Navigating Global Financial Markets: Trends and Strategies

Navigating Global Financial Markets: Trends and Strategies

Understanding and navigating global financial markets is essential for investors, businesses, and policymakers alike. In this exploration, we delve into the current trends shaping these markets and strategies to navigate their complexities.

The Ever-Changing Landscape of Global Financial Markets

Global financial markets are dynamic and subject to constant change. Factors such as economic indicators, geopolitical events, and technological advancements contribute to the fluidity of these markets. Staying informed about the evolving landscape is crucial for making informed financial decisions.

Key Players and Market Dynamics

Global financial markets are comprised of various key players, including institutional investors, retail traders, and central banks. Understanding the roles and interactions of these entities is essential for grasping market dynamics. Market forces such as supply and demand, liquidity, and investor sentiment significantly impact the trajectory of financial markets.

Technological Innovations Shaping Finance

Technological advancements play a pivotal role in shaping global financial markets. The rise of fintech, blockchain, and artificial intelligence has transformed the way financial transactions are conducted. Embracing these innovations is vital for staying competitive and navigating the increasingly digitized financial landscape.

The Impact of Global Economic Trends

Economic trends at the global level have a direct influence on financial markets. Factors such as GDP growth, inflation rates, and trade balances shape investor confidence and market sentiment. Analyzing these trends provides insights into potential investment opportunities and risks.

Geopolitical Events and Market Volatility

Geopolitical events have a profound impact on global financial markets. Political instability, trade tensions, and international conflicts can lead to increased market volatility. Investors must factor in geopolitical considerations when developing strategies to mitigate risks and capitalize on opportunities.

Diversification and Risk Management

Diversification is a fundamental strategy for navigating global financial markets. Spreading investments across different asset classes, regions, and industries helps mitigate risks associated with market fluctuations. Additionally, effective risk management strategies, including setting stop-losses and staying informed about market indicators, are essential for preserving capital.

Market Trends and Emerging Opportunities

Identifying and capitalizing on market trends is crucial for success in global financial markets. Whether it’s the rise of renewable energy investments, the growth of ESG (Environmental, Social, and Governance) investing, or emerging opportunities in developing markets, staying attuned to trends allows investors to position themselves strategically.

The Role of Central Banks in Monetary Policies

Central banks play a significant role in shaping global financial markets through monetary policies. Interest rate decisions, quantitative easing, and other policy measures influence borrowing costs, currency values, and market liquidity. Understanding the stance of central banks is key for predicting market movements.

Digital Transformation in Financial Services

The financial services industry is undergoing a digital transformation. Online trading platforms, robo-advisors, and digital banking have become integral parts of the financial landscape. Embracing these digital tools enhances accessibility and efficiency for investors navigating global financial markets.

Sustainable Investing and Socially Responsible Finance

Sustainable investing, including ESG considerations, is gaining prominence in global financial markets. Investors are increasingly factoring in environmental, social, and governance criteria when making investment decisions. This shift towards socially responsible finance reflects a growing awareness of the impact of investments on broader societal and environmental issues.

In conclusion, navigating global financial markets requires a multifaceted approach. By staying informed about market dynamics, embracing technological innovations, and implementing effective strategies such as diversification and risk management, investors can navigate the complexities of the financial world. For deeper insights into global financial markets, visit Global financial markets.

Global Stock Market Dynamics: Trends and Analysis

Global Stock Market Dynamics: Trends and Analysis

The worldwide stock market is a dynamic arena, influenced by various factors that contribute to its performance. This article explores the current trends and analyzes the factors shaping the global stock market landscape.

Understanding Global Stock Market Performance

Global stock market performance is a reflection of the collective performance of stock exchanges around the world. Major indices, such as the S&P 500, FTSE 100, and Nikkei 225, provide insights into the overall health of the global equity markets. Understanding these indices and their components is crucial for investors and analysts.

Market Trends and Economic Indicators

Examining worldwide stock market performance involves analyzing market trends and key economic indicators. Factors such as GDP growth, inflation rates, and employment figures can impact investor sentiment and influence stock prices. Investors closely monitor economic indicators to make informed decisions about their portfolios.

Regional Disparities and Market Dynamics

Global stock markets are not homogenous; they exhibit regional disparities influenced by geopolitical events, economic policies, and regional economic conditions. Understanding the unique dynamics of each market region helps investors tailor their strategies to capitalize on specific opportunities and mitigate risks.

Technology and Algorithmic Trading

Advancements in technology have revolutionized stock market trading. Algorithmic trading, driven by complex algorithms and machine learning, has become prevalent. This technological evolution impacts market liquidity, trading volumes, and the speed at which transactions occur, shaping the overall dynamics of global stock markets.

Impact of Geopolitical Events on Stock Markets

Geopolitical events, such as trade tensions, political instability, and conflicts, can significantly impact global stock markets. Investors closely monitor these events for potential market disruptions and adjust their portfolios accordingly. Geopolitical risk assessment is a critical component of strategic investment decisions.

Influence of Central Bank Policies

Central banks play a pivotal role in shaping global stock market dynamics. Monetary policies, interest rate decisions, and quantitative easing measures implemented by central banks influence liquidity conditions and investor behavior. Investors keenly observe central bank actions for signals about the future direction of markets.

Market Volatility and Risk Management

Volatility is inherent in stock markets, and understanding how to manage risk is essential for investors. Periods of heightened volatility can present both opportunities and challenges. Implementing effective risk management strategies, such as diversification and hedging, helps investors navigate turbulent market conditions.

Sectoral Performance and Industry Trends

Examining worldwide stock market performance involves analyzing the performance of specific sectors and industries. Technological advancements, shifts in consumer behavior, and industry-specific developments influence the performance of stocks within different sectors. Investors focus on identifying sectors with growth potential.

Environmental, Social, and Governance (ESG) Factors

ESG considerations have gained prominence in global stock markets. Investors increasingly prioritize companies with strong environmental, social, and governance practices. Understanding the impact of ESG factors on stock performance is integral to responsible and sustainable investing strategies.

The Role of Investor Sentiment and Behavioral Economics

Investor sentiment and behavioral economics play a significant role in stock market movements. Psychological factors, such as fear, greed, and herd behavior, can drive market trends. Analyzing investor sentiment provides insights into potential market shifts and opportunities for contrarian investment strategies.

Conclusion: Navigating the Global Stock Market Landscape

In conclusion, navigating the worldwide stock market requires a comprehensive understanding of its dynamics. For those interested in a deeper exploration of global stock market performance, visit Worldwide stock market performance. By staying informed about economic indicators, geopolitical events, and technological advancements, investors can make more informed decisions and adapt their strategies to the ever-evolving global stock market landscape.

Navigating Currency Exchange: Rates, Trends, and Strategies

Navigating Currency Exchange: Rates, Trends, and Strategies

Understanding currency exchange rates is crucial for businesses, investors, and travelers alike. This article delves into the intricacies of currency exchange, exploring the factors influencing rates, current trends, and effective strategies for navigating the dynamic world of foreign exchange.

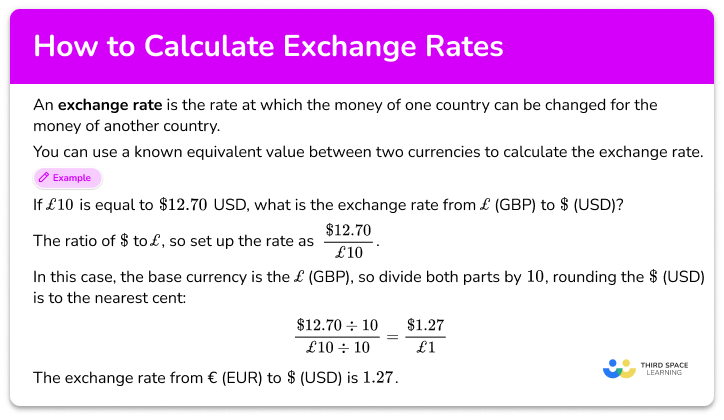

The Basics of Currency Exchange Rates

Currency exchange rates represent the value of one currency in terms of another. These rates fluctuate constantly due to supply and demand dynamics in the foreign exchange market. Traders, investors, and financial institutions engage in currency trading to capitalize on these fluctuations, making the forex market one of the largest and most liquid financial markets globally.

Factors Influencing Currency Exchange Rates

Several factors contribute to the movement of currency exchange rates. Economic indicators, interest rates, inflation, and geopolitical events all play a role. For example, a country with a strong and stable economy may experience a higher demand for its currency, leading to an appreciation of its exchange rate. Understanding these factors is essential for predicting and reacting to currency movements.

Economic Indicators and Currency Strength

Economic indicators, such as GDP growth, employment figures, and trade balances, provide insights into a country’s economic health. Strong economic performance typically leads to a stronger currency. Investors and traders closely monitor these indicators to gauge the relative strength of different currencies and make informed decisions in the forex market.

Interest Rates and Currency Appreciation

Central banks set interest rates, and these rates influence currency values. Higher interest rates in a country attract foreign capital, leading to an appreciation of its currency. Conversely, lower interest rates may result in a depreciation of the currency. Monitoring central bank policies and interest rate decisions is crucial for understanding potential currency movements.

Inflation and Currency Depreciation

Inflation erodes the purchasing power of a currency, leading to depreciation. Countries with lower inflation rates often experience currency appreciation, as the purchasing power of their currency remains relatively stable. Traders and investors factor in inflation rates when assessing the long-term prospects of a currency.

Geopolitical Events and Currency Volatility

Geopolitical events, such as political unrest, trade disputes, and international conflicts, can introduce volatility to currency exchange rates. Uncertainty and risk aversion may lead to rapid currency movements. Staying informed about global events is vital for anticipating potential currency fluctuations and adjusting risk management strategies accordingly.

Currency Trends in a Globalized World

In today’s interconnected world, currency trends are influenced not only by domestic factors but also by global economic conditions. Cross-border trade, capital flows, and international investments contribute to the interdependence of currencies. Analyzing global trends helps market participants make more informed decisions in the forex market.

Strategies for Effective Currency Risk Management

Businesses engaged in international trade face currency risk due to exchange rate fluctuations. Implementing effective currency risk management strategies, such as hedging through forward contracts or using financial derivatives, helps mitigate potential losses. Understanding these strategies is essential for businesses to navigate the challenges of a volatile forex market.

Currency Exchange for Travelers

For travelers, understanding currency exchange rates is crucial for budgeting and making informed financial decisions. Exchange rates at banks, currency exchange offices, and online platforms may vary. Comparing rates and transaction fees ensures travelers get the best value for their money when exchanging currencies.

Technology’s Impact on Currency Trading

Advancements in technology have transformed currency trading. Online platforms and mobile apps provide individuals with access to the forex market, enabling them to trade currencies conveniently. However, it’s essential for retail traders to stay informed and exercise caution, as the forex market can be complex and volatile.

Conclusion: Navigating the Forex Landscape

In conclusion, navigating currency exchange involves understanding the complex interplay of economic factors, geopolitical events, and global trends. For those interested in a deeper exploration of currency exchange rates, visit Currency exchange rates. Whether you are a business involved in international trade, an investor in the forex market, or a traveler preparing for a journey, a solid understanding of currency exchange is key to making informed decisions in the dynamic world of foreign exchange.