International Economic Ramifications of Healthcare Policy Shifts

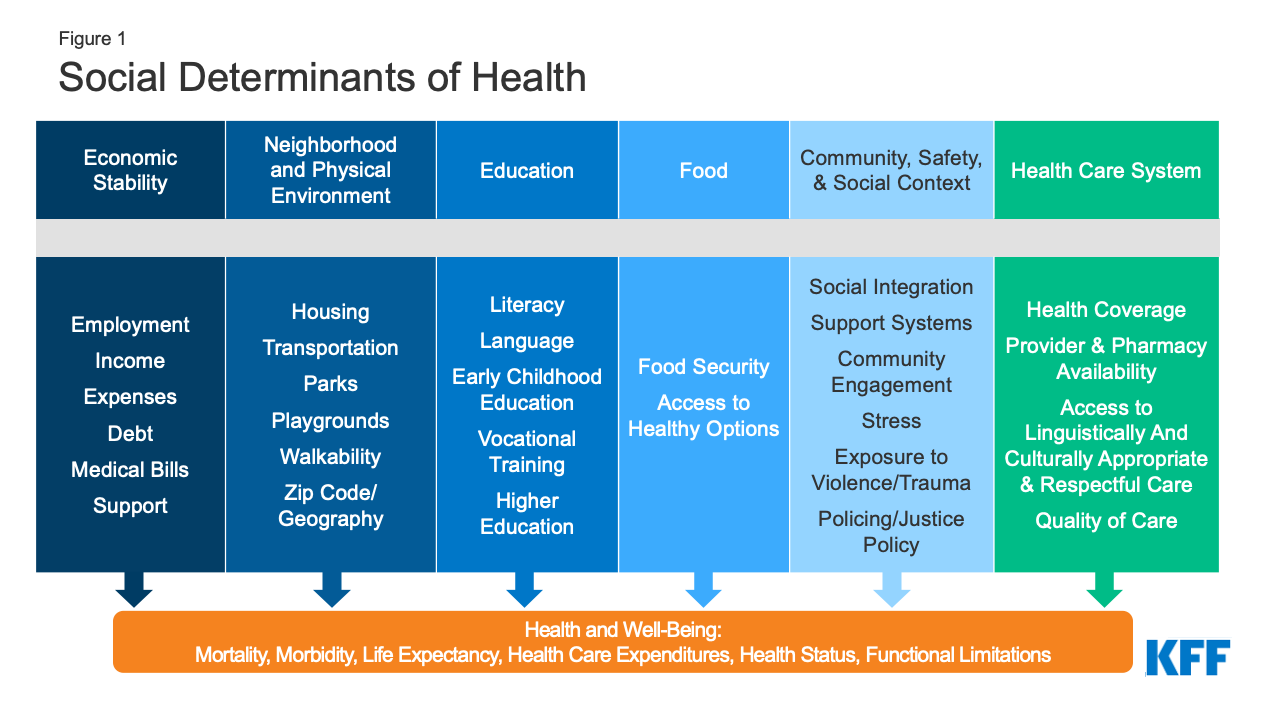

Introduction:

The global landscape of healthcare policies has undergone significant shifts in recent times, sparking a ripple effect that extends beyond the realms of public health. These changes have far-reaching consequences on the international economic stage, influencing various sectors and creating a dynamic interplay between healthcare and the economy.

Impact on Global Investments:

One of the immediate consequences of alterations in healthcare policies is the discernible impact on global investments. Investors closely monitor policy changes, as they can signal shifts in market dynamics. The uncertainty introduced by such alterations can lead to fluctuations in investment patterns, affecting diverse industries from pharmaceuticals to technology.

Trade Relations and Market Dynamics:

Changes in healthcare policies also influence international trade relations and market dynamics. Countries often adjust their import and export strategies in response to shifts in healthcare regulations. This can result in changes in market competitiveness and the restructuring of global trade alliances.

Healthcare Industry Transformation:

The healthcare industry itself undergoes a transformation in response to policy changes. Investments in research and development, as well as the adoption of new technologies, often become key focal points. This evolution can stimulate economic growth within the healthcare sector while presenting new opportunities for innovation.

Labor Market Adjustments:

Shifts in healthcare policies may necessitate adjustments in the labor market. Changes in demand for healthcare professionals, pharmaceutical experts, and related fields can impact employment patterns globally. Governments and businesses alike must adapt to these shifts, leading to a reevaluation of workforce requirements.

Impact on Public Finances:

Government spending on healthcare is a significant component of public finances. Alterations in healthcare policies can have a direct impact on a nation’s budget, affecting allocations for healthcare infrastructure, public health programs, and social services. Striking a balance between economic sustainability and public health becomes a crucial consideration.

Global Health Diplomacy:

The nexus between healthcare policies and international relations gives rise to a domain known as global health diplomacy. Nations engage in collaborative efforts to address health challenges collectively. This intersection between health and diplomacy can influence international alliances and diplomatic relations, shaping a nation’s standing on the global stage.

Resilience and Preparedness:

The importance of resilient healthcare systems becomes evident in times of global crises. Changes in healthcare policies often emphasize the need for preparedness and resilience to mitigate the economic fallout of pandemics and other health emergencies. Nations that can effectively navigate these challenges may emerge more economically robust.

Technology Adoption and Innovation:

Adaptation to new healthcare policies frequently involves the integration of technological solutions. The push for digital health, telemedicine, and other innovations becomes a prominent feature. This not only transforms healthcare delivery but also stimulates economic activity in the technology and healthcare sectors.

Linking Economic Consequences and Healthcare Policies:

In the midst of these multifaceted consequences, understanding the intricate relationship between international economics and healthcare policies is paramount. The need for a balanced approach that prioritizes both economic sustainability and public health is crucial in navigating the challenges posed by evolving global health landscapes.

For more insights into the international economic consequences of changes in healthcare policies, visit International economic consequences of changes in healthcare policies.

In conclusion, the interplay between healthcare policies and international economics is a complex and dynamic phenomenon. As nations grapple with the ongoing need for healthcare reform, the ripple effects are felt far beyond hospital walls, influencing investments, trade dynamics, and the very fabric of global economic interdependence. It is within this intricate web of relationships that the true impact of healthcare policy changes on the international economic stage is revealed.

Economic Consequences of International Monetary Regulation Changes

Navigating the Economic Landscape: International Changes in Monetary Regulations

The intricate dance of global economics is continually influenced by a multitude of factors. One such pivotal element is the constant evolution of monetary regulations on the international stage. In this article, we delve into the economic consequences of these changes and their far-reaching impacts.

The Ripple Effect on Global Trade and Commerce

Changes in international monetary regulations have a profound impact on global trade and commerce. Alterations in exchange rates, trade agreements, and currency valuations can lead to shifts in the competitive landscape. Exporters and importers must adapt to these changes, affecting supply chains and ultimately influencing the cost of goods and services worldwide.

Investor Sentiment and Financial Markets

Investors are particularly sensitive to changes in monetary regulations as they directly affect financial markets. Currency fluctuations and adjustments in interest rates can significantly impact investment strategies and portfolio performances. The uncertainty stemming from regulatory changes often leads to shifts in investor sentiment, influencing market trends and volatility.

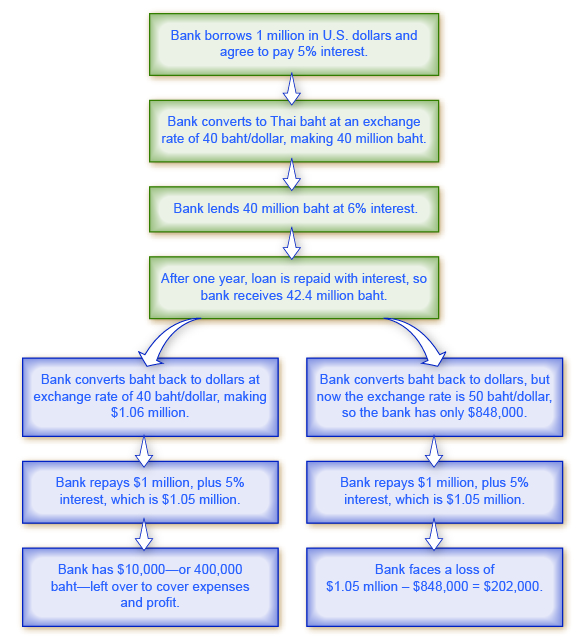

Currency Valuations and Exchange Rate Risks

One of the direct consequences of international monetary changes is the fluctuation in currency valuations. Exchange rates become more volatile, introducing new dimensions of risk for businesses engaged in international transactions. Companies must carefully manage and hedge against these risks to maintain stability in their financial operations.

Inflationary Pressures and Central Bank Policies

Changes in monetary regulations can have direct implications on inflationary pressures within countries. Central banks often adjust interest rates and money supply to achieve economic stability. However, the effectiveness of these policies can vary, leading to challenges in managing inflation and its cascading effects on consumer purchasing power and overall economic health.

Global Financial Stability and Systemic Risks

The interconnectedness of the global financial system means that changes in monetary regulations can introduce systemic risks. Events in one part of the world can quickly transmit shockwaves across borders, affecting financial institutions and markets. Policymakers must carefully balance the need for regulatory adjustments with the potential destabilizing effects on the broader financial ecosystem.

Impacts on Developing Economies and Emerging Markets

Developing economies and emerging markets are often more susceptible to the consequences of international changes in monetary regulations. These regions may face challenges in maintaining economic stability, attracting investments, and managing debt levels. The resulting disparities in economic conditions can exacerbate global inequalities.

Trade Balances and Current Account Deficits

International monetary changes can influence a country’s trade balance and current account deficits. Fluctuations in exchange rates impact the competitiveness of exports and imports, affecting the overall balance of trade. Persistent current account deficits can lead to economic imbalances and vulnerability to external shocks.

Technological Innovations in Financial Services

The landscape of financial services is evolving rapidly, and international monetary changes play a role in shaping this transformation. Innovations such as digital currencies and blockchain technology are gaining prominence, challenging traditional banking systems and providing new avenues for cross-border transactions. These advancements bring both opportunities and challenges for the global economic system.

Looking Ahead: Adaptation and Collaboration

As the world grapples with the economic consequences of international changes in monetary regulations, adaptation and collaboration are key. Policymakers, businesses, and investors must remain vigilant, fostering an environment that supports economic resilience and sustainability. The ability to navigate the complexities of the global economic landscape will be crucial for ensuring a stable and prosperous future.

For a more comprehensive understanding of the economic consequences of international changes in monetary regulations, explore this detailed study here. The study provides insights into case analyses and potential strategies to navigate the evolving global economic landscape in the wake of regulatory shifts.

Global Strife: Economic Consequences of International Conflicts

Unraveling the Economic Tapestry: Consequences of International Conflicts

International conflicts leave a lasting imprint on the global economic landscape, influencing markets, trade, and the financial well-being of nations. In this exploration, we delve into the multifaceted economic consequences that arise when geopolitical tensions escalate into full-blown international conflicts.

Trade Disruptions: The Domino Effect on Global Commerce

One of the immediate and pronounced economic consequences of international conflicts is the disruption of global trade. Tariffs, embargoes, and sanctions are often employed as instruments of economic warfare, impacting the flow of goods and services. Nations involved in conflicts witness a decline in exports and imports, leading to a ripple effect that resonates across industries and economies.

Market Volatility: Investors Navigating Uncertain Terrain

International conflicts inject a high level of uncertainty into financial markets. Investors react swiftly to geopolitical tensions, resulting in increased market volatility. Stock prices fluctuate, currency values are affected, and commodity markets experience disruptions. Navigating this uncertain terrain becomes a challenge for businesses and individuals alike, as they grapple with the repercussions of market fluctuations.

Impact on Currency Values and Exchange Rates

The economic consequences of international conflicts extend to currency values and exchange rates. Geopolitical uncertainties often lead to shifts in investor sentiment, affecting the relative strength of currencies. Nations involved in conflicts may experience currency depreciation, impacting their purchasing power and contributing to inflationary pressures.

Humanitarian and Infrastructure Costs: A Strain on Resources

Beyond the financial markets, international conflicts impose significant humanitarian and infrastructure costs. Nations allocate resources to fund military operations, address humanitarian crises, and rebuild infrastructure damaged during conflicts. The diversion of funds towards these endeavors places a strain on national budgets, affecting social services, education, and healthcare.

Displacement of Businesses and Economic Activities

The physical and logistical disruptions caused by international conflicts result in the displacement of businesses and economic activities. Companies may suspend operations or relocate, disrupting supply chains and regional economies. This displacement has long-term consequences, as rebuilding economic activities in conflict-ridden regions requires substantial time, effort, and resources.

Long-Term Economic Consequences: A Stifled Growth Trajectory

International conflicts can have enduring economic consequences that stifle long-term growth trajectories. The destruction of physical and human capital, coupled with the erosion of investor confidence, impedes economic development. Nations emerging from conflicts often face the arduous task of rebuilding not only their economies but also the trust of the global business community.

Human Capital Flight and Brain Drain

International conflicts can trigger human capital flight as individuals seek safety and opportunities in more stable regions. This brain drain deprives conflict-ridden nations of skilled workers and entrepreneurs, hindering their ability to innovate and compete in the global economy. The loss of human capital becomes a substantial impediment to post-conflict recovery.

Diplomatic and Economic Isolation: Consequences for Global Relations

Nations involved in international conflicts may face diplomatic and economic isolation. Sanctions imposed by the international community restrict their participation in global trade and financial systems. The consequences of this isolation extend beyond the immediate conflict, impacting long-term diplomatic relations and hindering economic cooperation.

Global Cooperation for Economic Recovery: A Necessity

The economic consequences of international conflicts underscore the need for global cooperation in post-conflict recovery. International organizations, diplomatic efforts, and humanitarian aid play crucial roles in rebuilding economies, fostering stability, and addressing the root causes of conflicts. Collaborative endeavors become imperative for charting a course toward economic recovery and sustained peace.

The Imperative for Conflict Prevention: Preserving Economic Stability

In conclusion, understanding the economic consequences of international conflicts emphasizes the imperative for conflict prevention. Preserving economic stability requires diplomatic efforts, international cooperation, and a commitment to addressing root causes. As the world navigates geopolitical challenges, a concerted focus on peace becomes not only a moral imperative but an economic necessity.

To explore more about Economic consequences of international conflicts, visit tankionlineaz.com.