Navigating Currency Exchange: Rates, Trends, and Strategies

Navigating Currency Exchange: Rates, Trends, and Strategies

Understanding currency exchange rates is crucial for businesses, investors, and travelers alike. This article delves into the intricacies of currency exchange, exploring the factors influencing rates, current trends, and effective strategies for navigating the dynamic world of foreign exchange.

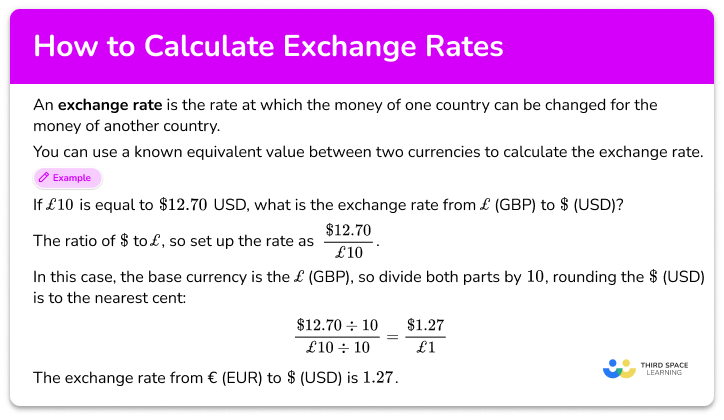

The Basics of Currency Exchange Rates

Currency exchange rates represent the value of one currency in terms of another. These rates fluctuate constantly due to supply and demand dynamics in the foreign exchange market. Traders, investors, and financial institutions engage in currency trading to capitalize on these fluctuations, making the forex market one of the largest and most liquid financial markets globally.

Factors Influencing Currency Exchange Rates

Several factors contribute to the movement of currency exchange rates. Economic indicators, interest rates, inflation, and geopolitical events all play a role. For example, a country with a strong and stable economy may experience a higher demand for its currency, leading to an appreciation of its exchange rate. Understanding these factors is essential for predicting and reacting to currency movements.

Economic Indicators and Currency Strength

Economic indicators, such as GDP growth, employment figures, and trade balances, provide insights into a country’s economic health. Strong economic performance typically leads to a stronger currency. Investors and traders closely monitor these indicators to gauge the relative strength of different currencies and make informed decisions in the forex market.

Interest Rates and Currency Appreciation

Central banks set interest rates, and these rates influence currency values. Higher interest rates in a country attract foreign capital, leading to an appreciation of its currency. Conversely, lower interest rates may result in a depreciation of the currency. Monitoring central bank policies and interest rate decisions is crucial for understanding potential currency movements.

Inflation and Currency Depreciation

Inflation erodes the purchasing power of a currency, leading to depreciation. Countries with lower inflation rates often experience currency appreciation, as the purchasing power of their currency remains relatively stable. Traders and investors factor in inflation rates when assessing the long-term prospects of a currency.

Geopolitical Events and Currency Volatility

Geopolitical events, such as political unrest, trade disputes, and international conflicts, can introduce volatility to currency exchange rates. Uncertainty and risk aversion may lead to rapid currency movements. Staying informed about global events is vital for anticipating potential currency fluctuations and adjusting risk management strategies accordingly.

Currency Trends in a Globalized World

In today’s interconnected world, currency trends are influenced not only by domestic factors but also by global economic conditions. Cross-border trade, capital flows, and international investments contribute to the interdependence of currencies. Analyzing global trends helps market participants make more informed decisions in the forex market.

Strategies for Effective Currency Risk Management

Businesses engaged in international trade face currency risk due to exchange rate fluctuations. Implementing effective currency risk management strategies, such as hedging through forward contracts or using financial derivatives, helps mitigate potential losses. Understanding these strategies is essential for businesses to navigate the challenges of a volatile forex market.

Currency Exchange for Travelers

For travelers, understanding currency exchange rates is crucial for budgeting and making informed financial decisions. Exchange rates at banks, currency exchange offices, and online platforms may vary. Comparing rates and transaction fees ensures travelers get the best value for their money when exchanging currencies.

Technology’s Impact on Currency Trading

Advancements in technology have transformed currency trading. Online platforms and mobile apps provide individuals with access to the forex market, enabling them to trade currencies conveniently. However, it’s essential for retail traders to stay informed and exercise caution, as the forex market can be complex and volatile.

Conclusion: Navigating the Forex Landscape

In conclusion, navigating currency exchange involves understanding the complex interplay of economic factors, geopolitical events, and global trends. For those interested in a deeper exploration of currency exchange rates, visit Currency exchange rates. Whether you are a business involved in international trade, an investor in the forex market, or a traveler preparing for a journey, a solid understanding of currency exchange is key to making informed decisions in the dynamic world of foreign exchange.