Decoding International Trade Statistics: Trends and Insights

Decoding International Trade Statistics: Trends and Insights

International trade statistics are a treasure trove of information, offering valuable insights into the dynamics of global commerce. In this exploration, we unravel the complexities behind these statistics, providing a comprehensive overview of trends and essential insights.

Understanding the Significance of International Trade Statistics

International trade statistics serve as a crucial barometer of the global economy. They encompass data on imports, exports, trade balances, and more. Analyzing these figures offers a deep understanding of the interconnectedness of nations and the economic forces at play.

Key Indicators in International Trade Statistics

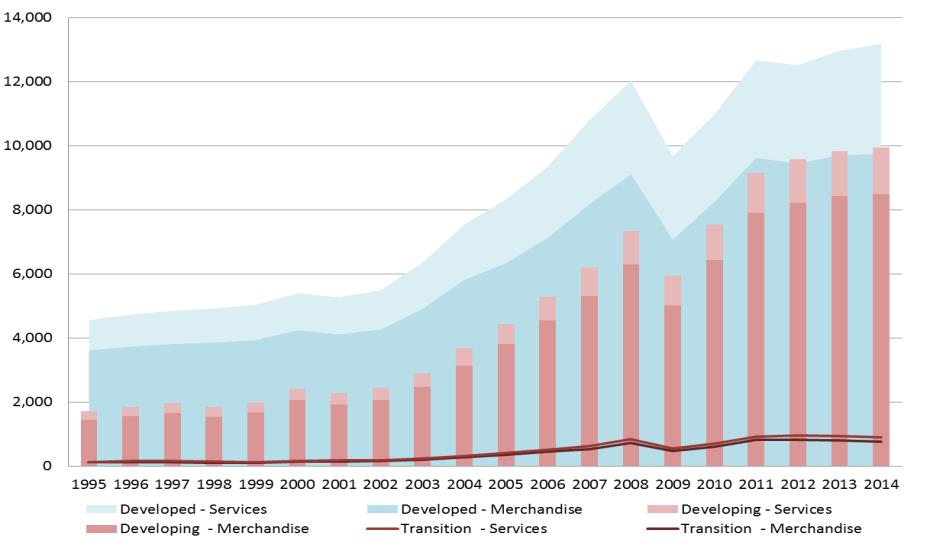

Delving into international trade statistics involves examining key indicators. From trade volumes and values to tariff rates and trade balances, these indicators paint a detailed picture of how countries engage in commerce. Understanding these metrics aids in forecasting economic trends and potential shifts in global trade dynamics.

Regional Disparities and Trade Patterns

Analyzing international trade statistics unveils regional disparities and distinctive trade patterns. Certain regions specialize in specific industries or commodities, influencing the global supply chain. Recognizing these patterns is essential for businesses, policymakers, and investors seeking strategic opportunities.

Impact of Trade Agreements on Statistics

International trade statistics are significantly influenced by trade agreements. Agreements such as free trade pacts and economic alliances can spur increased trade volumes between participating nations. Understanding the influence of these agreements is vital for businesses looking to expand their market reach.

Trade Statistics as Economic Indicators

Beyond the realm of commerce, trade statistics are powerful economic indicators. Changes in export or import volumes can signal shifts in a country’s economic health. Governments and financial institutions closely monitor these statistics to make informed decisions and adjust economic policies accordingly.

Challenges in Data Accuracy and Reporting

While international trade statistics offer valuable insights, challenges exist in ensuring data accuracy and consistent reporting. Discrepancies in reporting standards and data collection methods can impact the reliability of these statistics, requiring careful interpretation and consideration.

Technological Advances in Trade Data Analysis

Advancements in technology have revolutionized the analysis of international trade statistics. Big data analytics and machine learning algorithms enable more sophisticated interpretations, uncovering hidden trends and providing a more nuanced understanding of global trade dynamics.

Environmental Considerations in Trade Statistics

In recent years, environmental considerations have become integral to international trade discussions. Analyzing trade statistics reveals the environmental impact of global commerce, prompting discussions on sustainable trade practices and the ecological footprint of different industries.

Trade Statistics and Market Forecasting

Businesses leverage international trade statistics for market forecasting. By analyzing historical trade patterns and anticipating shifts, companies can make informed decisions about market entry, product development, and supply chain management.

The Future of International Trade Statistics

As we navigate a rapidly changing global landscape, the future of international trade statistics holds exciting possibilities. Continued advancements in technology, increased transparency in reporting, and a growing awareness of sustainable practices will shape the evolution of these critical economic metrics.

In conclusion, decoding international trade statistics requires a nuanced understanding of economic trends, regional dynamics, and the broader global context. For an in-depth exploration of these trends and insights, visit International trade statistics. By staying informed, businesses and policymakers can make strategic decisions that contribute to a more resilient and interconnected global economy.

Global Stock Market Dynamics: Trends and Analysis

Global Stock Market Dynamics: Trends and Analysis

The worldwide stock market is a dynamic arena, influenced by various factors that contribute to its performance. This article explores the current trends and analyzes the factors shaping the global stock market landscape.

Understanding Global Stock Market Performance

Global stock market performance is a reflection of the collective performance of stock exchanges around the world. Major indices, such as the S&P 500, FTSE 100, and Nikkei 225, provide insights into the overall health of the global equity markets. Understanding these indices and their components is crucial for investors and analysts.

Market Trends and Economic Indicators

Examining worldwide stock market performance involves analyzing market trends and key economic indicators. Factors such as GDP growth, inflation rates, and employment figures can impact investor sentiment and influence stock prices. Investors closely monitor economic indicators to make informed decisions about their portfolios.

Regional Disparities and Market Dynamics

Global stock markets are not homogenous; they exhibit regional disparities influenced by geopolitical events, economic policies, and regional economic conditions. Understanding the unique dynamics of each market region helps investors tailor their strategies to capitalize on specific opportunities and mitigate risks.

Technology and Algorithmic Trading

Advancements in technology have revolutionized stock market trading. Algorithmic trading, driven by complex algorithms and machine learning, has become prevalent. This technological evolution impacts market liquidity, trading volumes, and the speed at which transactions occur, shaping the overall dynamics of global stock markets.

Impact of Geopolitical Events on Stock Markets

Geopolitical events, such as trade tensions, political instability, and conflicts, can significantly impact global stock markets. Investors closely monitor these events for potential market disruptions and adjust their portfolios accordingly. Geopolitical risk assessment is a critical component of strategic investment decisions.

Influence of Central Bank Policies

Central banks play a pivotal role in shaping global stock market dynamics. Monetary policies, interest rate decisions, and quantitative easing measures implemented by central banks influence liquidity conditions and investor behavior. Investors keenly observe central bank actions for signals about the future direction of markets.

Market Volatility and Risk Management

Volatility is inherent in stock markets, and understanding how to manage risk is essential for investors. Periods of heightened volatility can present both opportunities and challenges. Implementing effective risk management strategies, such as diversification and hedging, helps investors navigate turbulent market conditions.

Sectoral Performance and Industry Trends

Examining worldwide stock market performance involves analyzing the performance of specific sectors and industries. Technological advancements, shifts in consumer behavior, and industry-specific developments influence the performance of stocks within different sectors. Investors focus on identifying sectors with growth potential.

Environmental, Social, and Governance (ESG) Factors

ESG considerations have gained prominence in global stock markets. Investors increasingly prioritize companies with strong environmental, social, and governance practices. Understanding the impact of ESG factors on stock performance is integral to responsible and sustainable investing strategies.

The Role of Investor Sentiment and Behavioral Economics

Investor sentiment and behavioral economics play a significant role in stock market movements. Psychological factors, such as fear, greed, and herd behavior, can drive market trends. Analyzing investor sentiment provides insights into potential market shifts and opportunities for contrarian investment strategies.

Conclusion: Navigating the Global Stock Market Landscape

In conclusion, navigating the worldwide stock market requires a comprehensive understanding of its dynamics. For those interested in a deeper exploration of global stock market performance, visit Worldwide stock market performance. By staying informed about economic indicators, geopolitical events, and technological advancements, investors can make more informed decisions and adapt their strategies to the ever-evolving global stock market landscape.

Global Economic Growth: Projections and Trends

Analyzing the Prospects: Global Economic Growth Forecast

The trajectory of the world economy is a topic of perpetual interest, and economic forecasts provide invaluable insights into the potential trends and challenges ahead. In this exploration, we delve into the current world economic growth forecast, examining the factors influencing projections, potential scenarios, and the implications for various stakeholders.

Navigating Uncertainties: Factors Influencing Forecasts

Economic forecasts are inherently influenced by a myriad of factors, and navigating uncertainties is a constant challenge. Variables such as geopolitical tensions, global trade dynamics, technological advancements, and demographic shifts all play a role in shaping the trajectory of economic growth. Analyzing these factors provides a nuanced understanding of the complex economic landscape.

Post-Pandemic Recovery: Charting a Course for Growth

The aftermath of the COVID-19 pandemic continues to reverberate across the globe. World economic growth forecasts are intricately linked to the recovery from the pandemic’s impact. While some regions experience robust rebounds, others grapple with ongoing challenges. Vaccination rates, containment measures, and the ability to adapt to the new normal all influence the pace of recovery.

To explore the latest world economic growth forecasts, visit World Economic Growth Forecast.

Regional Disparities: Divergent Paths of Economic Growth

Economic growth forecasts highlight regional disparities, with certain areas poised for rapid expansion while others face more moderate projections. Factors such as regional policies, infrastructure investments, and the resilience of local industries contribute to these disparities. Understanding the divergent paths enables policymakers and businesses to tailor strategies accordingly.

Trade Dynamics: Shaping Global Economic Prospects

The ebb and flow of global trade play a pivotal role in shaping world economic growth forecasts. Trade tensions, tariff policies, and international agreements influence the movement of goods and services. Forecasts closely monitor trade dynamics, providing crucial insights into how shifts in global commerce impact economies and contribute to the overall growth narrative.

Technological Transformations: Catalysts for Growth

Technological advancements stand as powerful catalysts for economic growth. Innovations in artificial intelligence, renewable energy, and digital infrastructure reshape industries and drive productivity. World economic growth forecasts incorporate the transformative impact of technology, emphasizing its role in creating new opportunities and steering economies toward sustainable growth.

Environmental Sustainability: A Cornerstone of Growth Strategies

The pursuit of economic growth is increasingly intertwined with environmental sustainability. World economic growth forecasts now consider the implications of green initiatives, renewable energy investments, and eco-friendly policies. Balancing economic development with environmental stewardship is seen as essential for fostering growth that is both inclusive and sustainable.

Policy Responses: Navigating Economic Challenges

Government policies play a crucial role in influencing economic growth trajectories. Fiscal and monetary measures, stimulus packages, and regulatory frameworks are designed to address specific economic challenges and spur growth. World economic growth forecasts analyze the effectiveness of these policies in navigating uncertainties and fostering a conducive environment for prosperity.

Global Collaboration: Addressing Shared Challenges

In an interconnected world, global collaboration is increasingly vital for sustaining economic growth. International organizations, diplomatic efforts, and collaborative initiatives contribute to addressing shared challenges. World economic growth forecasts underscore the importance of coordinated action in fostering a global environment conducive to inclusive and robust economic expansion.

Investment Trends: Aligning Strategies with Growth Forecasts

For businesses and investors, aligning strategies with world economic growth forecasts is imperative. Anticipating trends, identifying emerging markets, and understanding the risk landscape enable informed decision-making. Adapting investment strategies to the evolving growth scenarios positions stakeholders to capitalize on opportunities in dynamic global markets.

Conclusion: Navigating the Path Forward

In conclusion, world economic growth forecasts serve as beacons illuminating the path forward in an ever-changing global landscape. Understanding the intricacies of economic projections, regional disparities, and the influence of various factors empowers nations, businesses, and individuals to navigate challenges and capitalize on opportunities. As we collectively chart the course for the future, informed decision-making based on these forecasts becomes an essential tool for building a resilient and prosperous global economy.