Impact of International Sanctions on Global Economies

Navigating Economic Complexities: Effects of International Sanctions

International sanctions wield significant influence over the economic landscapes of nations. This article delves into the intricate web of the economic effects of international sanctions, exploring the multifaceted challenges, analyzing the ripple effects on global markets, and contemplating strategies for resilience in the face of these diplomatic measures.

Understanding the Mechanisms of Sanctions

International sanctions are diplomatic tools employed by nations or groups of nations to influence the behavior of a targeted country. They can manifest in various forms, including trade restrictions, asset freezes, and financial penalties. Understanding the mechanisms and motivations behind sanctions is crucial for assessing their economic impact.

Economic Contraction and Trade Disruptions

One of the immediate effects of international sanctions is the contraction of the targeted country’s economy. Trade disruptions, restrictions on imports and exports, and the imposition of financial penalties contribute to a reduction in economic activity. Businesses face challenges in accessing international markets, leading to decreased production and potential job losses.

To explore the economic effects of international sanctions, visit Economic Effects of International Sanctions.

Currency Depreciation and Inflationary Pressures

Sanctions often trigger currency depreciation in the targeted country as confidence in its economy wanes. The devaluation of the national currency contributes to inflationary pressures, affecting the purchasing power of citizens. Rising prices for goods and services create hardships for the population, exacerbating economic woes induced by the sanctions.

Impact on Financial Systems and Investments

International sanctions can have profound effects on the financial systems of targeted nations. Asset freezes and restrictions on financial transactions hinder the normal functioning of banking institutions. Investors, both domestic and foreign, may face challenges in repatriating funds or making cross-border investments, leading to a decline in overall investment levels.

Energy Sector Vulnerabilities

Sanctions often target the energy sectors of nations, particularly in cases where energy resources play a significant role in the economy. Restrictions on oil and gas exports can cripple a country’s primary revenue source, leading to fiscal deficits and economic instability. Additionally, energy-dependent industries may face disruptions in the supply chain, impacting various sectors.

Social and Humanitarian Impacts

Beyond the economic realm, international sanctions can have severe social and humanitarian consequences. Restricted access to essential goods, including food and medicine, can lead to public health crises. The vulnerable populations bear the brunt of these impacts, raising ethical concerns about the unintended humanitarian fallout of diplomatic measures.

Diplomatic Challenges and Global Relations

The economic effects of international sanctions extend to diplomatic challenges and strained global relations. Targeted nations may respond with retaliatory measures, escalating tensions and creating a complex geopolitical environment. The interplay of diplomatic strategies and countermeasures shapes the broader international landscape.

Adaptive Strategies and Economic Resilience

In the face of international sanctions, nations must adopt adaptive strategies to mitigate economic hardships. Diversifying trade partners, exploring alternative markets, and fostering self-sufficiency become crucial components of resilience. Governments may need to implement economic reforms to navigate the challenges posed by sanctions effectively.

Global Market Ramifications and Spillover Effects

The economic effects of international sanctions are not confined to the targeted nation; they often have spillover effects on the global market. Disruptions in supply chains, fluctuations in commodity prices, and shifts in investor confidence can reverberate across borders. The interconnectedness of the global economy means that sanctions can impact international markets and industries.

De-escalation and Diplomatic Solutions

Ultimately, the quest for economic stability amid international sanctions underscores the importance of de-escalation and diplomatic solutions. Dialogue and negotiations between involved parties can lead to the easing of sanctions, providing a pathway for economic recovery. Diplomatic resolutions contribute to fostering global economic stability and cooperation.

Conclusion: Balancing Diplomacy and Economic Well-being

In conclusion, the economic effects of international sanctions are complex and far-reaching. Balancing diplomatic strategies with the well-being of nations’ economies is a delicate act. As the world navigates geopolitical challenges, finding avenues for dialogue, conflict resolution, and fostering economic resilience becomes imperative for creating a more stable and interconnected global economic landscape.

Economic Consequences of International Monetary Regulation Changes

Navigating the Economic Landscape: International Changes in Monetary Regulations

The intricate dance of global economics is continually influenced by a multitude of factors. One such pivotal element is the constant evolution of monetary regulations on the international stage. In this article, we delve into the economic consequences of these changes and their far-reaching impacts.

The Ripple Effect on Global Trade and Commerce

Changes in international monetary regulations have a profound impact on global trade and commerce. Alterations in exchange rates, trade agreements, and currency valuations can lead to shifts in the competitive landscape. Exporters and importers must adapt to these changes, affecting supply chains and ultimately influencing the cost of goods and services worldwide.

Investor Sentiment and Financial Markets

Investors are particularly sensitive to changes in monetary regulations as they directly affect financial markets. Currency fluctuations and adjustments in interest rates can significantly impact investment strategies and portfolio performances. The uncertainty stemming from regulatory changes often leads to shifts in investor sentiment, influencing market trends and volatility.

Currency Valuations and Exchange Rate Risks

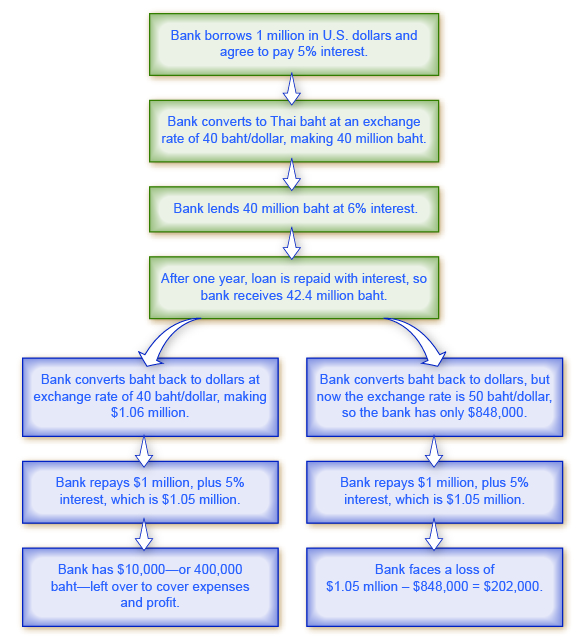

One of the direct consequences of international monetary changes is the fluctuation in currency valuations. Exchange rates become more volatile, introducing new dimensions of risk for businesses engaged in international transactions. Companies must carefully manage and hedge against these risks to maintain stability in their financial operations.

Inflationary Pressures and Central Bank Policies

Changes in monetary regulations can have direct implications on inflationary pressures within countries. Central banks often adjust interest rates and money supply to achieve economic stability. However, the effectiveness of these policies can vary, leading to challenges in managing inflation and its cascading effects on consumer purchasing power and overall economic health.

Global Financial Stability and Systemic Risks

The interconnectedness of the global financial system means that changes in monetary regulations can introduce systemic risks. Events in one part of the world can quickly transmit shockwaves across borders, affecting financial institutions and markets. Policymakers must carefully balance the need for regulatory adjustments with the potential destabilizing effects on the broader financial ecosystem.

Impacts on Developing Economies and Emerging Markets

Developing economies and emerging markets are often more susceptible to the consequences of international changes in monetary regulations. These regions may face challenges in maintaining economic stability, attracting investments, and managing debt levels. The resulting disparities in economic conditions can exacerbate global inequalities.

Trade Balances and Current Account Deficits

International monetary changes can influence a country’s trade balance and current account deficits. Fluctuations in exchange rates impact the competitiveness of exports and imports, affecting the overall balance of trade. Persistent current account deficits can lead to economic imbalances and vulnerability to external shocks.

Technological Innovations in Financial Services

The landscape of financial services is evolving rapidly, and international monetary changes play a role in shaping this transformation. Innovations such as digital currencies and blockchain technology are gaining prominence, challenging traditional banking systems and providing new avenues for cross-border transactions. These advancements bring both opportunities and challenges for the global economic system.

Looking Ahead: Adaptation and Collaboration

As the world grapples with the economic consequences of international changes in monetary regulations, adaptation and collaboration are key. Policymakers, businesses, and investors must remain vigilant, fostering an environment that supports economic resilience and sustainability. The ability to navigate the complexities of the global economic landscape will be crucial for ensuring a stable and prosperous future.

For a more comprehensive understanding of the economic consequences of international changes in monetary regulations, explore this detailed study here. The study provides insights into case analyses and potential strategies to navigate the evolving global economic landscape in the wake of regulatory shifts.