Navigating Global Economic Regulations for Stability

Navigating Global Economic Regulations for Stability

In the intricate web of global finance, economic regulations serve as the backbone, providing structure and stability to interconnected markets. This article delves into the world of worldwide economic regulations, exploring their significance, impact, and the challenges inherent in their implementation.

Understanding the Purpose of Economic Regulations

Economic regulations are a set of rules and guidelines established by governments to oversee and manage various aspects of economic activity. These regulations aim to prevent market failures, ensure fair competition, and protect consumers and investors. By providing a framework for ethical business conduct, they foster an environment conducive to sustainable economic growth.

The Global Landscape of Economic Regulations

In a world characterized by cross-border transactions and interdependence, the need for harmonized global economic regulations is evident. International organizations, such as the International Monetary Fund (IMF) and the World Trade Organization (WTO), play a crucial role in facilitating cooperation among nations to develop and implement consistent regulatory standards. This harmonization is essential for maintaining financial stability on a worldwide scale.

Challenges in Implementing Consistent Regulations

While the idea of uniform global economic regulations is compelling, the reality is fraught with challenges. Each country has its unique economic, social, and political landscape, making it difficult to establish one-size-fits-all regulations. Negotiating and reaching consensus on regulatory standards among diverse nations require diplomatic finesse and a nuanced understanding of each country’s priorities.

The Role of Technology in Regulatory Compliance

As technology continues to advance, its impact on economic regulations is substantial. Innovations such as blockchain and artificial intelligence are being leveraged to enhance regulatory compliance and oversight. These technologies provide transparency, security, and efficiency in monitoring financial transactions, contributing to a more robust regulatory framework.

Balancing Regulation and Innovation

One of the perennial challenges in economic governance is striking the right balance between regulation and innovation. Excessive regulations can stifle economic growth and hinder technological advancements, while inadequate oversight may lead to market abuses and financial crises. Achieving equilibrium requires a dynamic approach that adapts to evolving market dynamics without compromising systemic stability.

The Role of Public Policy in Shaping Regulations

Public policy plays a pivotal role in shaping economic regulations. Governments formulate policies to address socio-economic challenges, and these policies often translate into regulatory measures. Policymakers must navigate a complex landscape, considering the needs of diverse stakeholders, economic trends, and the global interconnectedness of markets.

Economic Regulations and Financial Inclusion

A critical aspect of economic regulations is their impact on financial inclusion. Regulations that are too stringent can exclude marginalized populations from accessing financial services. Striking a balance between regulatory oversight and promoting inclusive financial practices is essential for fostering economic development that benefits all segments of society.

Global Cooperation for Effective Regulation

Recognizing the limitations of a purely national approach, global cooperation is essential for effective economic regulation. Collaborative efforts among nations, international organizations, and regulatory bodies can lead to the development of comprehensive frameworks that address the challenges of the modern global economy.

To explore the latest developments in worldwide economic regulations, visit Worldwide Economic Regulations.

Conclusion: Navigating the Future of Economic Regulations

In conclusion, the landscape of worldwide economic regulations is complex and dynamic. Navigating this terrain requires a delicate balance between international cooperation, technological innovation, and responsive public policy. As we move forward, the challenge lies in creating a regulatory environment that fosters stability, encourages innovation, and ensures the inclusive participation of all stakeholders in the global economy.

Ensuring World Economic Stability for Future Prosperity

Nurturing a Foundation for Global Prosperity: World Economic Stability

In the intricate dance of global finance, achieving and maintaining world economic stability is a paramount objective. This article delves into the multifaceted aspects of this crucial goal, examining the challenges, strategies, and collaborative efforts necessary to foster stability in the world economy.

Understanding the Pillars of Economic Stability

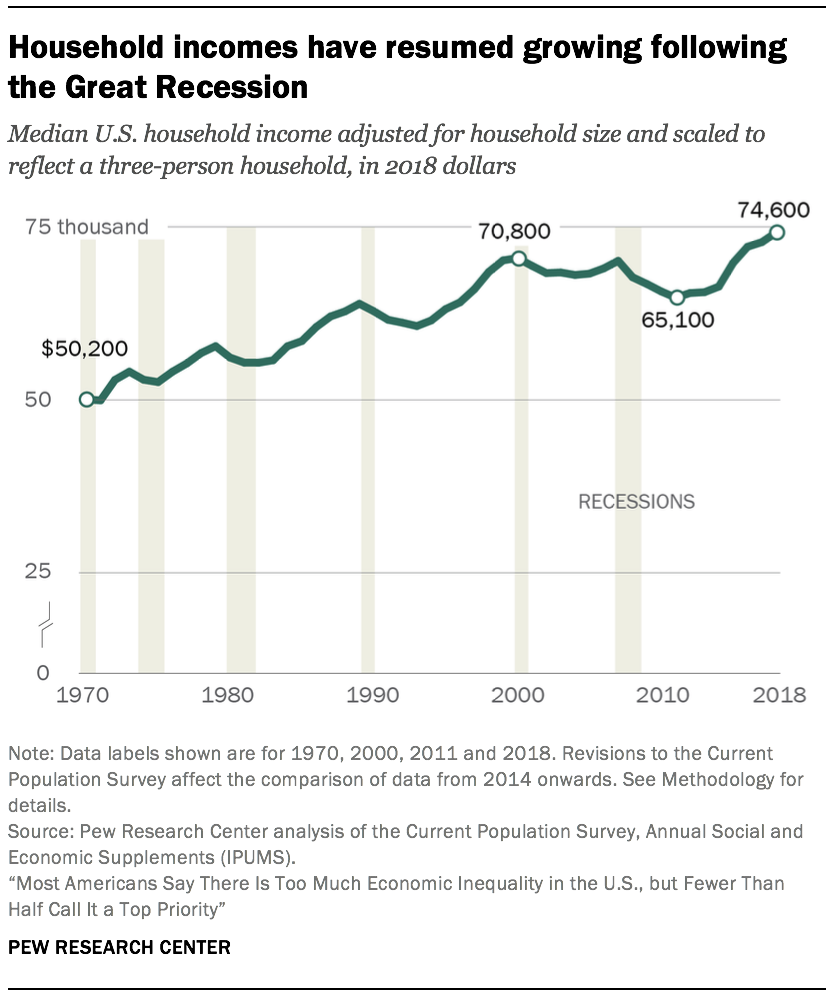

Economic stability is built upon several pillars, including steady GDP growth, controlled inflation, and low unemployment rates. These factors collectively create an environment conducive to investment, business expansion, and overall financial security. Governments, central banks, and international organizations play pivotal roles in establishing and maintaining these foundational elements.

Global Trade Harmony: A Key Ingredient

One of the cornerstones of world economic stability is a harmonious and open global trade environment. Trade agreements and partnerships foster interdependence among nations, promoting a sense of shared responsibility. By mitigating trade tensions and barriers, countries can enhance economic cooperation, leading to sustainable growth and stability on a global scale.

To explore the dynamics of world economic stability, visit World Economic Stability.

Resilience in the Face of Global Shocks

The ability to withstand and recover from unexpected shocks is integral to world economic stability. External factors such as natural disasters, geopolitical events, or health crises can significantly impact economies. Establishing resilient financial systems and contingency plans is imperative to minimize the adverse effects of unforeseen events.

Sound Monetary and Fiscal Policies: Guardians of Stability

Central banks and governments play pivotal roles as guardians of economic stability. Implementing sound monetary and fiscal policies helps regulate inflation, interest rates, and public spending. Coordinated efforts among nations to align these policies contribute to a more stable and predictable global economic environment.

Inclusive Growth for Sustainable Stability

World economic stability is not just about numbers; it’s about ensuring that the benefits of economic progress are shared inclusively. Addressing income inequality and promoting social welfare contribute to a more stable and harmonious global society. Inclusive growth strategies create a robust foundation for sustained economic stability.

International Cooperation: A Prerequisite for Stability

In an interconnected world, international cooperation is a prerequisite for achieving and maintaining economic stability. Collaborative efforts among nations, facilitated by organizations like the International Monetary Fund (IMF) and the World Bank, provide a platform for dialogue, policy coordination, and crisis management.

Technological Innovation: Catalyst for Economic Stability

Embracing technological innovation is crucial for future economic stability. Advancements in technology drive productivity, efficiency, and new opportunities for economic growth. Nations that invest in research and development, foster innovation ecosystems, and adapt to technological changes position themselves for greater stability in the global economic landscape.

Environmental Sustainability as an Economic Imperative

Recognizing the interdependence of economic activities and the environment, sustainability initiatives are integral to world economic stability. Balancing economic growth with environmental conservation ensures the longevity of resources and the well-being of future generations. Green technologies and sustainable practices contribute to a resilient and stable global economy.

Educational Empowerment for Economic Stability

Investing in education is an investment in economic stability. A skilled and adaptable workforce is essential for navigating the challenges of a rapidly evolving global economy. Educational empowerment, including vocational training and continuous learning, equips individuals with the tools needed to contribute to and benefit from economic stability.

Conclusion: Sustaining a Balanced Global Economic Ecosystem

In conclusion, sustaining world economic stability is a shared responsibility that requires collective action. From fostering international cooperation to embracing technological innovation and promoting inclusive growth, the journey toward stability is multifaceted. By recognizing the interconnectedness of global economies and actively addressing challenges, we can nurture a balanced economic ecosystem that paves the way for future prosperity.

Global Economic Crisis Management: Strategies for Resilience

Navigating Uncertainty: Global Economic Crisis Management

In the complex web of the global economy, effective crisis management is paramount for fostering resilience and ensuring a robust recovery. This article explores the intricacies of global economic crisis management, dissecting the challenges posed by crises, unveiling strategies for mitigation, and emphasizing the collaborative efforts needed to navigate the tumultuous economic landscapes.

Understanding the Dynamics of Economic Crises

Global economic crises manifest in various forms, from financial meltdowns to pandemics and geopolitical tensions. Understanding the dynamics of these crises is the first step in formulating effective crisis management strategies. The interconnected nature of the global economy means that a crisis in one region can have ripple effects worldwide, necessitating a coordinated and adaptive response.

To explore global economic crisis management strategies, visit Global Economic Crisis Management.

Proactive Measures: Risk Identification and Prevention

Proactive crisis management involves identifying potential risks before they escalate into full-blown crises. Governments, businesses, and international organizations must engage in thorough risk assessments, considering factors such as economic imbalances, geopolitical tensions, and systemic vulnerabilities. Prevention strategies may include regulatory reforms, stress testing financial systems, and fostering transparent communication.

Swift and Coordinated Responses

In the face of an unfolding economic crisis, swift and coordinated responses are essential. Governments play a pivotal role in implementing monetary and fiscal measures to stabilize financial markets, protect jobs, and stimulate economic activity. International collaboration becomes crucial, with nations working together to share information, resources, and strategies for mitigating the impact of the crisis on a global scale.

Adaptive Fiscal Policies and Stimulus Packages

Adaptive fiscal policies are integral to crisis management. Governments may deploy stimulus packages to inject liquidity into the economy, support affected industries, and provide financial relief to individuals. The design of these packages must be flexible, tailored to the specific challenges posed by the crisis, and capable of adapting to evolving economic conditions.

Resilience Building at the Business Level

Global economic crisis management extends to the business realm, where resilience building becomes imperative. Companies must implement adaptive strategies, diversify supply chains, and leverage technology to navigate challenges. Investing in innovation, upskilling the workforce, and maintaining financial prudence contribute to the overall resilience of businesses in the face of economic crises.

Social Safety Nets and Support Systems

Crisis management strategies should prioritize social safety nets and support systems to shield vulnerable populations. Governments play a crucial role in ensuring that individuals facing job losses or financial hardships have access to essential services, healthcare, and financial assistance. Strengthening support systems fosters social cohesion and mitigates the long-term impact of economic crises on communities.

Digital Transformation for Economic Agility

Digital transformation emerges as a key component of global economic crisis management. The adoption of digital technologies enhances economic agility, enabling businesses and governments to adapt quickly to changing circumstances. E-commerce, remote work, and digital communication tools become essential in maintaining economic activities during crises and facilitating recovery.

Environmental Sustainability in Crisis Recovery

As nations strategize for crisis recovery, environmental sustainability must be integrated into economic planning. Green initiatives, renewable energy projects, and sustainable practices contribute to long-term resilience. The recovery process presents an opportunity to build a more sustainable and environmentally conscious global economy, fostering economic growth while mitigating climate risks.

Transparent Communication and Trust Building

Transparent communication is a cornerstone of effective crisis management. Governments, businesses, and international organizations must communicate openly with the public, providing accurate information and fostering trust. Building public trust is crucial for garnering support for crisis management measures and ensuring a coordinated response that transcends borders.

International Cooperation for Future Preparedness

Global economic crisis management is an ongoing process that requires continuous international cooperation. Nations must collaborate in developing frameworks for crisis preparedness, sharing best practices, and establishing mechanisms for swift response. Strengthening international institutions and fostering a spirit of collaboration contribute to a more resilient global economic system.

Conclusion: Forging a Resilient Global Economy

In conclusion, navigating global economic crises demands a comprehensive and collaborative approach. From proactive risk identification to adaptive fiscal policies, the strategies employed must be dynamic and responsive. By prioritizing resilience at all levels, fostering international cooperation, and embracing sustainable practices, the global community can forge a more resilient and sustainable economic future.

Sustaining Strength: Global Economic Resilience

Building Fortitude: Navigating the Landscape of Global Economic Resilience

In an ever-changing world fraught with uncertainties, the concept of global economic resilience has become a focal point for nations, businesses, and communities alike. This article delves into the dynamics of global economic resilience, exploring its significance, key components, and the strategies that contribute to fortifying the global economic landscape.

Understanding Global Economic Resilience: A Shield Against Shocks

Global economic resilience is the capacity of the interconnected global economic system to withstand and recover from shocks, crises, and disruptions. It serves as a shield against the unexpected, providing the necessary strength to absorb shocks and adapt to changing circumstances. In essence, it is a proactive approach to ensure that the global economy can endure and recover from unforeseen challenges.

Diversification as a Pillar of Strength

Diversification is a cornerstone of global economic resilience. This principle extends to diverse sectors, industries, and markets. Economies heavily reliant on a single sector are more vulnerable to shocks specific to that sector. Diversifying across industries and geographic regions helps distribute risks and minimizes the impact of localized disruptions.

Adaptive Capacity in the Face of Change

The ability to adapt swiftly to changing circumstances is a key component of global economic resilience. Nations and businesses equipped with an adaptive mindset can adjust policies, strategies, and operations in response to emerging challenges. This adaptive capacity fosters a dynamic environment that can navigate uncertainties with resilience.

Innovation and Technological Preparedness

Embracing innovation and maintaining technological preparedness are vital aspects of global economic resilience. Technology serves as a catalyst for progress and efficiency. Economies that prioritize technological advancements are better equipped to respond to disruptions, leverage digital solutions, and ensure continuity in the face of unforeseen events.

International Cooperation and Collaborative Efforts

Global economic resilience is inherently tied to international cooperation and collaborative efforts. Nations working together, sharing knowledge, and coordinating responses contribute to a more resilient global economy. Collaborative initiatives in trade, finance, and crisis management enhance the collective capacity to weather economic storms.

Robust Financial Systems and Risk Management

A resilient global economy relies on robust financial systems and effective risk management. Well-regulated financial institutions, transparent markets, and sound risk management practices contribute to stability. Nations that prioritize the health of their financial systems are better positioned to absorb shocks and facilitate a quicker recovery.

Social Safety Nets and Inclusive Policies

The strength of a global economy is measured not only by its economic output but also by the well-being of its people. Social safety nets and inclusive policies ensure that the benefits of economic growth are distributed equitably. Nations with strong social safety nets can protect vulnerable populations during times of economic stress, fostering social stability.

Environmental Sustainability as a Resilience Factor

Global economic resilience is intertwined with environmental sustainability. Climate change and environmental degradation pose significant threats to economic stability. Sustainable practices, green technologies, and policies that address environmental concerns contribute to long-term resilience by mitigating the impact of ecological challenges.

Investment in Education and Human Capital

Investing in education and human capital is an investment in the future resilience of a global economy. A skilled and adaptable workforce is better equipped to navigate economic transformations and contribute to innovation. Nations that prioritize education create a foundation for continuous learning, ensuring a resilient workforce capable of meeting evolving challenges.

Strategies for Enhancing Global Economic Resilience

As nations and businesses aspire to enhance global economic resilience, a strategic approach is paramount. This involves continuous assessment, proactive risk management, and a commitment to adaptability. Strategies should include investing in infrastructure, fostering innovation, promoting inclusive policies, and strengthening international collaborations.

Embracing a Resilient Future

In conclusion, global economic resilience is not merely a response to crises; it is a mindset, a strategy, and a collective effort to build a future that can withstand the unexpected. By embracing diversification, innovation, international cooperation, and sustainable practices, nations contribute to a global economic landscape that is not just robust but also prepared to thrive in the face of challenges.

To explore more about Global economic resilience, visit tankionlineaz.com.

Navigating World Economic Disparities

Understanding the Nuances of Global Economic Inequality

Economic disparities across the world have long been a topic of concern, with vast differences in wealth and development among nations. Examining the intricate factors contributing to these imbalances allows us to comprehend the complexities of global economic inequality.

Historical Roots and Modern Realities

The roots of world economic disparities can be traced back to historical events such as colonialism and unequal trade relationships. In the modern era, these disparities persist and are exacerbated by various factors, including geopolitical power dynamics, resource distribution, and systemic inequalities.

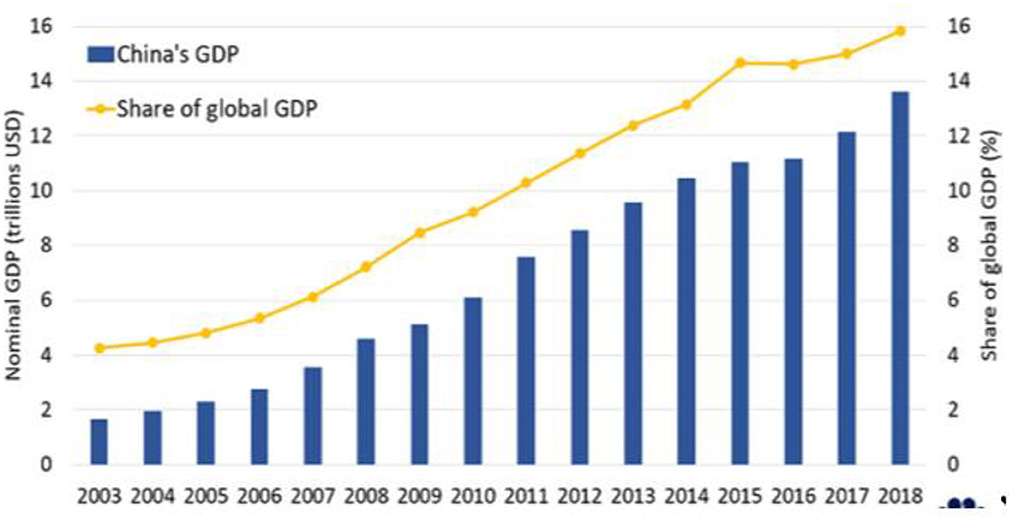

Global Trade and Wealth Accumulation

One major contributor to economic disparities is the uneven distribution of benefits from global trade. While some countries thrive on exports and economic integration, others face challenges in accessing international markets. The link between global trade policies and the widening wealth gap is a critical aspect that demands attention.

Technology Divide and Innovation Gaps

Advancements in technology play a significant role in shaping economic landscapes. However, the unequal adoption and access to technology contribute to a widening gap between technologically advanced nations and those struggling to keep pace. Addressing this “technology divide” is pivotal for fostering inclusive global economic growth.

Educational Disparities and Economic Mobility

Education serves as a cornerstone for economic development, but disparities in educational opportunities create barriers to upward mobility. Nations with robust educational systems tend to experience higher levels of economic prosperity. Bridging the educational gap is essential for fostering a more equitable distribution of wealth on a global scale.

Financial Inclusion and Access to Capital

Access to financial resources is a key determinant of economic success. Disparities in financial inclusion and access to capital contribute to a cycle of poverty in many regions. Efforts to enhance financial literacy and create avenues for inclusive financial systems are critical steps toward addressing economic disparities.

Environmental Challenges and Economic Impact

Environmental issues pose a dual challenge, affecting both developed and developing nations. However, the economic impact of environmental challenges often disproportionately burdens less developed countries. Sustainable development initiatives that address environmental concerns while promoting economic growth can contribute to narrowing global economic gaps.

Government Policies and Inequality Mitigation

Effective governance and policy implementation play a crucial role in mitigating economic disparities. Countries with well-designed social policies, progressive taxation systems, and inclusive economic strategies tend to experience more balanced wealth distribution. Analyzing successful policy models becomes imperative for nations striving to address economic inequalities.

International Cooperation for Sustainable Development

In an interconnected world, addressing economic disparities requires a collaborative approach. International organizations, partnerships, and agreements become instrumental in fostering cooperation among nations. By working together to implement sustainable development goals, countries can make strides toward a more equitable global economic landscape.

Challenges and Opportunities Ahead

While economic disparities pose significant challenges, they also present opportunities for positive change. Innovative solutions, inclusive policies, and a collective commitment to addressing the root causes can pave the way for a more balanced and sustainable global economy.

In the pursuit of understanding and addressing world economic disparities, it is essential to recognize the multifaceted nature of the issue. By fostering global awareness, encouraging inclusive policies, and promoting international cooperation, we can strive towards a world where economic opportunities are more evenly distributed.

To explore more about World economic disparities, visit tankionlineaz.com.

Global Financial Reforms: Navigating Economic Consequences

Navigating the Economic Landscape: Consequences of Global Financial Reforms

In the aftermath of financial crises and economic downturns, the global community often rallies to implement financial reforms aimed at fostering stability, resilience, and transparency in financial systems. While these reforms are crucial for preventing future crises, they also bring about significant economic consequences that ripple through various sectors.

Foundation of Reforms: Responding to Financial Crises

Global financial reforms typically emerge as responses to systemic failures and crises. The aftermath of events like the 2008 financial crisis witnessed an international commitment to reevaluate and enhance financial regulations. The primary objective was to build a more robust financial system that could withstand shocks and ensure the protection of investors and the broader economy.

Tightening Regulatory Measures: Impact on Financial Institutions

One of the immediate consequences of global financial reforms is the tightening of regulatory measures on financial institutions. Stricter capital requirements, stress testing, and enhanced risk management practices are imposed to mitigate the likelihood of financial institutions engaging in risky behaviors that could lead to systemic failures. While these measures contribute to stability, they can also limit the profitability and flexibility of financial institutions.

Effects on Lending Practices: Balancing Risk and Access to Credit

The reforms often influence lending practices, impacting the balance between risk management and the accessibility of credit. Stringent regulations may lead banks to adopt more conservative lending approaches, affecting businesses and individuals seeking loans. Striking the right balance becomes a delicate task for policymakers, ensuring that financial institutions remain stable without stifling economic growth through restricted credit availability.

Market Liquidity and Trading Dynamics

Global financial reforms can reshape market liquidity and trading dynamics. Regulations like the Volcker Rule, aimed at curbing excessive risk-taking by banks, can affect market-making activities. While the intention is to prevent speculative trading that could lead to financial instability, there’s a need to carefully assess the consequences on market liquidity, particularly during times of stress or crises.

Impact on Cross-Border Financial Activities

In an interconnected global economy, financial reforms have significant implications for cross-border financial activities. The extraterritorial reach of certain regulations can create challenges for multinational corporations and financial institutions operating across jurisdictions. Coordination and harmonization efforts become essential to ensure a consistent and effective regulatory framework globally.

Technological Innovation and Compliance Costs

As financial institutions adapt to new regulatory requirements, there’s a notable impact on technological innovation and compliance costs. The need to implement sophisticated risk management systems and reporting mechanisms can drive investments in technology. Simultaneously, compliance costs can escalate, particularly for smaller financial entities, influencing their competitiveness and ability to navigate the evolving regulatory landscape.

Global Financial Reforms and Emerging Markets

The consequences of global financial reforms are often amplified in emerging markets. While reforms aim to enhance stability, they may inadvertently create challenges for economies with less-developed financial systems. Stricter regulations can limit the flow of capital to these markets, impacting investment and growth. Policymakers in emerging economies must strike a balance between compliance and fostering economic development.

Unintended Consequences and Regulatory Adjustments

Despite meticulous planning, global financial reforms may lead to unintended consequences. Market participants and institutions may find ways to circumvent regulations, leading to new risks or vulnerabilities. Periodic reassessment and adjustments to regulatory frameworks are crucial to address emerging challenges and maintain the effectiveness of the reforms over time.

The Role of International Cooperation

The consequences of global financial reforms highlight the importance of international cooperation. Coordination among regulatory bodies, central banks, and policymakers is vital to address cross-border challenges and ensure a harmonized global financial system. Regular communication and collaboration contribute to a more effective implementation of reforms while minimizing potential conflicts.

Strategies for Navigating the New Financial Landscape

As the global financial landscape evolves under the influence of reforms, businesses, investors, and policymakers need to develop strategies for navigating the changes. This includes staying informed about regulatory developments, adapting risk management practices, and embracing technological innovations that enhance compliance and efficiency.

Explore more about the Economic Consequences of Global Financial Reforms to understand the evolving dynamics and strategies for navigating the reshaped financial landscape.