurisdictions could lead to uncertainty. The value of tokenized assets is inherently linked to the underlying asset, so any decrease in the asset’s value will impact the token’s price. The security of the blockchain platform is critical; any vulnerabilities could compromise the integrity of the tokens and potentially lead to losses.

Choosing a Tokenized Asset Platform

When exploring investments in tokenized assets, selecting a reliable platform is paramount. Look for platforms with a strong track record, robust security measures, and transparent fee structures. Research the platform’s compliance with relevant regulations and its reputation within the industry. Consider the platform’s user interface and the ease of buying, selling, and managing your tokenized assets. Don’t hesitate to compare different platforms before committing your investment.

Due Diligence and Diversification

Before investing in any tokenized asset, thorough due diligence is essential. Understand the underlying asset, its potential value appreciation, and the associated risks. Research the project team behind the tokenization, examining their experience and expertise. Remember that diversification is crucial to mitigate risk. Don’t put all your eggs in one basket; spread your investments across various tokenized assets to reduce the impact of any single asset’s underperformance.

The Future of Tokenized Assets

The potential for tokenized assets is immense. As blockchain technology matures and regulatory clarity improves, we can anticipate a significant increase in the adoption of tokenized assets across various asset classes. This could revolutionize how we invest, trade, and manage assets, making them more accessible and efficient for a broader range of participants. The future looks bright for this innovative investment avenue, but careful research and a well-informed investment strategy are crucial for success. Read also about how to invest in tokenized assets.

Blockchain’s New Frontier Tokenized Assets

What are Tokenized Assets?

Tokenization is the process of representing real-world assets, such as real estate, art, or even intellectual property, as digital tokens on a blockchain. These tokens, often represented as NFTs (Non-Fungible Tokens) or other types of digital assets, mirror the ownership and characteristics of the underlying asset. This allows for fractional ownership, easier trading, and increased liquidity in markets traditionally plagued by high transaction costs and slow processing times.

The Blockchain Advantage in Asset Tokenization

Blockchain’s decentralized, transparent, and secure nature makes it the ideal platform for tokenizing assets. Its immutable ledger ensures transparency and prevents tampering with ownership records, offering a high degree of trust and security. Smart contracts, self-executing contracts with the terms of the agreement between buyer and seller directly written into code, automate the transfer of ownership and other processes, streamlining the entire transaction process. This reduces reliance on intermediaries, lowering costs and speeding up transactions.

Fractional Ownership and Increased Liquidity

One of the most significant advantages of tokenized assets is the ability to divide assets into smaller, easily tradable units. This allows more people to participate in markets previously inaccessible due to high minimum investment thresholds. For instance, owning a piece of a valuable artwork or a share of a high-value real estate property becomes achievable for a wider range of investors. This increased accessibility fuels higher liquidity, making it easier to buy and sell these assets quickly and efficiently.

Real-World Applications of Tokenized Assets

The applications of tokenized assets are vast and continue to expand. In the real estate sector, fractional ownership through tokens allows investors to diversify their portfolios and access properties they wouldn’t be able to afford otherwise. In the art market, tokenization provides verifiable provenance and simplifies the buying, selling, and trading of digital and physical artwork. Beyond these, we see applications emerging in areas like supply chain management, where tokens can track goods throughout their journey, and in the financial sector, where tokenized securities offer a more efficient and transparent way of managing investments.

The Role of NFTs in Asset Tokenization

Non-Fungible Tokens (NFTs) play a crucial role in tokenizing unique and non-divisible assets. Unlike cryptocurrencies like Bitcoin which are fungible (interchangeable), NFTs represent unique digital assets with verifiable ownership. This is particularly relevant for unique items like artwork, collectibles, and intellectual property rights, where maintaining proof of ownership and authenticity is paramount. NFTs provide a secure and tamper-proof record of ownership, adding value and trust to the asset.

Challenges and Regulatory Considerations

While the potential of tokenized assets is enormous, there are challenges to overcome. Regulatory clarity is crucial. Governments worldwide are grappling with how to regulate these new forms of digital assets, and a consistent regulatory framework is needed to foster growth and prevent misuse. Concerns around security, scalability, and interoperability between different blockchain platforms also need addressing. These challenges, however, do not overshadow the transformative potential of tokenized assets to revolutionize various sectors.

The Future of Tokenized Assets

The future of tokenized assets looks bright. As blockchain technology matures and regulatory frameworks evolve, we can expect to see even wider adoption across diverse sectors. The ability to fractionalize ownership, enhance liquidity, and increase transparency will continue to attract investors and businesses. The development of new blockchain infrastructure and improved interoperability will further fuel this growth, leading to a more efficient and accessible global economy.

Security and Trust in Tokenized Asset Platforms

The security of the blockchain platform and the smart contracts used to govern tokenized assets is paramount. Robust security measures are necessary to protect against hacking and fraud. Furthermore, building trust in the underlying platform is essential for widespread adoption. This necessitates transparent processes, rigorous audits, and community involvement to ensure the integrity and reliability of tokenized asset platforms.

The Impact on Traditional Markets

Tokenized assets are poised to disrupt traditional markets significantly. Their increased efficiency, reduced costs, and enhanced transparency can challenge established intermediaries and create new opportunities for participants. This disruption, however, will also lead to opportunities for collaboration and innovation as traditional players adapt to this new landscape and integrate tokenization into their operations. The result will likely be a more efficient and competitive market environment. Read more about tokenized assets on the blockchain.