Navigating Emerging Markets: Trends and Analysis

![]()

Navigating Emerging Markets: Trends and Analysis

Emerging markets offer both opportunities and challenges for investors and businesses. Understanding the trends and conducting a thorough analysis is crucial for navigating these dynamic economies.

The Appeal of Emerging Markets

Emerging markets are characterized by rapid growth, expanding populations, and increasing consumer demand. These factors make them attractive for investors seeking high returns. However, the appeal comes with complexities that require a nuanced understanding of each market’s unique dynamics.

Economic Growth and Opportunities

One of the primary attractions of emerging markets is their potential for economic growth. As these economies develop, they create opportunities for investments across various sectors. Industries such as technology, infrastructure, and consumer goods often experience significant expansion in emerging markets, presenting lucrative prospects for investors.

Market Volatility and Risk Considerations

While the growth potential is substantial, emerging markets are also known for their volatility. Political instability, currency fluctuations, and regulatory changes can pose risks for investors. Conducting a comprehensive risk analysis is essential to mitigate potential downsides and make informed investment decisions.

Demographic Dividends and Consumer Trends

Many emerging markets benefit from a demographic dividend, with a large and youthful population entering the workforce. This demographic trend contributes to increased consumer spending, driving demand for a wide range of products and services. Analyzing consumer trends is crucial for businesses looking to tap into these growing markets.

Infrastructure Development and Investment Opportunities

Emerging markets often prioritize infrastructure development to support economic growth. Investments in areas such as transportation, energy, and telecommunications create opportunities for both local and international investors. Understanding the government’s infrastructure plans and regulatory frameworks is key to identifying viable investment avenues.

Technological Advancements and Digital Adoption

Technology plays a transformative role in emerging markets. Rapid digital adoption presents opportunities for businesses to reach new markets and streamline operations. Investing in technology companies and understanding digital trends in these markets is essential for staying competitive.

Environmental, Social, and Governance (ESG) Considerations

As interest in sustainable and responsible investing grows, ESG considerations become integral to emerging market analysis. Investors are increasingly looking at companies with strong ESG practices. Assessing the environmental impact, social responsibility, and governance standards of potential investments is vital for long-term success.

Government Policies and Regulatory Environment

Government policies and the regulatory environment significantly impact business operations in emerging markets. Understanding the political landscape, trade policies, and regulatory frameworks is crucial for assessing the stability and predictability of the investment climate. Close monitoring of policy changes is essential for proactive decision-making.

Financial Inclusion and Banking Sector Growth

Financial inclusion is a priority in many emerging markets. The growth of the banking sector and the adoption of financial technologies contribute to economic development. Investors should assess opportunities in the financial services sector and stay attuned to innovations that enhance financial inclusion.

Global Connectivity and Trade Relations

Emerging markets are increasingly interconnected in the global economy. Trade relations, both regionally and internationally, play a vital role in their economic development. Investors and businesses need to evaluate global connectivity, trade agreements, and geopolitical factors that may influence market dynamics.

Conclusion: Informed Decision-Making in Emerging Markets

In conclusion, navigating emerging markets requires a strategic and informed approach. Conducting thorough analysis, understanding local nuances, and staying abreast of market trends are essential for success. For those seeking a deeper exploration of emerging markets analysis, visit Emerging markets analysis.

By embracing the opportunities while being mindful of the risks, investors and businesses can participate meaningfully in the growth stories of emerging markets. The ability to adapt to evolving conditions and make data-driven decisions positions stakeholders for success in these dynamic and promising economies.

Unlocking World GDP Growth: Trends and Outlooks

Unlocking World GDP Growth: Trends and Outlooks

Understanding the dynamics of global GDP growth is essential for policymakers, businesses, and investors alike. In this exploration, we delve into the current trends and future outlooks, shedding light on the factors influencing world economic development.

The Current Landscape of Global GDP Growth

At the outset, it’s crucial to examine the current state of world GDP growth. Analyzing data from different regions provides insights into the overall health of the global economy. Factors such as industrial output, trade balances, and employment rates contribute to the complex tapestry of economic development.

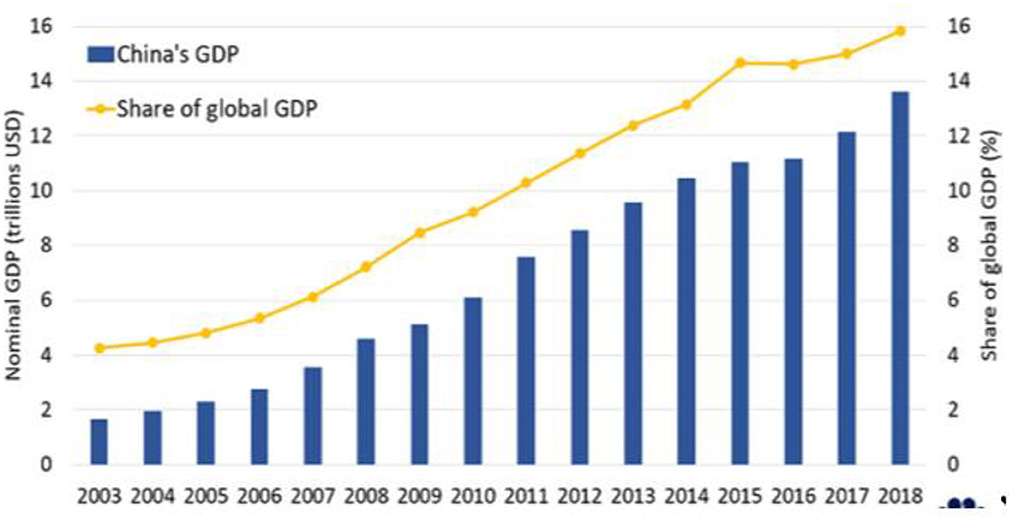

Regional Disparities and Emerging Markets

As we scrutinize global GDP growth, it becomes evident that disparities exist among different regions. While some economies experience robust expansion, others face challenges. Emerging markets play a significant role in shaping the global economic landscape, offering both opportunities and risks for investors and businesses.

Technological Advancements and Economic Expansion

Technological innovations drive economic growth on a global scale. The integration of cutting-edge technologies, such as artificial intelligence and automation, not only enhances productivity but also contributes to GDP growth. Understanding the intersection of technology and economic development is key to navigating the modern global economy.

Trade Dynamics and Global GDP Growth

Trade is a cornerstone of economic activity, and its dynamics profoundly influence global GDP growth. Examining international trade agreements, tariff policies, and geopolitical factors provides valuable insights into the interconnectedness of economies worldwide. The ebb and flow of global trade significantly impact the trajectory of GDP growth.

Environmental Sustainability as a Catalyst

In the 21st century, the pursuit of GDP growth is intricately linked with environmental sustainability. Governments and businesses are increasingly recognizing the importance of eco-friendly practices. Sustainable development not only ensures long-term environmental health but also contributes to economic growth by opening new avenues for innovation and investment.

Challenges to World GDP Growth

Despite positive trends, challenges persist on the path to global economic expansion. Factors such as political instability, trade tensions, and unforeseen global events pose risks to GDP growth. Acknowledging and addressing these challenges are essential for sustaining and accelerating global economic development.

Investment Strategies in a Growing Global Economy

For investors, understanding the dynamics of world GDP growth is paramount. Crafting investment strategies that align with the trajectory of global economic expansion involves diversification, risk management, and staying informed about market trends. A growing global economy presents opportunities for strategic investments.

The Role of Governments in Fostering Growth

Governments play a pivotal role in fostering an environment conducive to GDP growth. From implementing fiscal policies to investing in infrastructure, government initiatives have a direct impact on economic development. Collaboration between the public and private sectors is crucial for sustained and inclusive growth.

Innovation and Future Economic Prospects

Innovation serves as a driving force behind future economic prospects. Countries and industries that prioritize research and development are better positioned to lead in a rapidly changing global economy. Understanding the link between innovation and GDP growth is essential for shaping future economic landscapes.

Navigating Uncertainty and Embracing Opportunities

In conclusion, unlocking world GDP growth requires navigating uncertainties and embracing opportunities. Stakeholders across sectors must adapt to evolving economic dynamics, leveraging insights from current trends to inform strategic decisions. For a deeper exploration of the intricacies of global GDP growth, visit World GDP growth.

By staying informed and proactive, individuals, businesses, and governments can collectively contribute to a resilient and thriving global economy.

Global Financial Reforms: Navigating Economic Consequences

Navigating the Economic Landscape: Consequences of Global Financial Reforms

In the aftermath of financial crises and economic downturns, the global community often rallies to implement financial reforms aimed at fostering stability, resilience, and transparency in financial systems. While these reforms are crucial for preventing future crises, they also bring about significant economic consequences that ripple through various sectors.

Foundation of Reforms: Responding to Financial Crises

Global financial reforms typically emerge as responses to systemic failures and crises. The aftermath of events like the 2008 financial crisis witnessed an international commitment to reevaluate and enhance financial regulations. The primary objective was to build a more robust financial system that could withstand shocks and ensure the protection of investors and the broader economy.

Tightening Regulatory Measures: Impact on Financial Institutions

One of the immediate consequences of global financial reforms is the tightening of regulatory measures on financial institutions. Stricter capital requirements, stress testing, and enhanced risk management practices are imposed to mitigate the likelihood of financial institutions engaging in risky behaviors that could lead to systemic failures. While these measures contribute to stability, they can also limit the profitability and flexibility of financial institutions.

Effects on Lending Practices: Balancing Risk and Access to Credit

The reforms often influence lending practices, impacting the balance between risk management and the accessibility of credit. Stringent regulations may lead banks to adopt more conservative lending approaches, affecting businesses and individuals seeking loans. Striking the right balance becomes a delicate task for policymakers, ensuring that financial institutions remain stable without stifling economic growth through restricted credit availability.

Market Liquidity and Trading Dynamics

Global financial reforms can reshape market liquidity and trading dynamics. Regulations like the Volcker Rule, aimed at curbing excessive risk-taking by banks, can affect market-making activities. While the intention is to prevent speculative trading that could lead to financial instability, there’s a need to carefully assess the consequences on market liquidity, particularly during times of stress or crises.

Impact on Cross-Border Financial Activities

In an interconnected global economy, financial reforms have significant implications for cross-border financial activities. The extraterritorial reach of certain regulations can create challenges for multinational corporations and financial institutions operating across jurisdictions. Coordination and harmonization efforts become essential to ensure a consistent and effective regulatory framework globally.

Technological Innovation and Compliance Costs

As financial institutions adapt to new regulatory requirements, there’s a notable impact on technological innovation and compliance costs. The need to implement sophisticated risk management systems and reporting mechanisms can drive investments in technology. Simultaneously, compliance costs can escalate, particularly for smaller financial entities, influencing their competitiveness and ability to navigate the evolving regulatory landscape.

Global Financial Reforms and Emerging Markets

The consequences of global financial reforms are often amplified in emerging markets. While reforms aim to enhance stability, they may inadvertently create challenges for economies with less-developed financial systems. Stricter regulations can limit the flow of capital to these markets, impacting investment and growth. Policymakers in emerging economies must strike a balance between compliance and fostering economic development.

Unintended Consequences and Regulatory Adjustments

Despite meticulous planning, global financial reforms may lead to unintended consequences. Market participants and institutions may find ways to circumvent regulations, leading to new risks or vulnerabilities. Periodic reassessment and adjustments to regulatory frameworks are crucial to address emerging challenges and maintain the effectiveness of the reforms over time.

The Role of International Cooperation

The consequences of global financial reforms highlight the importance of international cooperation. Coordination among regulatory bodies, central banks, and policymakers is vital to address cross-border challenges and ensure a harmonized global financial system. Regular communication and collaboration contribute to a more effective implementation of reforms while minimizing potential conflicts.

Strategies for Navigating the New Financial Landscape

As the global financial landscape evolves under the influence of reforms, businesses, investors, and policymakers need to develop strategies for navigating the changes. This includes staying informed about regulatory developments, adapting risk management practices, and embracing technological innovations that enhance compliance and efficiency.

Explore more about the Economic Consequences of Global Financial Reforms to understand the evolving dynamics and strategies for navigating the reshaped financial landscape.