Fractional Ownership Invest in Art, Now Easier Than Ever

Unlocking the World of Art Investment: Fractional Ownership

For years, the art market has been seen as an exclusive club, accessible only to the ultra-wealthy. The sheer cost of acquiring significant pieces has kept many potential investors on the sidelines. But the rise of fractional ownership is changing all that, democratizing access to blue-chip artworks and offering a new avenue for diversification within investment portfolios.

How Fractional Ownership Works: A Simple Explanation

Fractional ownership, in the context of art investment, is precisely what it sounds like: owning a share of a valuable artwork. Imagine a masterpiece valued at $1 million. Instead of one individual needing to invest the full amount, the artwork is divided into, say, 100 shares, each costing $10,000. Investors can purchase one or more shares, giving them proportional ownership and all the associated benefits – appreciation in value, potential for exhibitions, and even a share of any profits from future sales.

The Benefits of Investing in Art Through Fractional Ownership

The advantages are multifaceted. Firstly, it significantly lowers the barrier to entry. Access to high-value art is no longer limited by massive capital requirements. Secondly, art often acts as a hedge against inflation, providing a portfolio buffer against market volatility. Thirdly, diversification is key to any successful investment strategy, and art, traditionally an illiquid asset, is now accessible to a broader range of investors, adding a unique layer of diversification. Finally, successful art investments can offer impressive returns, potentially outperforming traditional asset classes over the long term.

Navigating the Fractional Ownership Market: Choosing the Right Platform

With the growing popularity of fractional ownership, several platforms have emerged to facilitate these transactions. Careful due diligence is crucial. Look for platforms with transparent fee structures, robust security measures, and a proven track record. Consider the platform’s selection of artworks; does it offer a diverse range of styles, artists, and price points? Read reviews and compare different platforms before making a decision. Reputable platforms provide detailed information on the artworks, including provenance (history of ownership) and professional appraisals, building confidence and transparency.

Understanding the Risks Involved: A Balanced Perspective

While fractional ownership offers exciting opportunities, it’s important to acknowledge the inherent risks. The art market is inherently volatile, influenced by factors such as artist popularity, market trends, and economic conditions. Unlike more liquid assets, selling your fractional share may take time. There’s also the risk associated with choosing a less reputable platform, hence the importance of thorough research. Diversification across multiple artworks and platforms can help mitigate some of these risks.

The Future of Art Investment: Fractional Ownership’s Role

Fractional ownership is undoubtedly transforming the art investment landscape. It’s not just about making art accessible to a wider audience; it’s about broadening investment opportunities and fostering a deeper engagement with the art world. As technology continues to advance and platforms refine their offerings, fractional ownership is poised for significant growth, making the art market more inclusive and dynamic than ever before. This opens up exciting possibilities for both seasoned investors and newcomers alike, offering a fresh perspective on diversification and long-term investment strategies.

Due Diligence and Professional Advice: Protecting Your Investment

Before investing in fractional art ownership, it’s strongly recommended to seek professional financial advice. A qualified financial advisor can help assess your risk tolerance, investment goals, and determine if fractional art ownership aligns with your overall portfolio strategy. Thoroughly research the chosen platform and the specific artwork before committing funds. Understand the platform’s fees, the valuation process, and the potential liquidity challenges associated with selling your fractional share. Remember, informed decisions are crucial for successful investing.

Beyond Financial Returns: The Intangible Benefits of Art Ownership

Investing in art through fractional ownership isn’t solely about financial gains; it also provides access to a world of cultural enrichment. Owning a piece of history, a moment of creative genius, can offer intangible rewards that extend far beyond monetary value. The ability to appreciate the artwork, visit exhibitions, and connect with the art world adds another dimension to this unique investment opportunity. Please click here for news about tokenized assets.

Vertical SaaS Explained What It Means For You

Understanding Vertical SaaS

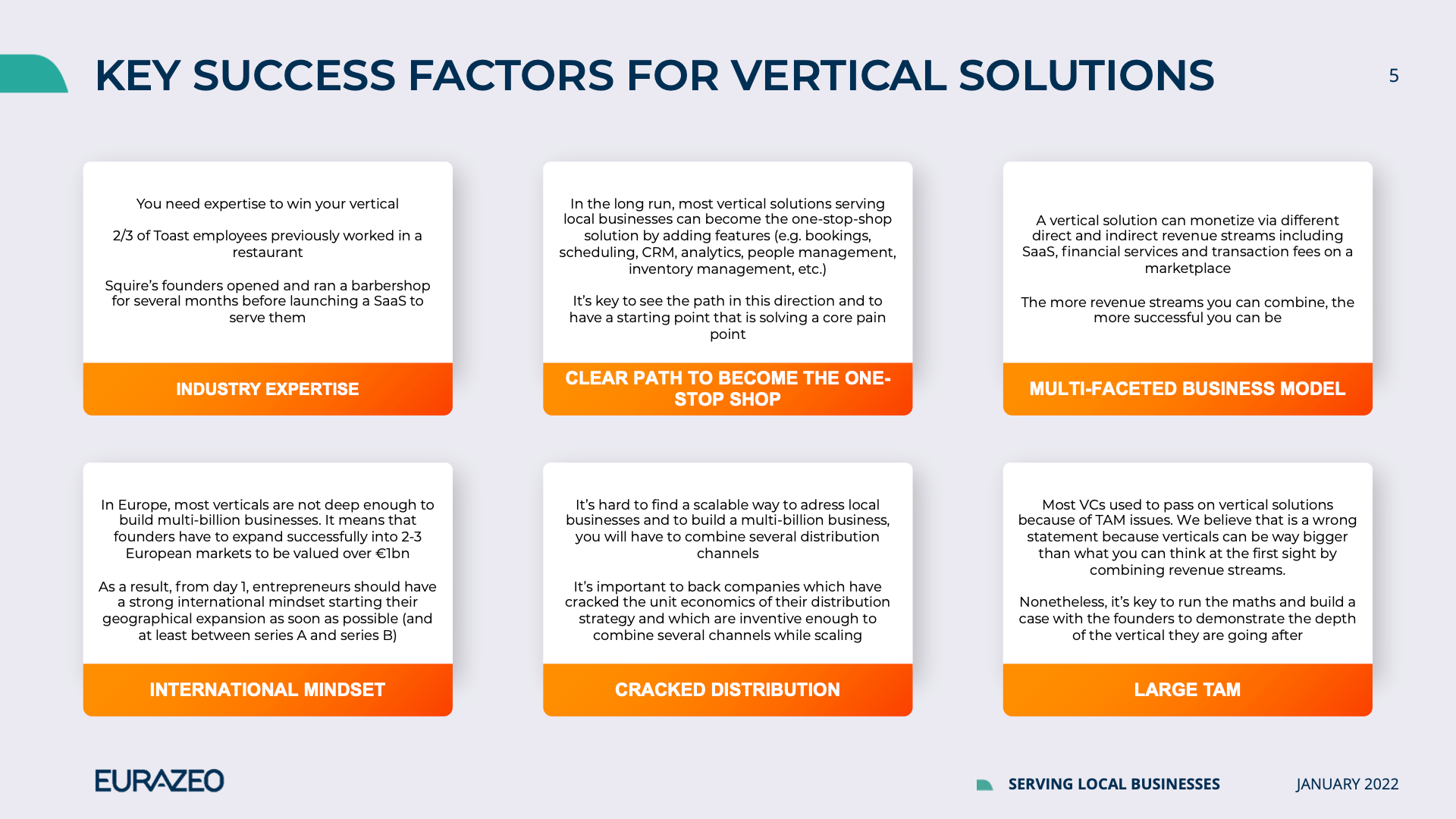

Vertical SaaS, or Software as a Service, is a specific type of software designed to cater to the unique needs of a particular industry or niche. Unlike horizontal SaaS, which aims to serve a broad range of businesses regardless of their sector (think CRM systems or project management tools), vertical SaaS solutions are deeply specialized. They’re built with the specific workflows, regulations, and pain points of a particular vertical in mind. Imagine accounting software tailored exclusively for dentists, or a customer relationship management (CRM) system specifically designed for breweries – that’s vertical SaaS in action.

The Benefits of Vertical SaaS for Businesses

For businesses operating within a specific vertical, the advantages of vertical SaaS are significant. These solutions often come pre-loaded with industry-specific features and functionalities that save time and money. No more struggling to adapt generic software to your unique needs; vertical SaaS is built to work seamlessly with your existing processes. This integration boosts efficiency, reduces the need for extensive customization, and simplifies training for employees. The deep understanding of industry regulations and best practices built into the software also minimizes compliance risks.

How Vertical SaaS Differs from Horizontal SaaS

The key difference lies in the scope and focus. Horizontal SaaS aims for broad applicability, offering generic features that can be adapted to different industries. This broad approach can lead to a lack of specific features relevant to your business, requiring workarounds and potentially costly customizations. Vertical SaaS, conversely, focuses on a specific industry. It delivers features tailored to the industry’s unique challenges and opportunities, resulting in a more streamlined and efficient solution that’s ready to use from the get-go. The level of customization required is significantly reduced, leading to faster implementation and lower costs.

Examples of Vertical SaaS in Action

Consider the healthcare industry. A horizontal CRM might track customer interactions, but a vertical SaaS solution for healthcare practices would integrate with electronic health records (EHRs), manage patient scheduling, and comply with HIPAA regulations – features crucial to the healthcare sector but irrelevant to, say, a retail business. Similarly, a construction management software would integrate with project blueprints, track material costs specifically relevant to the construction industry, and manage worker certifications, unlike a generic project management tool.

Choosing the Right Vertical SaaS Solution

Selecting the right vertical SaaS solution requires careful consideration. Begin by identifying your specific needs and challenges. Research different vendors offering solutions within your industry. Look for software with a strong track record, positive user reviews, and robust customer support. Consider scalability; choose a solution that can grow with your business. Don’t hesitate to request demos and trials to assess the software’s usability and functionality before committing to a long-term contract. A well-chosen vertical SaaS solution can be a game-changer for your business.

The Future of Vertical SaaS

The vertical SaaS market is expanding rapidly. As businesses increasingly recognize the benefits of specialized solutions, the demand for industry-specific software is only expected to grow. We’re likely to see further innovation in this space, with solutions becoming even more tailored and integrated with other technologies. Artificial intelligence and machine learning are poised to play a significant role, enhancing automation and providing deeper insights into business operations within specific verticals. This increased specialization will lead to greater efficiency and productivity for businesses across various industries.

Cost Considerations and ROI of Vertical SaaS

While the initial investment in vertical SaaS might seem higher compared to a generic horizontal solution, the long-term return on investment (ROI) is often significant. The increased efficiency, reduced customization costs, and minimized compliance risks can lead to substantial cost savings. Furthermore, the specialized features often translate to improved productivity and better decision-making, ultimately boosting profitability. Carefully evaluating the total cost of ownership (TCO), including implementation, training, and ongoing support, against the potential benefits is crucial for making an informed decision.

Security and Data Privacy in Vertical SaaS

Security and data privacy are paramount considerations when selecting any SaaS solution, particularly within regulated industries. Look for vendors who comply with relevant industry standards and regulations (like HIPAA in healthcare or GDPR in Europe). Ensure the vendor has robust security measures in place to protect your sensitive data. Transparency regarding data security practices is crucial. Don’t hesitate to ask detailed questions about the vendor’s security protocols and data encryption methods to ensure your business and customer data remains safe. Read also about what vertical SaaS means.

Shielding Your Business Legal Protection Strategies

Navigating Legal Protection Strategies for Your Business

Introduction:

In the competitive landscape of modern business, legal protection is paramount. Shielding your business from potential legal pitfalls requires a proactive approach and a solid understanding of effective protection strategies. From safeguarding intellectual property to mitigating liability risks, implementing robust legal protection measures is essential for long-term success and sustainability.

Understanding Legal Risks:

Before implementing legal protection strategies, it’s crucial to understand the diverse range of legal risks that businesses face. These may include contract disputes, employment law violations, intellectual property infringement, regulatory compliance issues, and more. By identifying potential risks specific to your industry and operations, you can develop targeted protection strategies to mitigate these risks effectively.

Safeguarding Intellectual Property:

Intellectual property (IP) is often one of the most valuable assets of a business. From trademarks and patents to copyrights and trade secrets, protecting your IP is vital for maintaining a competitive edge and preventing unauthorized use or infringement. Legal protection strategies for IP may include registering trademarks and patents, drafting robust contracts with confidentiality clauses, and implementing internal policies to safeguard trade secrets.

Mitigating Liability Risks:

Liability risks pose significant threats to businesses of all sizes and industries. Whether it’s slip-and-fall accidents at your physical premises or product liability claims arising from defective goods, mitigating liability risks requires proactive risk management strategies. This may involve obtaining comprehensive liability insurance coverage, implementing stringent safety protocols, and conducting regular risk assessments to identify and address potential hazards.

Ensuring Regulatory Compliance:

In today’s complex regulatory environment, businesses must adhere to a myriad of laws and regulations at the local, state, and federal levels. Failure to comply with regulatory requirements can result in hefty fines, legal penalties, and damage to your business reputation. Legal protection strategies for regulatory compliance may include staying informed about relevant laws and regulations, conducting regular compliance audits, and implementing robust internal controls and policies to ensure adherence.

Drafting Comprehensive Contracts:

Contracts serve as the foundation of business transactions, outlining rights, obligations, and expectations for all parties involved. To protect your business interests, it’s essential to draft comprehensive contracts that clearly articulate terms and provisions, including dispute resolution mechanisms and indemnification clauses. Working with experienced legal counsel can help ensure that your contracts are legally sound and adequately protect your interests.

Employment Law Compliance:

Employment law regulations govern various aspects of the employer-employee relationship, including hiring, termination, wages, benefits, and workplace safety. Non-compliance with employment laws can lead to costly litigation, reputational damage, and employee morale issues. Legal protection strategies for employment law compliance may include developing employee handbooks and policies, providing regular training for managers and staff, and conducting thorough investigations into any complaints or allegations of misconduct.

Maintaining Data Privacy and Security:

With the increasing digitization of business operations, data privacy and security have become paramount concerns for businesses. Protecting sensitive customer information and proprietary data from data breaches and cyberattacks requires robust cybersecurity measures and compliance with data privacy regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Legal protection strategies for data privacy and security may include implementing encryption protocols, conducting regular security audits, and providing employee training on data protection best practices.

Conclusion:

Shielding your business from legal risks requires a proactive and comprehensive approach. By understanding potential risks, implementing targeted protection strategies, and staying vigilant about compliance with relevant laws and regulations, you can safeguard your business’s interests and ensure long-term success and sustainability. With the right legal protection measures in place, your business can navigate the complexities of the legal landscape with confidence and resilience. Read more about legal shield business