Building Worldwide Economic Resilience

Nurturing Global Prosperity: Worldwide Economic Resilience

In the face of ever-evolving challenges, cultivating worldwide economic resilience becomes imperative for sustained prosperity. This article delves into the multifaceted aspects of building resilience on a global scale, exploring the key components, strategies for fostering economic robustness, and the collaborative efforts needed to navigate the complexities of the modern economic landscape.

Understanding the Foundations of Economic Resilience

At the core of worldwide economic resilience lies a foundation built on adaptability, diversification, and sustainable practices. Nations and businesses must recognize the interconnectedness of the global economy and embrace strategies that enable them to withstand shocks, whether from geopolitical tensions, pandemics, or economic downturns. This understanding forms the bedrock of a resilient economic ecosystem.

To explore the nuances of worldwide economic resilience, visit Worldwide Economic Resilience.

Diversification of Economies and Industries

One key strategy in building worldwide economic resilience is the diversification of economies and industries. Overreliance on a single sector can leave nations vulnerable to fluctuations. By fostering a diverse economic landscape, nations can mitigate the impact of external shocks, ensuring that the strengths of various industries contribute to overall stability.

Technological Innovation as a Catalyst

Embracing technological innovation is pivotal for enhancing economic resilience. Advancements in digital technologies, automation, and artificial intelligence not only drive efficiency but also create new avenues for growth. Nations that invest in research and development, foster innovation ecosystems, and integrate technology into their industries position themselves for greater economic resilience in the face of rapid change.

Inclusive Growth Strategies for Societal Well-being

Economic resilience goes beyond GDP numbers; it encompasses the well-being of societies. Inclusive growth strategies that address income inequality, promote education, and ensure social welfare contribute to the overall resilience of a nation. A resilient economy is one that benefits all segments of the population, creating a foundation for long-term stability.

Environmental Sustainability: A Cornerstone of Resilient Economies

The pursuit of economic resilience is inseparable from the imperative of environmental sustainability. Nations must balance economic growth with ecological responsibility to ensure the longevity of resources and the well-being of future generations. Green initiatives, renewable energy adoption, and sustainable practices are integral components of building environmentally resilient economies.

Global Collaboration in Crisis Response

In times of crisis, global collaboration becomes a linchpin in building worldwide economic resilience. The ability of nations to come together, share resources, and coordinate responses to challenges such as pandemics or natural disasters is crucial. Collaborative efforts foster a sense of shared responsibility and contribute to the overall resilience of the global economic community.

Flexible Fiscal and Monetary Policies

Governments play a central role in fostering economic resilience through flexible fiscal and monetary policies. The ability to adapt policies in response to changing economic conditions, implement stimulus measures during downturns, and maintain fiscal discipline contributes to the overall resilience of a nation’s economy. Striking the right balance is essential for long-term stability.

Investment in Infrastructure for Future Preparedness

Infrastructure development is a strategic investment in economic resilience. Robust transportation networks, digital infrastructure, and energy systems enhance a nation’s ability to respond to challenges and capitalize on opportunities. Forward-looking nations prioritize infrastructure projects that not only stimulate economic activity but also lay the groundwork for future resilience.

Crisis Preparedness and Risk Management

Anticipating and preparing for potential crises is a hallmark of economically resilient nations. Comprehensive risk management strategies, contingency planning, and crisis response frameworks enable nations to navigate uncertainties with agility. The ability to identify, assess, and mitigate risks contributes to the overall preparedness of economies in the face of unforeseen challenges.

Conclusion: Forging a Resilient Global Economic Future

In conclusion, building worldwide economic resilience is a dynamic and collaborative endeavor. It requires a holistic approach that integrates economic diversification, technological innovation, environmental sustainability, and inclusive growth. As nations navigate the complexities of the modern economic landscape, fostering resilience becomes not only a strategic imperative but a shared responsibility for securing a prosperous and stable global future.

Worldwide Economic Impact: Changes in Trade Regulations

Navigating Global Economies: Unraveling the Effects of Changes in Trade Regulations

In the ever-evolving landscape of international commerce, changes in trade regulations have a profound impact on worldwide economic dynamics. This article explores the intricate web of consequences that unfolds when nations adjust their trade policies.

The Domino Effect on Global Supply Chains

Changes in trade regulations send ripples through the intricate tapestry of global supply chains. These adjustments can disrupt established trade routes, influence production costs, and impact the availability of goods and services worldwide. The interconnected nature of modern economies means that a change in one region can set off a domino effect, affecting businesses and consumers globally.

Trade Balances and Economic Equilibrium

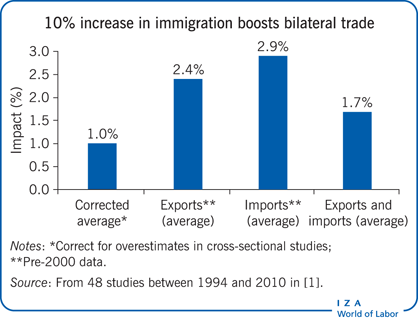

Trade regulations play a crucial role in shaping a country’s trade balance, influencing the equilibrium between exports and imports. Alterations in these regulations can lead to shifts in trade balances, affecting a nation’s economic stability. Persistent trade imbalances may result in currency fluctuations, inflationary pressures, and adjustments in interest rates as countries strive to maintain economic equilibrium.

Investor Confidence and Market Volatility

The financial markets are not immune to the effects of changes in trade regulations. Investor confidence can be significantly influenced by uncertainties arising from shifts in trade policies. Market volatility often ensues as investors recalibrate their portfolios in response to changing trade dynamics. Understanding and anticipating these fluctuations become essential for investors navigating the global economic landscape.

Job Markets and Employment Patterns

One of the direct consequences of alterations in trade regulations is the impact on job markets. Industries that heavily rely on international trade may experience fluctuations in demand for their products and services. Job losses or gains can occur as a result, shaping employment patterns within countries and influencing overall economic well-being.

Technological Innovation and Industry Evolution

As trade regulations evolve, industries are compelled to innovate and adapt. Technological advancements play a pivotal role in this process, enabling businesses to explore new markets, optimize supply chains, and foster international collaborations. Changes in trade policies can act as catalysts for industry evolution, driving innovation and competitiveness on a global scale.

Safeguarding Domestic Industries and National Interests

Nations often adjust trade regulations to safeguard domestic industries and protect national interests. This approach may involve imposing tariffs, quotas, or other trade barriers. While intended to bolster domestic production, these measures can spark retaliatory actions from trading partners, initiating trade tensions that have broader economic implications.

The Role of International Organizations and Agreements

The framework of international trade is often guided by agreements and organizations that promote cooperation and regulate trade practices. Changes in trade regulations can strain these agreements, affecting diplomatic relations and global economic cooperation. Navigating the intricate web of international trade requires careful diplomacy and strategic decision-making to foster collaboration and mutual benefit.

Consumer Impacts and Purchasing Power

For consumers, changes in trade regulations can have direct implications on purchasing power. Shifts in trade policies may lead to changes in the availability and prices of imported goods. Consumers may experience the effects through variations in the cost of living, influencing consumption patterns and lifestyle choices.

Environmental Considerations and Sustainability

Trade regulations are increasingly being scrutinized for their environmental impact. Changes in trade policies can influence the movement of goods and resources, affecting environmental sustainability. Balancing economic interests with environmental considerations becomes crucial in shaping trade regulations that promote long-term ecological resilience.

For a comprehensive exploration of the worldwide economic effects of changes in trade regulations, delve into this insightful study here. The study offers in-depth analyses of case studies, providing valuable insights into the intricate dynamics of global economies in the face of evolving trade regulations.

Ensuring World Economic Stability for Future Prosperity

Nurturing a Foundation for Global Prosperity: World Economic Stability

In the intricate dance of global finance, achieving and maintaining world economic stability is a paramount objective. This article delves into the multifaceted aspects of this crucial goal, examining the challenges, strategies, and collaborative efforts necessary to foster stability in the world economy.

Understanding the Pillars of Economic Stability

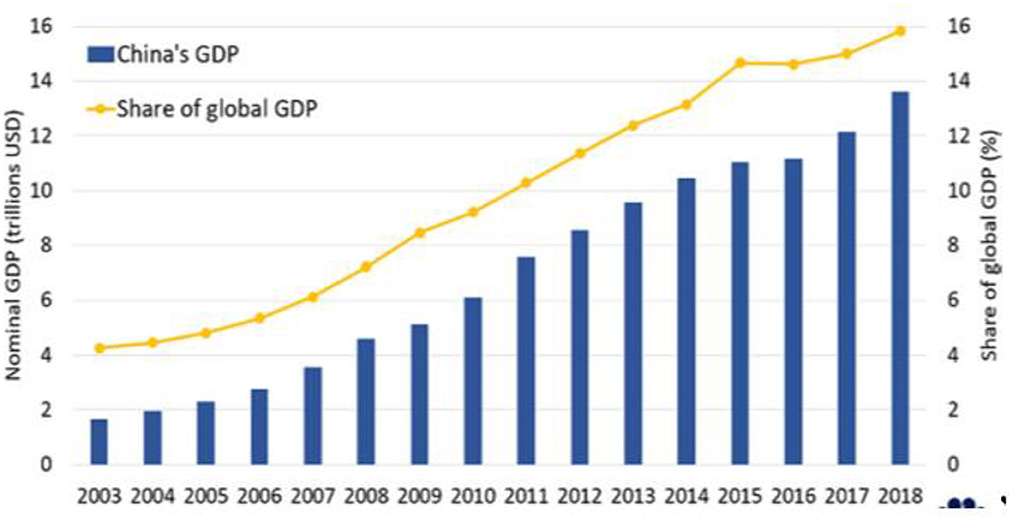

Economic stability is built upon several pillars, including steady GDP growth, controlled inflation, and low unemployment rates. These factors collectively create an environment conducive to investment, business expansion, and overall financial security. Governments, central banks, and international organizations play pivotal roles in establishing and maintaining these foundational elements.

Global Trade Harmony: A Key Ingredient

One of the cornerstones of world economic stability is a harmonious and open global trade environment. Trade agreements and partnerships foster interdependence among nations, promoting a sense of shared responsibility. By mitigating trade tensions and barriers, countries can enhance economic cooperation, leading to sustainable growth and stability on a global scale.

To explore the dynamics of world economic stability, visit World Economic Stability.

Resilience in the Face of Global Shocks

The ability to withstand and recover from unexpected shocks is integral to world economic stability. External factors such as natural disasters, geopolitical events, or health crises can significantly impact economies. Establishing resilient financial systems and contingency plans is imperative to minimize the adverse effects of unforeseen events.

Sound Monetary and Fiscal Policies: Guardians of Stability

Central banks and governments play pivotal roles as guardians of economic stability. Implementing sound monetary and fiscal policies helps regulate inflation, interest rates, and public spending. Coordinated efforts among nations to align these policies contribute to a more stable and predictable global economic environment.

Inclusive Growth for Sustainable Stability

World economic stability is not just about numbers; it’s about ensuring that the benefits of economic progress are shared inclusively. Addressing income inequality and promoting social welfare contribute to a more stable and harmonious global society. Inclusive growth strategies create a robust foundation for sustained economic stability.

International Cooperation: A Prerequisite for Stability

In an interconnected world, international cooperation is a prerequisite for achieving and maintaining economic stability. Collaborative efforts among nations, facilitated by organizations like the International Monetary Fund (IMF) and the World Bank, provide a platform for dialogue, policy coordination, and crisis management.

Technological Innovation: Catalyst for Economic Stability

Embracing technological innovation is crucial for future economic stability. Advancements in technology drive productivity, efficiency, and new opportunities for economic growth. Nations that invest in research and development, foster innovation ecosystems, and adapt to technological changes position themselves for greater stability in the global economic landscape.

Environmental Sustainability as an Economic Imperative

Recognizing the interdependence of economic activities and the environment, sustainability initiatives are integral to world economic stability. Balancing economic growth with environmental conservation ensures the longevity of resources and the well-being of future generations. Green technologies and sustainable practices contribute to a resilient and stable global economy.

Educational Empowerment for Economic Stability

Investing in education is an investment in economic stability. A skilled and adaptable workforce is essential for navigating the challenges of a rapidly evolving global economy. Educational empowerment, including vocational training and continuous learning, equips individuals with the tools needed to contribute to and benefit from economic stability.

Conclusion: Sustaining a Balanced Global Economic Ecosystem

In conclusion, sustaining world economic stability is a shared responsibility that requires collective action. From fostering international cooperation to embracing technological innovation and promoting inclusive growth, the journey toward stability is multifaceted. By recognizing the interconnectedness of global economies and actively addressing challenges, we can nurture a balanced economic ecosystem that paves the way for future prosperity.

Global Energy Policies: Economic Implications

Navigating Global Economies: Understanding the Economic Implications of International Energy Policies

In an era where energy policies have become central to global discussions, understanding their economic implications is crucial. This article explores the intricate relationship between international energy policies and global economies, shedding light on the economic challenges and opportunities that arise in the pursuit of sustainable and efficient energy practices.

The Energy Transition Imperative

The global call for an energy transition has prompted nations to reassess their energy policies. Shifting from fossil fuels to cleaner, renewable sources is imperative for mitigating climate change. However, the economic implications of this transition are significant. Industries heavily reliant on traditional energy sources may face disruptions, necessitating economic adjustments and innovations.

Investments in Renewable Energy: Economic Opportunities

One of the positive economic implications of international energy policies is the surge in investments in renewable energy. Nations embracing solar, wind, and other clean energy sources attract investments, stimulate job creation, and foster technological innovation. The economic benefits extend to the growth of a green economy, positioning countries at the forefront of sustainable development.

Challenges for Traditional Energy Industries

While the transition to renewable energy presents economic opportunities, it poses challenges for traditional energy industries. Sectors such as coal, oil, and gas may experience economic downturns as policies shift away from fossil fuels. Governments and businesses in these industries must navigate economic transitions, considering the implications for employment, investment, and regional economies.

Energy Security and Economic Stability

International energy policies play a crucial role in ensuring energy security, which, in turn, contributes to economic stability. Diversifying energy sources, investing in domestic energy production, and securing international energy partnerships are strategies nations employ to mitigate economic risks associated with energy shortages and price volatility.

Geopolitical Considerations and Economic Impact

Energy policies are entwined with geopolitical considerations, and shifts in energy dynamics can have far-reaching economic consequences. Countries that are major energy producers wield economic influence, while energy-dependent nations must navigate geopolitical complexities to ensure a stable and affordable energy supply. Geopolitical tensions can disrupt energy markets, impacting global economic stability.

Policy Frameworks and Economic Competitiveness

The design of energy policies directly influences a nation’s economic competitiveness. Policies that incentivize energy efficiency, innovation, and sustainable practices enhance economic competitiveness. Conversely, inadequate or inconsistent policies may hinder economic growth, posing challenges for industries striving to adopt environmentally friendly practices.

Energy Affordability and Socioeconomic Equity

The affordability of energy is a critical aspect of international energy policies with direct socioeconomic implications. Policies that ensure affordable energy access contribute to socioeconomic equity, benefiting both businesses and households. Striking a balance between economic considerations and equitable energy distribution is essential for fostering inclusive economic development.

Transition Costs and Economic Resilience

The transition to new energy paradigms incurs costs that impact economies. The initial investments in renewable infrastructure, grid upgrades, and workforce retraining constitute transition costs. However, these investments are essential for long-term economic resilience, energy independence, and reducing the environmental externalities associated with traditional energy sources.

Innovation and Technological Advancements

International energy policies often stimulate innovation and technological advancements. Economic implications include the growth of clean technology industries, job creation in research and development, and increased competitiveness in the global marketplace. Countries leading in energy innovation are well-positioned to drive economic growth and shape the future of sustainable industries.

Collaboration for Global Energy Solutions

Addressing the economic implications of international energy policies requires collaboration on a global scale. Nations, businesses, and international organizations must work together to align policies, share technological advancements, and address economic disparities. Collaborative efforts contribute to a more resilient and sustainable global energy landscape.

Towards a Sustainable Energy-Economic Nexus

In conclusion, the economic implications of international energy policies are diverse and far-reaching. While challenges exist for industries undergoing transitions, opportunities for economic growth, innovation, and environmental sustainability abound. Navigating this nexus requires a comprehensive understanding of the economic implications and collaborative efforts to shape a sustainable energy future.

Explore more about Economic Implications of International Energy Policies and the intricate balance between energy transitions and global economic dynamics.

Global Financial Reforms: Navigating Economic Consequences

Navigating the Economic Landscape: Consequences of Global Financial Reforms

In the aftermath of financial crises and economic downturns, the global community often rallies to implement financial reforms aimed at fostering stability, resilience, and transparency in financial systems. While these reforms are crucial for preventing future crises, they also bring about significant economic consequences that ripple through various sectors.

Foundation of Reforms: Responding to Financial Crises

Global financial reforms typically emerge as responses to systemic failures and crises. The aftermath of events like the 2008 financial crisis witnessed an international commitment to reevaluate and enhance financial regulations. The primary objective was to build a more robust financial system that could withstand shocks and ensure the protection of investors and the broader economy.

Tightening Regulatory Measures: Impact on Financial Institutions

One of the immediate consequences of global financial reforms is the tightening of regulatory measures on financial institutions. Stricter capital requirements, stress testing, and enhanced risk management practices are imposed to mitigate the likelihood of financial institutions engaging in risky behaviors that could lead to systemic failures. While these measures contribute to stability, they can also limit the profitability and flexibility of financial institutions.

Effects on Lending Practices: Balancing Risk and Access to Credit

The reforms often influence lending practices, impacting the balance between risk management and the accessibility of credit. Stringent regulations may lead banks to adopt more conservative lending approaches, affecting businesses and individuals seeking loans. Striking the right balance becomes a delicate task for policymakers, ensuring that financial institutions remain stable without stifling economic growth through restricted credit availability.

Market Liquidity and Trading Dynamics

Global financial reforms can reshape market liquidity and trading dynamics. Regulations like the Volcker Rule, aimed at curbing excessive risk-taking by banks, can affect market-making activities. While the intention is to prevent speculative trading that could lead to financial instability, there’s a need to carefully assess the consequences on market liquidity, particularly during times of stress or crises.

Impact on Cross-Border Financial Activities

In an interconnected global economy, financial reforms have significant implications for cross-border financial activities. The extraterritorial reach of certain regulations can create challenges for multinational corporations and financial institutions operating across jurisdictions. Coordination and harmonization efforts become essential to ensure a consistent and effective regulatory framework globally.

Technological Innovation and Compliance Costs

As financial institutions adapt to new regulatory requirements, there’s a notable impact on technological innovation and compliance costs. The need to implement sophisticated risk management systems and reporting mechanisms can drive investments in technology. Simultaneously, compliance costs can escalate, particularly for smaller financial entities, influencing their competitiveness and ability to navigate the evolving regulatory landscape.

Global Financial Reforms and Emerging Markets

The consequences of global financial reforms are often amplified in emerging markets. While reforms aim to enhance stability, they may inadvertently create challenges for economies with less-developed financial systems. Stricter regulations can limit the flow of capital to these markets, impacting investment and growth. Policymakers in emerging economies must strike a balance between compliance and fostering economic development.

Unintended Consequences and Regulatory Adjustments

Despite meticulous planning, global financial reforms may lead to unintended consequences. Market participants and institutions may find ways to circumvent regulations, leading to new risks or vulnerabilities. Periodic reassessment and adjustments to regulatory frameworks are crucial to address emerging challenges and maintain the effectiveness of the reforms over time.

The Role of International Cooperation

The consequences of global financial reforms highlight the importance of international cooperation. Coordination among regulatory bodies, central banks, and policymakers is vital to address cross-border challenges and ensure a harmonized global financial system. Regular communication and collaboration contribute to a more effective implementation of reforms while minimizing potential conflicts.

Strategies for Navigating the New Financial Landscape

As the global financial landscape evolves under the influence of reforms, businesses, investors, and policymakers need to develop strategies for navigating the changes. This includes staying informed about regulatory developments, adapting risk management practices, and embracing technological innovations that enhance compliance and efficiency.

Explore more about the Economic Consequences of Global Financial Reforms to understand the evolving dynamics and strategies for navigating the reshaped financial landscape.