Navigating Global Financial Markets: Trends and Strategies

Navigating Global Financial Markets: Trends and Strategies

Understanding and navigating global financial markets is essential for investors, businesses, and policymakers alike. In this exploration, we delve into the current trends shaping these markets and strategies to navigate their complexities.

The Ever-Changing Landscape of Global Financial Markets

Global financial markets are dynamic and subject to constant change. Factors such as economic indicators, geopolitical events, and technological advancements contribute to the fluidity of these markets. Staying informed about the evolving landscape is crucial for making informed financial decisions.

Key Players and Market Dynamics

Global financial markets are comprised of various key players, including institutional investors, retail traders, and central banks. Understanding the roles and interactions of these entities is essential for grasping market dynamics. Market forces such as supply and demand, liquidity, and investor sentiment significantly impact the trajectory of financial markets.

Technological Innovations Shaping Finance

Technological advancements play a pivotal role in shaping global financial markets. The rise of fintech, blockchain, and artificial intelligence has transformed the way financial transactions are conducted. Embracing these innovations is vital for staying competitive and navigating the increasingly digitized financial landscape.

The Impact of Global Economic Trends

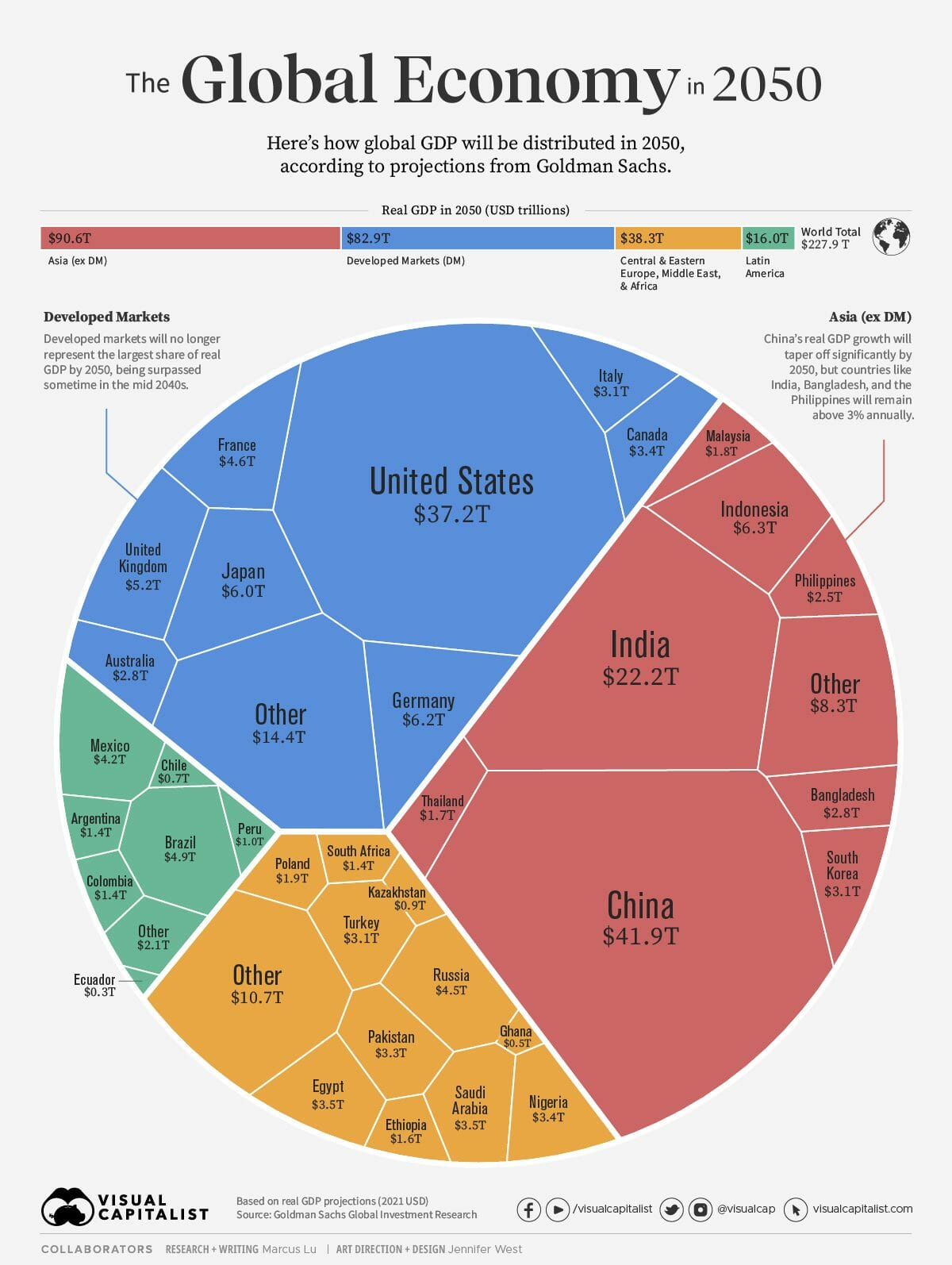

Economic trends at the global level have a direct influence on financial markets. Factors such as GDP growth, inflation rates, and trade balances shape investor confidence and market sentiment. Analyzing these trends provides insights into potential investment opportunities and risks.

Geopolitical Events and Market Volatility

Geopolitical events have a profound impact on global financial markets. Political instability, trade tensions, and international conflicts can lead to increased market volatility. Investors must factor in geopolitical considerations when developing strategies to mitigate risks and capitalize on opportunities.

Diversification and Risk Management

Diversification is a fundamental strategy for navigating global financial markets. Spreading investments across different asset classes, regions, and industries helps mitigate risks associated with market fluctuations. Additionally, effective risk management strategies, including setting stop-losses and staying informed about market indicators, are essential for preserving capital.

Market Trends and Emerging Opportunities

Identifying and capitalizing on market trends is crucial for success in global financial markets. Whether it’s the rise of renewable energy investments, the growth of ESG (Environmental, Social, and Governance) investing, or emerging opportunities in developing markets, staying attuned to trends allows investors to position themselves strategically.

The Role of Central Banks in Monetary Policies

Central banks play a significant role in shaping global financial markets through monetary policies. Interest rate decisions, quantitative easing, and other policy measures influence borrowing costs, currency values, and market liquidity. Understanding the stance of central banks is key for predicting market movements.

Digital Transformation in Financial Services

The financial services industry is undergoing a digital transformation. Online trading platforms, robo-advisors, and digital banking have become integral parts of the financial landscape. Embracing these digital tools enhances accessibility and efficiency for investors navigating global financial markets.

Sustainable Investing and Socially Responsible Finance

Sustainable investing, including ESG considerations, is gaining prominence in global financial markets. Investors are increasingly factoring in environmental, social, and governance criteria when making investment decisions. This shift towards socially responsible finance reflects a growing awareness of the impact of investments on broader societal and environmental issues.

In conclusion, navigating global financial markets requires a multifaceted approach. By staying informed about market dynamics, embracing technological innovations, and implementing effective strategies such as diversification and risk management, investors can navigate the complexities of the financial world. For deeper insights into global financial markets, visit Global financial markets.

Catalyzing Global Economic Transformation: Shaping a New Era

Catalyzing a Paradigm Shift: Navigating Global Economic Transformation

In the fast-evolving landscape of international economies, the concept of global economic transformation has taken center stage. As nations grapple with unprecedented challenges and opportunities, a paradigm shift is underway, reshaping the way we perceive and engage in economic activities on a global scale.

The Dynamics of Change in a Globalized World

Global economic transformation is not merely a buzzword; it reflects the dynamic shifts in economic structures, trade patterns, and technological advancements that characterize our interconnected world. As countries strive for resilience and sustainability, the traditional norms of conducting business and managing economies are undergoing a profound metamorphosis.

Innovations Driving Economic Evolution

In the heart of this transformation lie groundbreaking innovations. Technological advancements, artificial intelligence, and digitalization are catalysts propelling economies into a new era. These innovations are not only changing the way businesses operate but are also redefining the skills required in the workforce, ushering in an era of unprecedented opportunities for growth and efficiency.

Global Collaboration in Economic Resilience

The interconnectedness of economies demands a collaborative approach to economic resilience. Nations are recognizing the need to forge global partnerships that go beyond traditional trade agreements. Collaborative initiatives in research, development, and sustainable practices are emerging as key drivers in ensuring that the global economic transformation is inclusive and beneficial for all.

Sustainable Practices Shaping the Agenda

Amidst the transformation, sustainability is emerging as a cornerstone of global economic agendas. Environmental consciousness is influencing policies, and businesses are increasingly adopting sustainable practices. This shift not only aligns with societal expectations but also addresses long-term economic viability, promoting a harmonious relationship between economic development and environmental stewardship.

The Role of Digitalization in Economic Restructuring

Digitalization is a linchpin in the ongoing economic restructuring. From e-commerce to remote work capabilities, the digital revolution is reshaping business models and consumer behaviors. The adaptability to digital platforms is becoming a determining factor for economic success, emphasizing the need for nations to invest in robust digital infrastructures.

Economic Inclusion and Social Impact

As we navigate this transformative journey, emphasis on economic inclusion and social impact is gaining prominence. The global economic transformation should not be an exclusive process; it must uplift marginalized communities and ensure that the benefits are shared equitably. Inclusive economic policies and initiatives are vital for creating a more just and balanced global economic landscape.

Challenges Amidst the Transformation

Despite the promises and potential, the path to global economic transformation is not without challenges. Issues such as income inequality, geopolitical tensions, and the ethical implications of technological advancements present hurdles that require strategic and collaborative solutions. Navigating these challenges is essential to ensure a smooth and sustainable transition.

Investment Strategies in a Transformed World

Investment strategies are evolving in tandem with the global economic transformation. Investors are increasingly considering factors beyond traditional financial metrics. Environmental, social, and governance (ESG) criteria are becoming integral to investment decisions, reflecting a broader recognition of the interconnected nature of economic, social, and environmental systems.

Shaping the Future: Global Economic Transformation Unveiled

In the midst of these transformative forces, the concept of global economic transformation is not a distant vision but a current reality. Shaping the future requires proactive participation from governments, businesses, and individuals alike. By embracing innovation, fostering sustainability, and prioritizing inclusive growth, we can collectively steer the course towards a more resilient, equitable, and prosperous global economy.

Explore more about the ongoing Global Economic Transformation and its implications for the future of economies worldwide.

Unveiling Global Energy Market Trends

Exploring the Dynamics of Global Energy Market Trends

The global energy landscape is undergoing rapid transformations, shaped by technological advancements, environmental concerns, and geopolitical shifts. In this article, we will delve into the current trends influencing the global energy market and the implications for the future.

Rise of Renewable Energy Sources

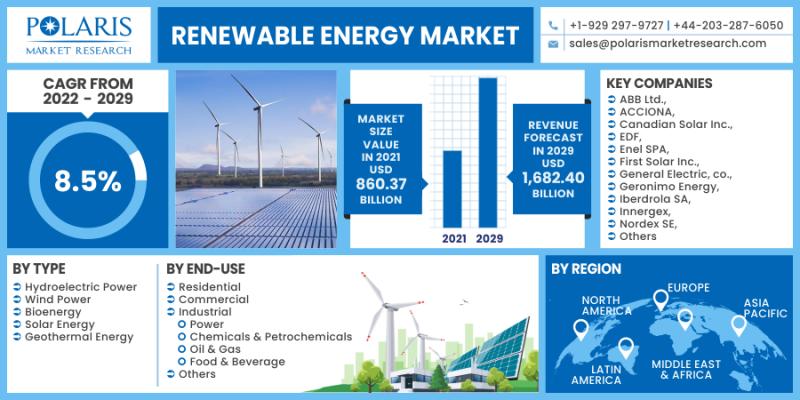

One of the most notable trends in the global energy market is the increasing prominence of renewable energy sources. Solar, wind, hydro, and geothermal power are witnessing substantial growth as nations strive to reduce carbon emissions and transition to sustainable energy alternatives. This shift is not only driven by environmental considerations but also by the declining costs and increased efficiency of renewable technologies.

Technological Innovations Driving Efficiency

Technological advancements play a pivotal role in shaping the energy landscape. Innovations in energy storage, smart grids, and digital technologies are enhancing the efficiency and reliability of energy systems. These innovations not only optimize energy production and distribution but also contribute to the integration of renewable energy sources into the mainstream energy grid.

Decentralization and Distributed Energy Systems

The traditional centralized model of energy generation and distribution is undergoing a transformation towards decentralization. Distributed energy systems, including microgrids and localized renewable energy installations, are gaining popularity. This trend not only enhances energy resilience but also empowers communities to have greater control over their energy sources and consumption.

Transition to Electric Vehicles

The global shift towards sustainable transportation is a key factor influencing energy market trends. The increasing adoption of electric vehicles (EVs) is driving up the demand for electricity while challenging traditional oil-dependent transportation systems. This trend is reshaping energy consumption patterns, necessitating investments in EV infrastructure and charging technologies.

Natural Gas as a Transition Fuel

While renewable energy is on the rise, natural gas continues to play a significant role as a transition fuel. Its lower carbon emissions compared to traditional fossil fuels make it a more environmentally friendly option. The global energy market is witnessing increased exploration and utilization of natural gas reserves, particularly as a complement to intermittent renewable sources.

Energy Market Trends and Geopolitical Considerations

Geopolitical factors continue to shape global energy markets. Shifts in political alliances, trade dynamics, and regional tensions impact energy supply chains and pricing. Nations are strategically positioning themselves to secure energy resources, leading to fluctuations in the global energy market and influencing long-term energy security considerations.

Investments in Energy Storage Solutions

As the share of intermittent renewable energy sources grows, investments in energy storage solutions become crucial. Battery technologies, pumped storage, and other innovative storage methods are gaining attention to address the challenge of storing excess energy for use during periods of low renewable generation. These investments are essential for maintaining a stable and reliable energy supply.

Energy Efficiency and Conservation Initiatives

Amid concerns about resource depletion and environmental impact, energy efficiency and conservation initiatives are gaining prominence. Governments, businesses, and individuals are increasingly focused on optimizing energy use to reduce waste and lower carbon footprints. This trend is influencing consumer behavior, regulatory frameworks, and corporate sustainability practices.

Emergence of Energy Market Digitalization

The digital transformation wave is reaching the energy sector, bringing forth the emergence of energy market digitalization. Smart grids, IoT (Internet of Things) applications, and data analytics are enhancing grid management, predictive maintenance, and overall operational efficiency. This digitalization trend is creating more adaptive and resilient energy systems.

Global Collaboration for Sustainable Energy

Addressing the challenges of climate change and ensuring a sustainable energy future requires global collaboration. International partnerships, agreements, and initiatives are fostering the exchange of expertise, technology, and resources to accelerate the transition to clean and sustainable energy. This collaborative approach is essential for overcoming shared challenges and achieving global energy security.

In conclusion, the global energy market is in a state of flux, driven by a complex interplay of technological, environmental, and geopolitical factors. Embracing renewable energy, investing in innovative technologies, and fostering international cooperation are key strategies for navigating the evolving energy landscape. To explore more about Global energy market trends, visit tankionlineaz.com.