Unraveling the Truist Lawsuit Key Insights and Updates

In the realm of corporate disputes and legal battles, the Truist lawsuit has emerged as a focal point of attention. This article aims to unravel the complexities of this lawsuit, providing key insights and updates on the ongoing proceedings.

Understanding the Background

The Truist lawsuit stems from allegations of misconduct and breach of fiduciary duty by key executives and board members of the company. These allegations have raised significant concerns among shareholders and investors, prompting legal action to address the alleged wrongdoing.

Key Allegations and Claims

At the heart of the Truist lawsuit are allegations of financial mismanagement, conflicts of interest, and breaches of corporate governance standards. Shareholders have accused the company’s leadership of prioritizing personal gain over the best interests of the company and its stakeholders, leading to financial losses and erosion of shareholder value.

Legal Proceedings and Developments

Legal proceedings in the Truist lawsuit have unfolded over a series of hearings and court filings, with each side presenting its arguments and evidence in support of their respective positions. Key developments, such as motions, rulings, and settlements, have shaped the trajectory of the lawsuit and influenced its outcome.

Impact on Stakeholders

The Truist lawsuit has had far-reaching implications for various stakeholders, including shareholders, employees, customers, and the broader business community. Shareholders have seen the value of their investments fluctuate in response to developments in the lawsuit, while employees and customers may have concerns about the company’s stability and reputation.

Market Response and Investor Sentiment

The financial markets have closely monitored the Truist lawsuit, with investors reacting to news and updates related to the case. Fluctuations in the company’s stock price, trading volumes, and investor sentiment have reflected the market’s assessment of the potential impact of the lawsuit on the company’s financial performance and long-term prospects.

Legal Strategy and Defense

Truist and its legal team have vigorously defended against the allegations raised in the lawsuit, asserting their innocence and challenging the validity of the claims. Their legal strategy has involved thorough investigation, expert testimony, and strategic litigation tactics aimed at securing a favorable outcome for the company and its leadership.

Transparency and Accountability

Throughout the legal proceedings, stakeholders have called for transparency and accountability from Truist and its leadership. Shareholders and investors have emphasized the importance of corporate governance, ethical conduct, and adherence to regulatory standards in safeguarding the company’s reputation and long-term viability.

Navigating Uncertainty

As the Truist lawsuit continues to unfold, stakeholders are faced with uncertainty regarding its eventual outcome and impact on the company’s future. While legal proceedings may take time to reach a resolution, stakeholders remain vigilant and attentive to developments that may shape the trajectory of the lawsuit and its implications for Truist and its stakeholders.

Moving Forward

In the face of ongoing legal challenges, Truist remains committed to its mission of delivering value to its shareholders, customers, and employees. With a focus on transparency, accountability, and ethical conduct, the company seeks to navigate the complexities of the lawsuit and emerge stronger, ensuring a bright future for all stakeholders involved. Read more about truist lawsuit

Global Economic Impact: Changes in Tax Policies

Navigating Fiscal Frontiers: Unraveling the Global Economic Impact of Changes in Tax Policies

In the intricate dance of global economics, changes in tax policies wield significant influence. This article delves into the multifaceted effects that alterations in tax regulations can have on the global economic landscape.

The Dynamics of Revenue Collection and Government Spending

Changes in tax policies play a pivotal role in shaping how governments collect revenue and allocate funds. Shifts in tax rates, structures, and incentives impact the overall revenue available to governments, subsequently influencing public spending on infrastructure, social programs, and other critical initiatives. The delicate balance between taxation and expenditure sets the tone for a nation’s economic trajectory.

Investor Sentiment and Business Landscape

The business community closely monitors changes in tax policies, as these adjustments can significantly impact investor sentiment and the overall business landscape. Alterations in corporate tax rates or regulations may influence investment decisions, capital flows, and the profitability of enterprises. Understanding these dynamics becomes crucial for businesses navigating the ever-evolving global market.

Income Distribution and Social Equity

Tax policies serve as a tool for shaping income distribution and addressing issues of social equity. Progressive or regressive tax structures directly impact the disposable income of individuals and households. Changes in these policies can contribute to either widening or narrowing the wealth gap within a society, influencing social dynamics and public perception of economic fairness.

International Competitiveness and Trade Relations

Nations often adjust tax policies to enhance international competitiveness and foster favorable trade relations. A reduction in corporate tax rates, for example, may attract foreign investment and stimulate economic growth. However, these strategies can also spark competition among nations, creating a dynamic interplay of tax policies as countries vie for a favorable position in the global economic arena.

Impact on Consumer Behavior and Spending Patterns

Changes in tax policies resonate with consumers, influencing their behavior and spending patterns. Adjustments in sales taxes, value-added taxes, or other consumption-related levies directly impact the cost of goods and services. Consumers respond by adjusting their spending habits, affecting industries and sectors differently and contributing to the broader economic landscape.

Innovation and Research & Development Initiatives

Tax incentives can act as catalysts for innovation and research & development (R&D) initiatives. Governments may use tax policies to encourage businesses to invest in technology, innovation, and sustainable practices. Changes in these incentives can shape the direction of corporate strategies, influencing the pace of technological advancements and fostering economic growth through innovation.

Foreign Direct Investment and Economic Growth

The allure of favorable tax environments often attracts foreign direct investment (FDI), contributing to economic growth. Changes in tax policies can impact the attractiveness of a country as an investment destination. Understanding the correlation between tax regulations and FDI is essential for policymakers seeking to bolster their nation’s economic development.

Challenges and Unintended Consequences

While changes in tax policies aim to achieve specific economic goals, they can also pose challenges and lead to unintended consequences. Sudden adjustments may disrupt established business models, create uncertainties, and result in unanticipated outcomes. Policymakers must carefully weigh the potential benefits against these challenges to formulate effective and sustainable tax strategies.

Global Cooperation and Tax Harmonization

In an interconnected world, achieving global economic stability often requires cooperation and coordination on tax matters. The pursuit of tax harmonization aims to reduce tax evasion, foster fair competition, and create a level playing field for businesses. Global collaboration becomes imperative to address cross-border tax challenges and create a cohesive and equitable international tax framework.

For a more comprehensive understanding of the global economic impact of changes in tax policies, explore this detailed study here. The study offers in-depth analyses of case studies, providing valuable insights into the intricate dynamics of global economies in the wake of evolving tax regulations.

Economic Consequences of International Monetary Regulation Changes

Navigating the Economic Landscape: International Changes in Monetary Regulations

The intricate dance of global economics is continually influenced by a multitude of factors. One such pivotal element is the constant evolution of monetary regulations on the international stage. In this article, we delve into the economic consequences of these changes and their far-reaching impacts.

The Ripple Effect on Global Trade and Commerce

Changes in international monetary regulations have a profound impact on global trade and commerce. Alterations in exchange rates, trade agreements, and currency valuations can lead to shifts in the competitive landscape. Exporters and importers must adapt to these changes, affecting supply chains and ultimately influencing the cost of goods and services worldwide.

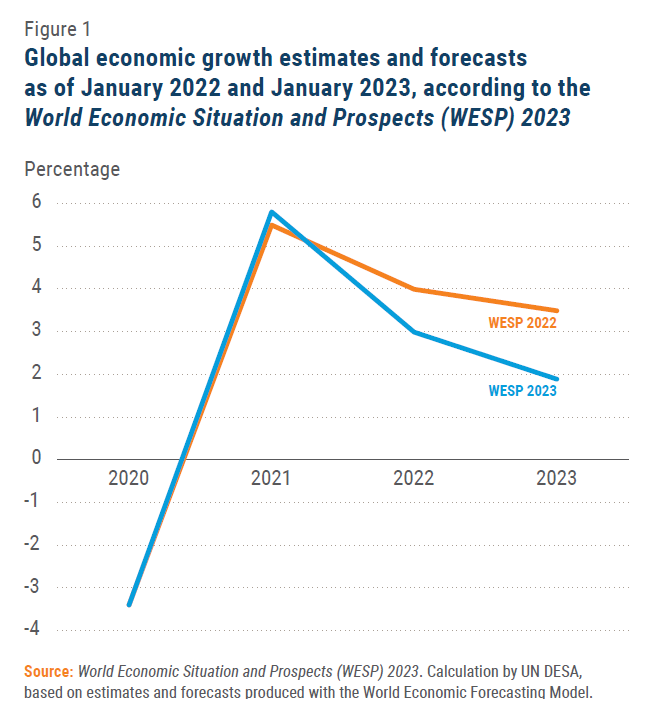

Investor Sentiment and Financial Markets

Investors are particularly sensitive to changes in monetary regulations as they directly affect financial markets. Currency fluctuations and adjustments in interest rates can significantly impact investment strategies and portfolio performances. The uncertainty stemming from regulatory changes often leads to shifts in investor sentiment, influencing market trends and volatility.

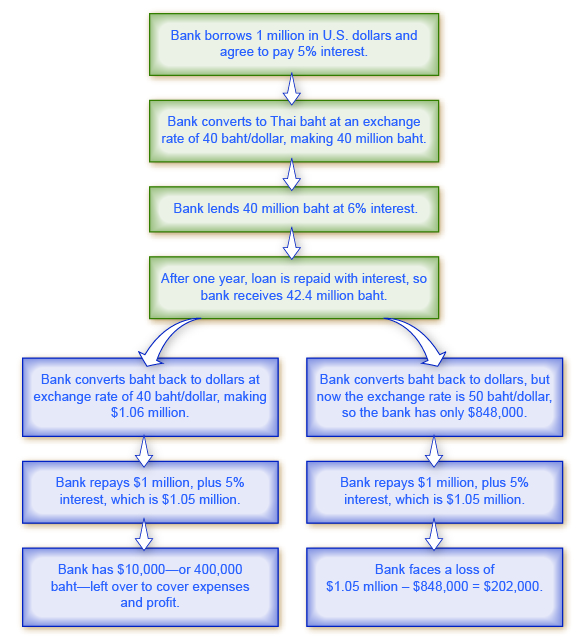

Currency Valuations and Exchange Rate Risks

One of the direct consequences of international monetary changes is the fluctuation in currency valuations. Exchange rates become more volatile, introducing new dimensions of risk for businesses engaged in international transactions. Companies must carefully manage and hedge against these risks to maintain stability in their financial operations.

Inflationary Pressures and Central Bank Policies

Changes in monetary regulations can have direct implications on inflationary pressures within countries. Central banks often adjust interest rates and money supply to achieve economic stability. However, the effectiveness of these policies can vary, leading to challenges in managing inflation and its cascading effects on consumer purchasing power and overall economic health.

Global Financial Stability and Systemic Risks

The interconnectedness of the global financial system means that changes in monetary regulations can introduce systemic risks. Events in one part of the world can quickly transmit shockwaves across borders, affecting financial institutions and markets. Policymakers must carefully balance the need for regulatory adjustments with the potential destabilizing effects on the broader financial ecosystem.

Impacts on Developing Economies and Emerging Markets

Developing economies and emerging markets are often more susceptible to the consequences of international changes in monetary regulations. These regions may face challenges in maintaining economic stability, attracting investments, and managing debt levels. The resulting disparities in economic conditions can exacerbate global inequalities.

Trade Balances and Current Account Deficits

International monetary changes can influence a country’s trade balance and current account deficits. Fluctuations in exchange rates impact the competitiveness of exports and imports, affecting the overall balance of trade. Persistent current account deficits can lead to economic imbalances and vulnerability to external shocks.

Technological Innovations in Financial Services

The landscape of financial services is evolving rapidly, and international monetary changes play a role in shaping this transformation. Innovations such as digital currencies and blockchain technology are gaining prominence, challenging traditional banking systems and providing new avenues for cross-border transactions. These advancements bring both opportunities and challenges for the global economic system.

Looking Ahead: Adaptation and Collaboration

As the world grapples with the economic consequences of international changes in monetary regulations, adaptation and collaboration are key. Policymakers, businesses, and investors must remain vigilant, fostering an environment that supports economic resilience and sustainability. The ability to navigate the complexities of the global economic landscape will be crucial for ensuring a stable and prosperous future.

For a more comprehensive understanding of the economic consequences of international changes in monetary regulations, explore this detailed study here. The study provides insights into case analyses and potential strategies to navigate the evolving global economic landscape in the wake of regulatory shifts.

Global Economy in Flux: Geopolitical Events and Their Impact

Global Economy in Flux: Geopolitical Events and Their Impact

Geopolitical events wield substantial influence over the world economy, shaping trade, investment, and overall economic stability. This article explores the intricate relationship between geopolitical events and the global economy, delving into specific impacts and strategies for navigating this complex terrain.

Understanding the Interconnectedness

Geopolitical events, ranging from trade disputes to military conflicts and diplomatic tensions, have far-reaching consequences on the interconnected global economy. As nations become more interdependent, disruptions in one region can create ripples that affect markets, supply chains, and investor confidence worldwide.

Trade Wars and Economic Consequences

Trade wars, characterized by tariffs and trade barriers between nations, can significantly disrupt international commerce. The tit-for-tat imposition of tariffs escalates costs for businesses, disrupts supply chains, and can lead to a slowdown in global trade. Analyzing the economic consequences of such trade disputes is crucial for businesses and policymakers alike.

Impact on Currency Markets and Exchange Rates

Geopolitical events often trigger volatility in currency markets. Uncertainty surrounding geopolitical tensions can lead to fluctuations in exchange rates, impacting businesses engaged in international trade. Understanding how geopolitical events influence currency markets is essential for businesses engaged in cross-border transactions and for investors managing currency risks.

Energy Markets and Geopolitical Stability

Geopolitical events in energy-producing regions can have a profound impact on global energy markets. Disruptions in the supply of oil and gas due to geopolitical tensions can lead to price spikes, affecting industries and consumer spending worldwide. Diversifying energy sources and developing resilient energy policies become imperative in such geopolitical contexts.

Investor Sentiment and Financial Markets

Geopolitical events often result in shifts in investor sentiment. Uncertainty and perceived risks can lead to market volatility, impacting stock prices and investment decisions. Examining how geopolitical events influence financial markets helps investors make informed decisions and implement risk management strategies.

Global Security Concerns and Economic Resilience

Events related to global security, including conflicts and terrorism, can have lasting impacts on the world economy. Heightened security concerns may lead to increased defense spending, diverting resources from other economic activities. Building economic resilience in the face of security challenges involves addressing underlying geopolitical tensions and fostering diplomatic solutions.

Diplomatic Relations and Trade Alliances

Diplomatic relations and trade alliances shape the economic landscape. The establishment or dissolution of alliances can impact trade flows, market access, and economic cooperation. Evaluating the diplomatic dimensions of geopolitical events is crucial for businesses seeking to navigate changing trade dynamics and identify emerging opportunities.

Navigating Sanctions and Economic Restrictions

Geopolitical events often involve the imposition of sanctions or economic restrictions. These measures can have direct consequences on businesses operating in affected regions. Understanding the intricacies of sanctions, their scope, and potential loopholes is essential for businesses to navigate regulatory compliance and minimize economic disruptions.

Technology and Cybersecurity Considerations

In an interconnected world, technological advancements and cybersecurity play a pivotal role in geopolitical events. Cyberattacks, technology-related disputes, and concerns over data privacy can impact businesses and disrupt digital ecosystems. Implementing robust cybersecurity measures becomes imperative in mitigating risks associated with geopolitical technological challenges.

The Role of International Organizations and Multilateralism

International organizations and multilateral cooperation play a critical role in addressing the economic fallout from geopolitical events. Collaborative efforts to resolve conflicts, promote dialogue, and uphold global norms contribute to stability. Businesses and governments should actively engage in and support multilateral initiatives for a more secure and predictable global economic environment.

Conclusion: Navigating Uncertainty with Strategic Insights

In conclusion, the impact of geopolitical events on the world economy is undeniable. For those interested in a deeper exploration of the topic, visit Impact of geopolitical events on the world economy. Navigating the uncertainties requires strategic insights, proactive risk management, and a commitment to fostering international cooperation. As businesses and nations adapt to an ever-changing geopolitical landscape, understanding the multifaceted nature of these events is key to building a resilient global economy.